| Silver train leaves the station…

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | Silver Streak

| | | Despite what many have been saying, silver has been leveraging the gold rally since the beginning.

Now it’s really starting to play catch up, however, and it seems the silver train is accelerating out of the station.

| |

March 18, 2024

Dear Fellow Investor, | | The big story in gold is silver.

| | Every secular bull market in gold has seen silver outperform its glittering cousin. That means two things:

| | 1) Silver’s outperformance is a confirmation that a gold bull market has truly begun, and...

2) It’s a great way to play gold during such a bull market.

| | So if you believe that the macroeconomic environment is bullish for gold, then you need to own silver as well to boost the performance of your precious metals portfolio.

As I’ve always put it, if you like gold, you should love silver.

Of course, this begs the question of what silver is telling us now...

| | Get On Board The Silver Train

| | If you’ve been perusing gold-oriented commentators on social media and in newsletters, you’ve noticed a general consensus view that silver hasn’t been doing its job during the remarkable gold rally this month.

But if you look at the data, nothing could be further from the truth.

|  | | As this six-month chart of the silver price clearly shows, the price bottomed in mid-February and has soared since then.

OK, that’s great...but has silver actually outperformed gold during this period? To discover that, let’s take a look at the famed gold:silver ratio, and plot it against the price of gold.

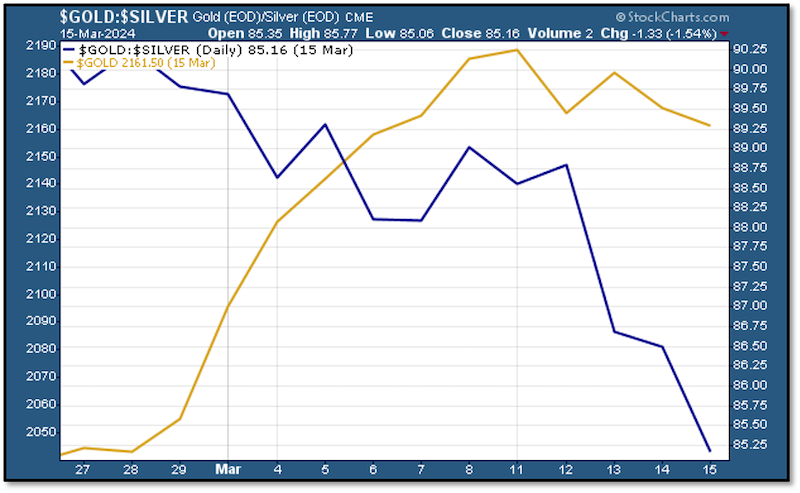

|  | | The gold line above is the price of gold and, as you can see, the rally began with a relatively mild gain on February 29th. From that point, gold took off on an uninterrupted rocket-shot until beginning to digest those gains early last week.

If you look at the gold/silver ratio over that time period, you see that it consistently fell from the end of February. A falling G/S ratio shows that the silver price is rising more quickly than gold (or falling less rapidly).

| | In this case it shows that, despite the general consensus view, silver has been doing better than gold.

| | This, again, is an important confirmation that a secular gold bull market has begun.

So how much better has silver done?

|  | | In the chart above, silver is in blue and gold is in black. As you can see, silver has essentially doubled the performance of gold since the rally began (12.13% rise vs 5.82%).

Notably, even as gold has moved sideways since last Tuesday, silver has taken off to the upside. This has created a lot of buzz in the market, but has also obscured the fact that silver has been doing its job from the very beginnings of this rally.

The mining equities have also been leveraging gold’s move and this, too, has been an important confirmation signal.

All this said, what’s the next big question?

| | How To Leverage This Move

| | If we’ve begun a secular bull market in gold (which I believe to be true) and silver has always outperformed gold in such a situation, then obviously we need to add silver to our monetary metals portfolio mix.

The foundation of any such portfolio is physical metals, and I recommend that the first thing investors do is buy both gold and silver bullion. In gold, focus on gold bullion coins, while in silver you can use both bullions coins and bars.

Many investors new to the metals also buy ETFs to get a simple and liquid paper representation of physical holdings. In particular, many buy the I-Shares Silver Trust (SLV), the biggest silver ETF.

I don’t advise that anyone do this, because J.P. Morgan is the custodian of SLV.

Need I say any more? No, but I will.

| | Noted silver analyst Ted Butler has recently raised concerns that the silver in SLV is not metal that has been bought in the general market, and thereby does not represent added demand that impacts the silver price.

| | As Butler recently put it, “I asked the CFTC (along with the S.E.C.) to make clear whether the 103 million oz reported in the I-Shares Silver Trust, SLV, and being held in New York by JPMorgan on behalf of the trust, was also being reported in the JPMorgan COMEX warehouse or whether these were two separate silver inventories.”

After much delay, the CFTC eventually responded with “a literal word-salad of unrelated information describing the functioning of the agency not all related to my question and designed to put as many words in the response to make it sound like much deep thought went into the response.”

In my view, as well as Butler’s, this likely confirms that the inventories are double-counted.

To cut to the chase, I don’t recommend SLV, instead preferring the Sprott Silver Bullion Trust (PSLV) created by Eric Sprott.

Eric is the consummate silver bug, and I have full confidence that his organization is actually buying the silver in the trust from the market.

On top of physical holdings, you can get leverage on top of leverage by investing in silver mining equities, from the producers down to the exploration companies. As we saw most recently in the post-pandemic metals rally, the junior silver shares can offer absolutely explosive returns.

| | We cover many of the best silver juniors in Gold Newsletter. If you’re serious about investing in this sector and you’re not already a subscriber, you can get our ongoing coverage of junior resource stocks by signing up here.

| | The best of the silver juniors are just now starting to take off along with silver.

Again, this is both a confirmation that a major new gold bull market has begun...and an indication that we need to boost our silver exposure to maximize our gains.

Gold is up a bit today while silver is down a bit. It looks like a great opportunity to me, so let’s get started!

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

| | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |