Some discoveries take decades to make.

|

The mining industry is replete with stories of projects that were mined periodically with no big hits or explored by one operator after another with no significant results.

Then one company comes along and either applies modern mining techniques where they hadn’t been applied before or makes a novel geological interpretation.

The result: A new discovery puts an historic producer in a whole new light; a project previously thought barren or mined out turns out to host a major deposit.

|

Such is the story that may well be developing at Idaho Champion Gold Mines’ (ITKO.CN; GLDRF.OTC) Champagne project in central Idaho.

|

Building on a wealth of historical data from past exploration, small-scale mining and a period of open-pit operations in the early 1990s, Idaho Champion has a novel theory about the source at depth of all that mineralization.

If its geologists are right, the company may be on the verge of a game-changing discovery on this project.

|

Champagne: A History Of Production

|

Idaho Champion was initially attracted to Champagne by its history of open-pit gold-silver production with Bema Gold and by the possibility that more mineralization remained to be found.

|

But once the company’s geologic team got on site and began surveying the old Bema pits and other historic workings…they realized that Champagne had district-scale potential.

|

In response, Idaho Champion staked a large area of ground around its original interest.

The newer ground is shown in blue in the map below; it surrounds the teal of the original land package.

|

|

The company also bought a package of historic data that Kinross owned on the project.

That drilling data showed something interesting; When Bema had looked to add to the resource it was mining at Champagne, it kept its drill holes shallow, only looking for more of the “scoopable” oxide gold-silver near the surface.

In fact, a large number of the holes had been drilled to an arbitrary depth of just 15 meters, or about 50 feet!

When decades-low gold and silver prices eventually shut Champagne down in the ’90s, the project’s true potential at depth remained very underexplored.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Massive Anomaly Could Be The Mother Lode

|

Idaho Champion began rectifying that oversight last year with an RC and core drill program to test the areas under and around Bema’s old pits.

This resulted in recent assays that have indicated the mineralization underneath the pit areas was offset by a newly-interpreted fault that cut off the deposit at depth.

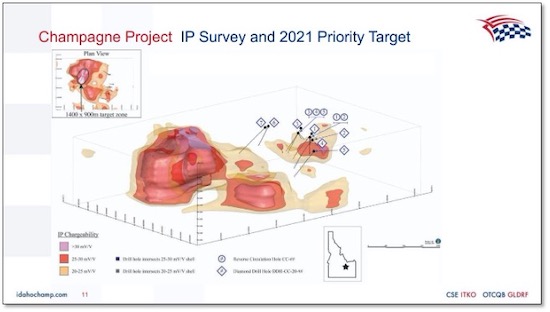

Then came the results of a recent induced polarization survey at Champagne — and the anomaly outlined to the northwest of the pit areas lit up like a Christmas tree.

|

|

As the above 3-D image of the area indicates, there is a massive chargeability anomaly to the northwest of the mined areas (noted by the drill map’s drill hole pin marks) at Champagne.

And get this: The anomaly is a whopping two kilometers long and could extend to as much as 600 meters in depth.

And it could well be the source of the near-surface mineralization mined on the project over the years.

|

Idaho Champion’s management posits that if Bema had run this IP survey on the project back in the ’90s, it might still be mining here.

|

The mounting geological evidence of a major find at Champagne was so compelling that Rob Kell, a geologist with decades of experience, came on site as a consultant last September and eventually signed up as the company’s chief geologist.

Having helped discover and develop major porphyry-style deposits for Anaconda, BHP and Newmont, Kell liked how the data was coming together at Champagne.

Simply put, if the drill program Idaho Champion is currently getting permitted hits significant mineralization on this anomaly, it could catapult ITKO’s share price higher.

|

Baner:

Yet Another Potential Discovery In The Making

|

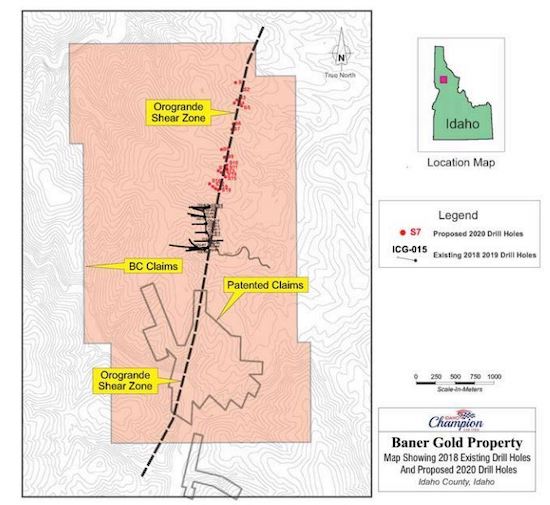

Providing a solid backstop to this drill-hole speculation at Champagne is the company’s Baner project in north-central Idaho.

The company outlined a prominent area of near-surface oxide mineralization at Baner in 2018. Then its work there got hamstrung by a weak financing market that made it difficult for juniors of all stripes to raise money to drill.

That changed in a big way in 2020, and the company was able to secure financing to fund drilling on both Baner and Champagne.

|

|

Recent assays from the program at Baner indicate potential for the area to the north and northeast of the original area outlined in 2018 to host more near-surface oxide gold and some higher-grade sulphide gold at depth.

Idaho Champion plans to round back to Baner later this year to flesh out its potential.

|

|

For now, though, all eyes are on what the drills can turn up at Champagne.

The company’s program will begin by testing the anomaly at its northern end, where post-mineral cover is only about 60 meters thick.

It will then move southward with drill-hole fences to test the deeper-buried heart of the anomaly, which gets stronger and wider with depth.

|

Simply put, success with this program has the potential to be a company-maker.

|

If you want to place a bet on that prospect, you’ll want to position yourself in Idaho Champion before the drills start turning.

|