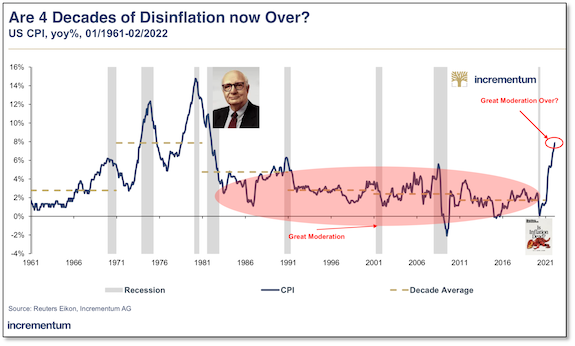

| This chart tells it all...

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| The Single Best Report On Gold

| |

The annual In Gold We Trust report — the single best research report on gold — is going to be released in a few months.

In the meantime, its authors have given us a sneak peek with this remarkable “Preview Chartbook.”

| | | |

If you’re a serious investor interested in gold, May 24th is the day you need to circle on your calendar.

|

Because that’s when our friends at Incrementum AG, a highly regarded asset management firm in Liechtenstein, will release the 2022 edition of their annual “In Gold We Trust” report.

|

Simply put, this is widely regarded as the most authoritative report on gold investing in the world today. It’s worth a small fortune for anyone interested in seeing how gold fits in the global macro picture and getting a clear view on where the price will trend.

And while it’s worth a small fortune...Incrementum graciously provides it for free!

| | Golden Opportunities continues below...

| | | SPONSOR:

Tomorrow Investor

| | Uranium Supply Crisis:

Why It's Worse Than You Think

| | Stage is set for a massive run up in mining stocks as nuclear utilities rush to secure non-Russian-controlled supplies.

| | A small exploration outfit is developing a project that could soon yield what is suddenly one of the world's most critical metals — uranium.

The combination of rocketing demand and severe supply chain disruptions in the world's top producing countries offers uranium investors the perfect storm they have been waiting for.

Even before Kazakhstan erupted in political upheaval, disrupting 41% of global production, uranium demand was outpacing supply.

| | More than half of global uranium

supply is now under severe threat.

| | Major supply disruptions from Central Asia and Eastern Europe, with more than half the world's annual production, are sending nuclear power operators on a frenzied hunt to lock in new sources from safer jurisdictions.

That's why investors need to make a deep dive in a hurry into junior explorer Basin Uranium (OTC:BURCF, CNSX:NCLR), a company that is developing a high-grade uranium project in Canada, just north of Cameco's Millennium deposit.

Click here to discover more about the fastest-growing megatrend of this era, and the company that could soon be a market leader.

| | | |

In Gold We Trust is the brainchild of noted market expert Ronald-Peter Stoeferle, who has been a valued presenter at our New Orleans Investment Conference. Ronni first published the report in 2007, and for the past 10 years has published it with his business partner Mark Valek.

If I haven’t made it clear yet, their work on this report over the past 15 years has been absolutely incredible — and from what I saw in an email from them this morning, the 16th edition is going to raise the bar even further.

You see, while we await the May 24th issue date, Ronni and Mark and their team have just released a “Preview Chartbook” for this year’s annual report. I’ve just reviewed it, and found this first entry to be the most compelling of dozens of insightful charts:

|  |

As you can see, a sea change is afoot. While inflation has moderated ever since Paul Volcker quashed it in the early 1980s, it has now broken out to the upside.

Moreover, this isn’t a one-off event. This preview provides a powerful array of charts showing that a secular change is underway in inflation. Moreover, as Ronni and Mark noted in their email to me this morning, these charts and the upcoming In Gold We Trust report will show:

|

• Inflationary Pressure – why inflation has arrived and what inflationary forces are pushing from all sides.

• Stagflation Ahead? – With inflation rates at these highs and a cooling economy, the Fed is trapped in paralysis.

• The Status Quo of Gold, Silver and Mining Stocks – Given the current macroeconomic conditions, these assets are predestined market outperformers.

• The argument (and it’s a good one) for a $30,000 gold price.

• Why there’s a 50.2% chance of a gold price between $3,000-$6,000 by 2030 (and the still-significant odds for much higher prices).

• The gold price measured in iPhones — and why it’s pointing upward.

|

The bottom line: This report shows why new all-time highs in gold are just a matter of time this year, and back up Incrementum’s long-term price target of $4,800/ounce by the end of this decade.

We’ll have to wait a bit longer for the full report, but I urge you to click on the link below to get this amazing Preview Chartbook, hot off the digital press.

|

All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| |

CLICK HERE

To Get The

Preview Chartbook Of The

2022 In Gold We Trust Report

| | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |