| Rest and relaxation for gold? | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | Contact Us | Privacy Policy | View in Browser | Forward to a Friend | | .png) | | Rest And Relaxation | | | Gold is taking another break from its nearly relentless rise. If past form holds true, this spells opportunity. | | March 24, 2025

Dear Fellow Investor, | | Flash: Gold has dropped over $40 in price since last week’s high. |  | | The gold bug reaction? A collective yawn...because a $40 loss in gold ain’t what it used to be.

I remember well, at the bottom of both the metals and miners in 2000, where that would’ve represented a 15% crash. Even as recently as the beginning of last year, it would have represented a 2% decline, instead of barely over 1% today. By the same token, a standard 10% correction in gold today would mean a drop of over $300 — something that would rattle the nerves of even the staunchest gold bull.

It is a different world today, for sure.

That fact was highlighted in a fascinating piece by Taylor Burnett of the World Gold Council released last Friday. As Burnett noted, | | “Gold reached more than 40 new all-time highs in 2024 and fourteen more so far this year. Its upward move has been no coincidence and, in our most recent Gold Market Commentary, we talked about a potential perfect storm forming for gold. The focus isn’t just the number itself but the pace at which gold has reached it.

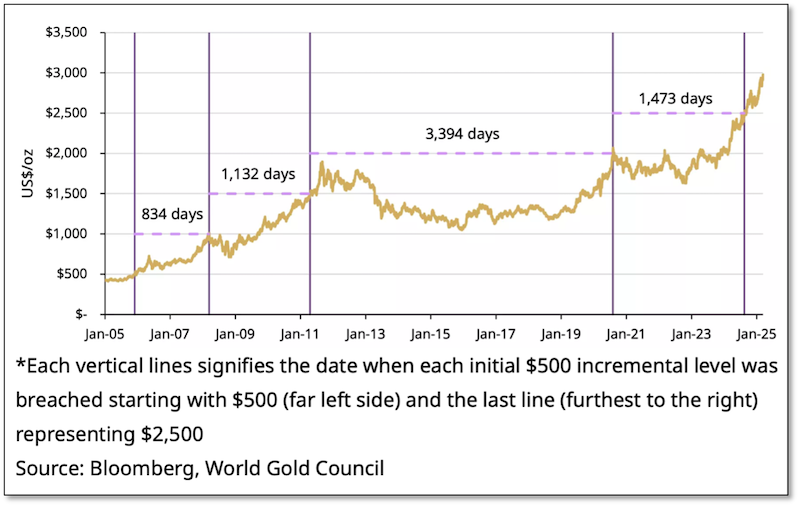

“The jump from US$2,500/oz to US$3,000/oz took just 210 days – a notably faster move that underscores the momentum gold has built over the past two years. Compare that to the approximate 1,700 days that gold took, on average, to achieve previous US$500/oz increments, and the move stands out.” | | Burnett highlights gold’s record-breaking rise in this chart: |  | | Click image to enlarge | | So, with such a rapid rise, even accounting for relentless central bank buying and the other extraordinary factors working in favor of gold, a brief break or even a full-blown correction would not be surprising. And even welcomed.

However, there’s more at work here.

For one thing, as also highlighted by Burnett in the WGC piece, options expiries are likely behind Friday’s price weakness and perhaps some more coming up this week: | | “From a technical and positioning standpoint, if gold were to remain above US$3,000/oz over the next couple of weeks, it would likely trigger additional buying from derivatives contracts. For example, we estimate there is roughly US$8bn in net delta-adjusted notional in options contracts from US gold ETFs that expire Friday 21 March,4 and US$16bn in options on futures that expire on 26 March. While this may create a slingshot effect, it could also trigger short-term-profit taking.” | | So look for some price volatility through Wednesday, in either direction.

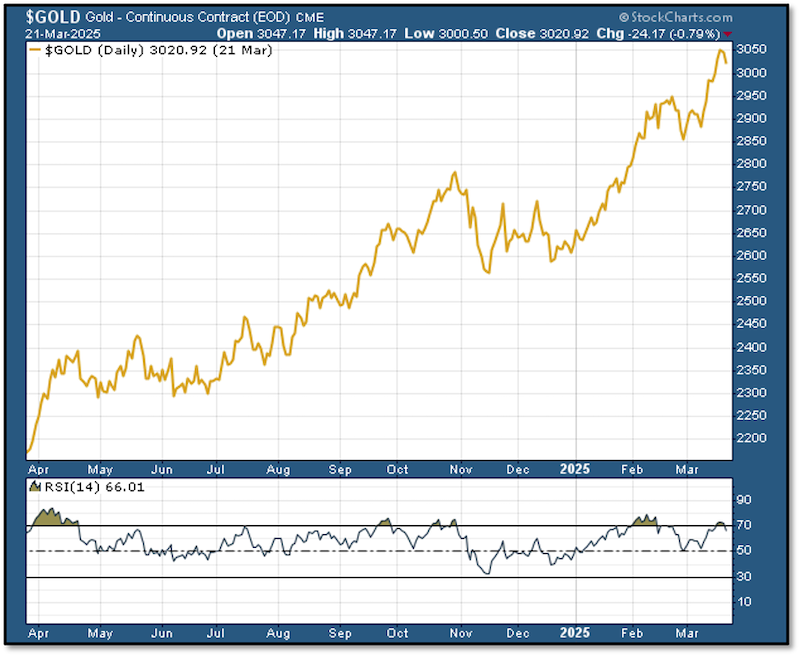

Regardless, gold’s track record over the past year indicates that any break in the uptrend is likely to be very short. Consider this chart of gold with its RSI... |  | | Every previous instance of gold’s RSI peaking above 70 has presaged a price correction and, with the exception of the post-election correction, the pause in the rally has been brief.

We’ll see the extent of this rest period soon. In the meantime, the mining stocks have been leveraging gold (both to the upside and downside, however) and I’ve seen the FOMO factor at work lately in the juniors. (A company called me last week asking me to exercise warrants in the money, fully 18 months before expiry. I can’t tell you the last time that happened!) | | In short, the markets are moving, money is coming in and news is being made. I wouldn’t wait to make sure your portfolio is properly positioned. | | As I noted last week, you should view my presentation at the recent Metals Investor Forum to see more details on why this is a generational opportunity in junior miners...and you should click on the link below to subscribe to Gold Newsletter or our Gold Newsletter Alert service.

The junior mining stocks are beginning their big moves, and I’m pointing my readers to the best of them. Frankly, considering the potential profits to be realized, our services are worth many times the cost. | | All the best, |  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference | | CLICK HERE

To Subscribe To

Gold Newsletter | | | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the Gold Newsletter Youtube channel. | | | | | | © Golden Opportunities, 2009 - 2025 | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411 | | | |