March 25, 2024

Dear Fellow Investor, |

| It’s been a “March Metals Madness” as the price of gold has soared since the beginning of this month, to the amazement of the entire financial sector.

|

| Of course, we’ve been predicting this as the Fed’s inevitable shift from rate-hiking to rate-cutting becomes imminent. In fact, in a speech on March 1st I predicted that the gold price had bottomed and was due to take off — with only the timing being uncertain.

Little did I know that, even as I spoke, that big rally was just beginning.

|

|

| It’s been an amazing run so far. Even though we’ve backed off from the highs of last week, gold’s up another $10 or so as I write and it seems that this move is just the beginning of something truly significant.

But even while gold bugs are rejoicing, there’s been one nagging question in the back of everyone’s mind:

|

| Who’s doing all this buying?

|

| You see, the demand for gold has only increased as the price has risen. This typically means that Western investors, who usually follow a price trend, are flocking to the sector.

But even as the gold price soared, the holdings in GLD, the biggest gold ETF and the best proxy for U.S. demand, collapsed.

So what about Asian buyers? They don’t usually buy as the gold price rises; they’ve historically been bargain hunters who buy on price declines.

No, the consistency of the buying and the fact that it didn’t wane as the price rose pointed toward central banks as the source of the insatiable bid for gold.

|

| In fact, we saw record central bank gold buying in 2022, and the level last year nearly matched that record.

|

| So were central banks responsible for all of the buying we’ve been seeing in gold? Not by a long shot....

|

| Explosive New Report On Global Gold Demand

|

| As I’ve reported in Gold Newsletter, we’ve also seen a tremendous surge in domestic Chinese gold demand, as gauged by withdrawals from the Shanghai Gold Exchange.

But that’s not all — China’s central bank has also been buying hand-over-fist.

This comes from a stunning new report from Jan Nieuwenhuijs, who I regard as the best analyst of global gold flows around today.

I’ve reported on Jan’s research many times over the years, and he was a featured presenter for our New Orleans ’20 virtual investment conference. It’s fair to say that I regard his work as authoritative.

|

| So I was very eager to read his latest work — entitled “China Has Taken Over Gold Price Control From The West” — a report that he had to revise as extraordinary new data emerged.

|

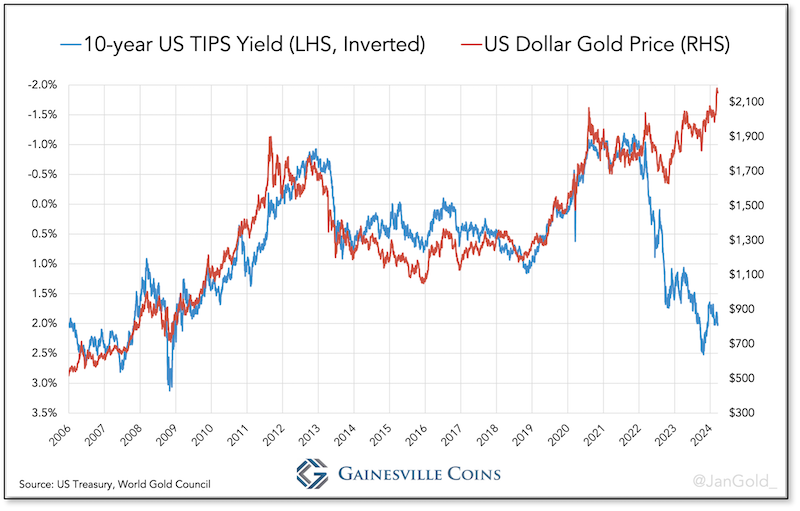

| Before summarizing Jan’s findings, I have to note that something compelling happened two years ago in the gold market. As you can see below, gold’s very tight inverse correlation with real (inflation-adjusted) yields not only ceased, but completely reversed!

|

|

| Not coincidentally, this happened right around the time that Russia invaded Ukraine, and the U.S. weaponized the dollar via harsh economic sanctions on Russia.

|

| One can argue whether these sanctions were appropriate and justified, but one thing that isn’t arguable is that this dollar weaponization sent a number of central banks running to exchange dollars for gold.

|

| In short, the big surge in central bank gold purchases was launched precisely at this time.

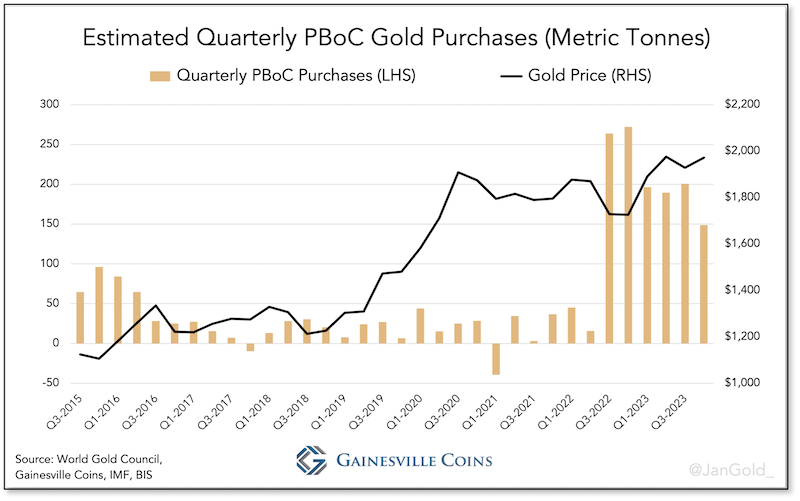

But, as Jan’s research just uncovered, no central bank has been more aggressively buying gold than the People’s Bank of China.

|

|

| Now, China is extremely secretive about its gold buying. But with access to all of the latest global gold-flow statistics, Jan has been able to estimate that the PBOC bought 735 tonnes of gold in 2023, up significantly from the 597 tonnes it bought in 2022.

That’s stunning in and of itself...but Jan has also determined that the Chinese people are buying even more — 1,411 tonnes last year.

Why the big surge in buying from Chinese citizens, who usually stop buying when the price is rising? As Jan notes,

|

| “As the real estate sector in China began crumbling late 2021, Chinese people started changing their gold buying behavior and lost their long-standing sensitivity for the price. One explanation could be that because of capital controls Chinese investors have few places to go other than the local stock market, real estate, and gold. And when the former two are in the doldrums, which is currently the case, the latter attracts more attention.”

|

| Add it all up, and China alone was responsible for nearly 2,150 tonnes of gold buying last year — more than two-thirds of global gold production!

Importantly, all of this gold buying has occurred without the participation of U.S. and other Western gold investors...until now.

While the holdings in GLD have been falling during most of this gold-price surge, they have started to increase over just the last few days.

|

| In short, Western investors are just now beginning to follow the price trend higher.

|

| If all three of these sources of gold demand — central banks, Chinese citizens and Western investors — buy together, the implications for the gold price are truly explosive.

Jan comes to this same conclusion in his latest research report.

I strongly urge you to read his report now. It is truly ground-breaking, with compelling repercussions for gold and the entire mining sector.

Click on the link below to read it now.

|

| All the best,

|

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|

| CLICK HERE

To Read Jan Nieuwenhuijs’

Ground-Breaking Report Now

|