| Only one investment is outperforming gold... | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | Contact Us | Privacy Policy | View in Browser | Forward to a Friend | | .png) | | The One Sector Beating Gold | | | As the first quarter comes to an end, the record shows that gold significantly outperformed stocks, bonds and every other investment...except for one very special sector. | | March 28, 2025

Dear Fellow Investor, | | Gold has defied all expectations and continued to soar — barely pausing at $3,000 and quickly clearing $3,100 on a futures basis. |  | | Behind these headline-making moves are some important developments in the gold market — and the one sector that’s actually outperforming the metal. | | The Big Change We’ve Been Waiting For | | I’ve argued in a few appearances and presentations recently that the vast bulk of all the buying in gold since this new bull market began has been as insurance and not as investment.

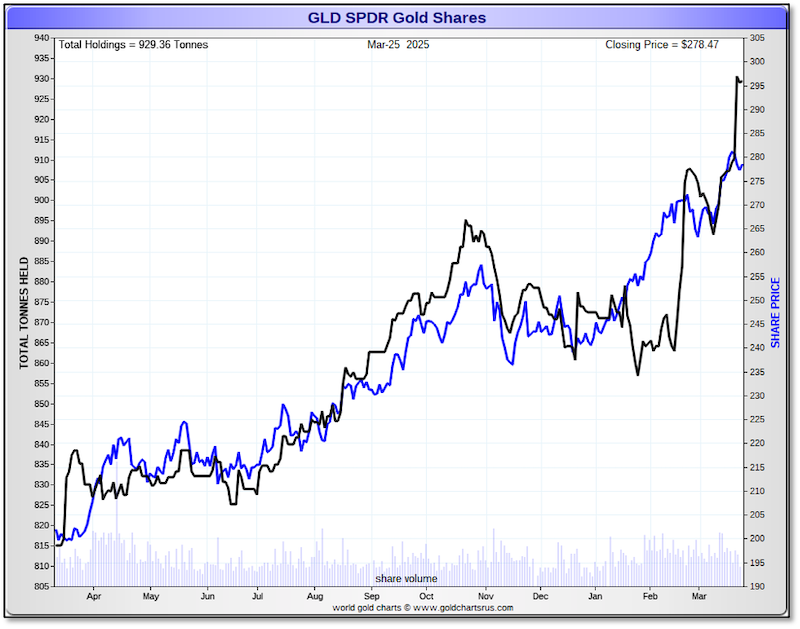

In other words, the gains we’ve seen so far have been due to central banks insuring themselves against dollar hegemony and individuals/institutions hedging against a likely acceleration in fiat currency depreciation. | | That’s been great...but some players have been left out of this game: Because central banks don’t buy silver or mining stocks, these sectors have uncharacteristically lagged for much of this gold rally. | | That has been changing, and quite dramatically, over the past few months. For one, take a look at how the holdings in GLD, the largest gold ETF, have recently surged: |  | | GLD is the best proxy we have for Western “physical” gold demand, and it’s apparent that these investors are currently hedging and betting on gold.

We can’t get too excited, however, because they did the same thing last summer, before everything got derailed in the “Trump trade.” That said, there are other positive indicators, primarily the ratio of the GDX gold stock index to gold itself, as shown in the accompanying chart. |  | | From the beginning of the year, with a brief exception in the second half of February, the gold stocks have been outperforming gold itself.

It’s the only sector that has been able to do that.

That’s extremely impressive when you consider the run that gold has been on. Consider that gold’s run to $3,000 took it three standard deviations above its 200-day moving average!

Again, for the gold stocks to beat that performance is extraordinary. As the accompanying performance chart shows, in fact, the mining equities have essentially doubled gold’s 16% return since the beginning of the year. |  | | The significant recent flows into the GLD gold ETF show Western investors buying gold, and the outperformance of the GDX gold mining index further shows that these more trading-oriented buyers are now using the mining equities to gain leverage on a gold rally that’s already progressed quite far.

The still-missing factor is silver. Although we’ve seen gold’s poor cousin periodically outperform, it’s been summarily beaten back every time it’s broken above the significant resistance at $35.

Silver recently broke above $35 on a futures basis and just below that resistance on a spot basis. It may finally break through for good — thanks to another important factor lying just ahead: Gold, and gold stocks, have outperformed every other asset class this quarter. | | At quarter-end reporting, and into Q2, funds will not want to show investors that they aren’t aboard this train. We will begin to see much more substantive portfolio allocation shifts from equities and Bitcoin, where the blooms are fading on those roses, to gold. | | And because the gold and gold stock markets are so tiny in comparison to these other markets, we’ll only need to see a relatively small shift in allocations to make a very big difference. | | Juniors On The Move... | | Of course, beyond our physical metals holdings, the way we like to play this macro-trend in the metals is through our recommended junior mining stocks.

It’s here that we’re really beginning to see some major moves.

I was just noticing that, while a number of our long-time holdings remain below our entry prices, many others have recently staged exceptional rallies...with quite a few doubling or more over the past few months.

I’m seeing more and more signs of FOMO (fear of missing out) in this market, and money has been pouring into the sector as financings are being announced and oversubscribed with regularity.

Because this rocket is just leaving the launching pad, I’ve unveiled no less than four exciting new stock recommendations in our just-released April issue of Gold Newsletter. | - A company embarking on a high-confidence drill program to uncover high-grade gold feeder zones that previous explorers completely missed. Results will be in hand within a few weeks, and good results could multiply this tiny company’s share price.

- An amazing portfolio of five distinct, high-potential gold targets in one company. The first drill results on just two of them have already yielded two new discoveries and sent the company’s share price soaring…yet it’s still trading at just a small fraction of the value of either discovery.

- A group that recently received a long-sought permit to outline remaining resources on one of the world’s largest and most historic mines. They’ve already turned up what could be billions in value…yet forced selling by a fund is temporarily keeping a lid on their share price.

- A gold-copper explorer with a massive land packaged directly abutting another company’s big new discovery. Sampling and geophysics shows this company could have most of the discovery on their ground…yet it’s currently valued at only a fraction of the other company. (And that’s not even considering their million-ounce gold resource!)

| | Our April issue gives full details on all four of these explosive opportunities...as well as full coverage on all of the exciting companies in our Gold Newsletter portfolio.

Frankly, a Gold Newsletter subscription is a tremendous value in any market environment. But in this red-hot new metals and mining bull market, the potential rewards are potentially thousands of times the cost of a subscription.

| | Take Advantage Of Our

Iron-Clad Satisfaction Guarantee | | I urge you to click on the link below to subscribe to Gold Newsletter for a full year, with the option to cancel at any time for a refund of all undelivered issues...

...Or simply try us out by purchasing our April issue for just $29.

Whichever route you take, act now. This market is on the move, and the earlier you get in, the more profits you could enjoy. | | All the best, |  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference | | CLICK HERE

To Subscribe To

Gold Newsletter

Or Purchase Our April Issue

| | | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the Gold Newsletter Youtube channel. | | | | | | © Golden Opportunities, 2009 - 2025 | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411 | | | | |