| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

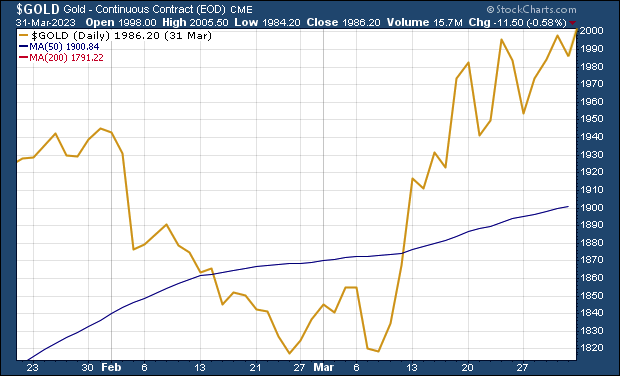

Gold has flirted with the next “big number” a couple of times over the past couple of weeks. Now it seems destined to finally get over the line...and then challenge the all-time highs.

| | | |

It looks like gold’s about to stop teasing us.

|

I’ve been writing recently that big numbers like the $2,000 level can act as a magnet of sorts for the gold price — a target that essentially becomes a self-fulfilling prophecy.

As you can see from the following chart, the yellow metal has been pulled toward that key benchmark a couple of times over the past week or so, only to just barely fail to close above it.

|  |

Note that this chart tracks the current active futures contract in gold. It’s actually updated only through yesterday’s close, but I’ve taken the liberty of adding to the trendline to show today’s move — with the active contract hitting $2,007 at the time that I updated it this morning.

At least on this basis, it seems that gold is about to stop teasing us and once again clear $2,000. And from that point, the next big target will be the all-time high.

| | Golden Opportunities continues below...

| | | SPONSOR:

Investing Channel

| | Invest in the Future of Food Kiosks – Offer Ends Soon

| | There’s a growing demand for food on the go. Enter Blendid, the maker of compact, robotic smoothie kiosks that operate 24/7 and allow brands to make more money while scaling to high-traffic locations like malls, colleges and airports.

Blendid has 500+ contracts with national brands to help them expand their reach while boosting profit margins. And they’re seeking investors to help expand the kiosk’s cuisine options, making higher profits possible for more brands in up to 70K+ locations.

| | Learn more about Blendid. Opportunity ends soon!

| | | | Golden Opportunities continues...

| | Some Important Caveats...

|

It’s important to note that I usually track the spot price for gold, which typically trades well below the futures price, accounting for the natural contango in the futures market.

|

And on that basis, the price is well below the above-mentioned active (June) futures price. As I write, spot gold is around $1,990, up about $20 in today’s session.

|

So we still have some room to run to get the spot price over $2,000.

Still, that key level is acting as we had expected, drawing the “paper gold” speculators like moths to a flame. And, granted, because of this factor — and this futures market that is so unattached to the real-world fundamentals — we naturally want to be skeptical of such moves.

However, there are some fundamentals driving the price higher right now.

More immediately, the ISM manufacturing index for March, released this morning, was a significant miss. It came in at 46.3, far lower than the consensus expectation of 47.5 and down from the previous month’s 47.7.

This shows that the economy is slowing as the Fed had hoped, and fuels the market’s hopes that Powell & Co. will pause on their rate-hike crusade.

But there was a more important input today: A group of oil producers led by Saudi Arabia made a stunning announcement of a million-barrel/day output cut, beginning next month.

The bottom line of all of this: The Fed is more likely to pause...just as oil prices will begin to rise again, fueling higher inflation.

As you know, I’ve been predicting that the Fed would pause without having gotten inflation near its 2% target, with the level more likely to remain stubbornly in the 4%-5% range.

This, I argued, would be very bullish for gold and silver.

|

However, with oil prices surging now on this surprise production cut, I wouldn’t be surprised if the inflation rate begins to head higher once again.

|

And nor would I be surprised if this new dynamic pushes spot gold far beyond the previous record high of $2,063 in the weeks just ahead.

So hang on — it’s about to get very interesting.

| |  |

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |