| Gold explorer has sights on million-ounce goal | | | Please find below a special message from our advertising sponsor, MAS Gold. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. | |

Led by one of Canadian mining’s most decorated explorationists, MAS Gold (MAS.V) has no less than two projects with more than 500,000 ounces of gold between them.

The company’s immediate goal is to double its portfolio-wide resources to a million ounces — and with results from winter drilling due any day now, a big re-rating could come at any time.

| | |

The simplest stories are often the most powerful.

|

While the path to a higher valuation for a junior gold explorer can depend on a wide variety of circumstances, exploration success is always the most compelling trigger.

|

And that trigger could be pulled at any moment for MAS Gold (MAS.V), as it advances plans to turn the global 500,000 ounces of gold it controls into a million ounces or more.

|

The company recently completed definition and resource expansion drilling on its two resource-hosting projects — and drill results will start coming in soon.

The short-term upside is clear: If these programs show existing resources are expandable and exploration-stage targets host gold, the market reaction could be swift.

The team at MAS is confident that it can clear the million-ounce hurdle fairly quickly. All by itself, that would argue for a significant re-rating of its current share price.

Add in a little help from a renewal of the gold bull market, and MAS Gold could see its value soar from today’s levels.

|

Exploration Hall Of Famer At The Helm

|

It helps tremendously that this team is headed by renowned mining explorer Ron Netolitzky.

Ron’s career in the mining industry spans more than 40 years and includes direct involvement in some of Canada’s biggest discoveries, including Eskay Creek and Snip.

Past accolades include a PDAC Prospector of the Year award and a Developer of the Year award from the BC & Yukon Chamber of Mines. In 2015, he was inducted into the Canadian Mining Hall of Fame.

Simply put, few people on the planet know more about Canada’s geologic potential, and in MAS Gold’s collection of projects in the La Ronge Belt, he sees a big opportunity.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

An Underappreciated Gold District

|

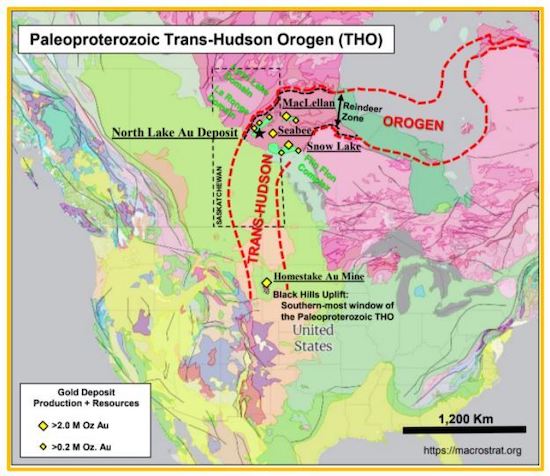

In short, Netolitzky sees a clear link between the Trans-Hudson Orogen that is the overarching geological structure hosting the La Ronge Belt and the gold belts of West Africa.

If accurate, there is likely a lot more gold to be found in the area. As it stands, SSR Mining’s nearby Seabee project is already producing more than 100,000 ounces of gold annually.

|

|

Moreover, Saskatchewan is one of the world’s great mining jurisdictions, with a government level-set on complementing huge potash and uranium resources with gold and other metals.

Between the presence of supportive infrastructure for its projects and mining-friendly local and provincial governments, the La Ronge belt is a near-ideal place to go looking for gold.

|

A Big Head Start On A Million-Ounce Resource

|

And with 500,000 ounces of gold already outlined on its two core projects, MAS Gold enjoys a big head start on companies with projects at an earlier stage of exploration.

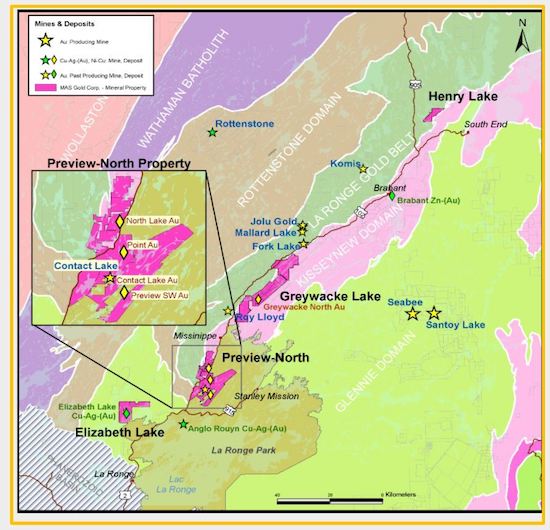

As you’ll see from the map below, the company’s projects (highlighted in magenta) straddle a key geologic contact area in the La Ronge Belt.

|

|

The Greywacke Lake target hosts a small deposit of high-grade, near-surface gold (81,500 oz. indicated and 14,100 oz. inferred) on its Greywacke North target.

Given the strong recoveries that the resources have demonstrated in met testing, MAS could easily go to production with this resource…but it has much bigger plans.

Hence, the ~3,000-metre drilling program it recently completed on Greywacke Lake.

With results pending, this program to upgrade Greywacke North’s deposit and extend it at depth (and to identify more gold on the Greywacke Central and Lyons targets) is one to follow closely.

| |

|

Success here would complement the drilling MAS has also recently completed on its Preview North project.

|

To Greywacke’s high-grade, underground deposit, Preview North adds a 417,000-oz. open-pittable deposit on its North Lake target.

|

Historic drilling on North Lake in the ’80s and ’90s, combined with more recent drilling in 2019, has allowed MAS to establish multiple, wide zones of near-surface gold there.

| |

|

The yellow dots in the map above of North Lake show where MAS Gold sited the holes for its 2021 drilling program. These holes are targeting the down-dip extension of the deposit at depth.

Add in the potential for more gold to remain on Preview North’s past-producing Point gold deposit, and the results from this recent drilling at North Lake could well help catapult MAS towards its million-ounce goal.

|

Upcoming Assays Could Pull The Trigger

|

The multiple exploration targets on Greywacke Lake and Preview North give MAS Gold multiple shots on goal.

|

Moreover, these targets are expanding on proven gold mineralization — dramatically increasing the likelihood of good results.

|

With assays from the recent programs on both projects due to hit the market in the days and weeks ahead, the window to speculate on positive results is closing fast.

| | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |