April 7, 2025

Dear Fellow Investor, |

| If you’re reading this to get an update on the markets and what you need to do you need to know this: Whatever I might write about what’s happening this minute could be completely different the next. |

| It’s been that kind of day. And perhaps a kind of day that has never been seen before. |

| Personally, I can’t remember a trading session in which the major U.S. stock indices ranged across such extremes during a single session, from crashing in the red to well in the green, and back and forth. |

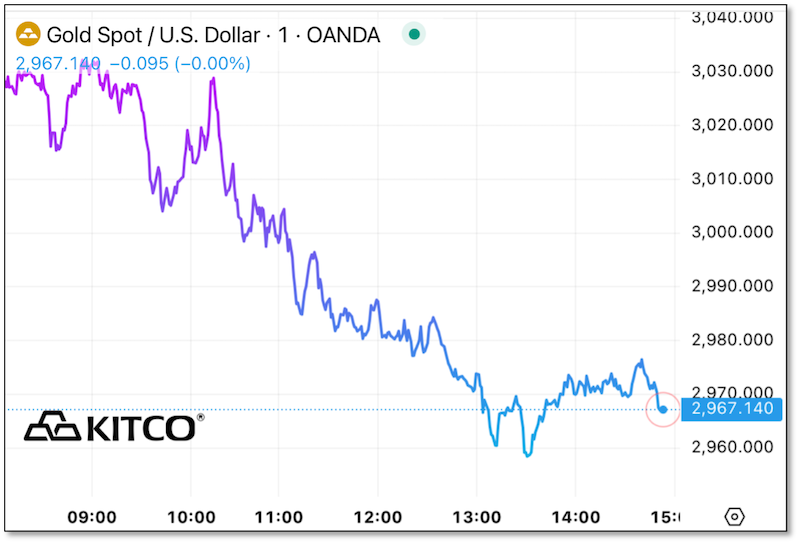

| A morning rumor that President Trump was willing to postpone the tariffs for 90 days sent the markets soaring, but was quickly shot down by the administration...sending assets crashing again, especially after Trump later retaliated against China’s retaliation by threatening yet another 50% tariff on top of all the previous levies. The Dow itself ranged from down 1,700 points to up nearly 500. The Nasdaq, down 5% at one point, rose well into the green before falling back. The 10-year Treasury yield dropped in overnight trading, but rose during the New York session as the flight-to-safety trade yielded to investors selling Treasurys for other reasons. Gold was not spared the volatility, as you can see below. At one point trading about $30 higher pre-open, it’s now down about $70. |

|

| Remarkably, silver has been up from the beginning, and quite strong for most of the day. It’s still higher by about a dime at last check. Looks like the market doesn’t like silver in the $20s. |

| It was a topsy turvy day as the markets tried to find a bottom and seemed ready to bounce strongly if/when Trump provides an excuse. |

| While gold has suffered from the kind of margin-call-related selling that we would expect, its relative resilience and willingness to pop right back up is evidence of the strong buying — and speculation — fuel remaining.

On the central bank front, it’s obvious that Trump’s trade war is turning the retreat from the dollar hegemony into a stampede. And that stampede is into gold.

This volatility is creating bargains, and erasing them, so quickly it’s hard for an investor, much less a trader, to react.

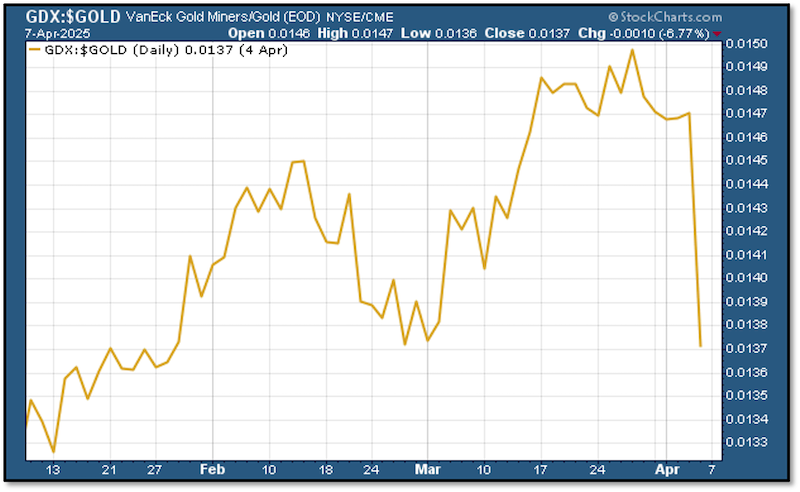

One area that seems to be a great value at the moment are gold miners. Although the mining indices are outperforming gold today, they have been providing leverage to the downside in recent sessions, as the chart below of the GDX mining stock index/gold shows. |

|

| The major miners seem to be tremendous values at current levels, but I’m particularly excited about the junior sector. |

| I’ve been unveiling some exciting new junior mining stock picks in Gold Newsletter, and they were already beginning to take off before this market mayhem erupted. |

| Now they’re truly incredible opportunities after gold has fallen back a bit. In fact, the chance to get in on the top juniors at fire-sale levels could soon pass, as there’s lots of green today on my screen. |

| Another Big Opportunity:

Silver |

| Like mining stocks, silver had fallen much more than gold during this sell-off...until today. It is important to note that — unlike any other asset — silver has been positive all day.

The opportunity for a major bounce-back in silver is so apparent that the market has noticed it before anything else.

So how do you play it?

The junior silver miners are one great way, and our latest issue of Gold Newsletter is the first place to start. See the link below to get your copy, or to subscribe for a full year.

The other way is through physical, hold-in-your-hands metal. And it is here that my friend Dana Samuelson, of American Gold Exchange, has found an extraordinary deal.

As Dana just emailed me, |

| The current sell-off in both gold and silver is creating an unusually good buying opportunity for both gold and silver, but especially for silver. The gold to silver ratio is almost an unheard of 100-to-1 today. The last time it was this high was during the abnormal liquidity event driven sell-off in March of 2020 due to COVID economic closures when it peaked at 122-to -1. Within two months silver had rebounded sharply, closing the ratio to 65:1.

While we may not see that strong of a recoil in the silver price relative to gold, this is only the second time in history the ratio has been this high, indicating that, relative to gold, silver is especially cheap today. |

|

| We were able to acquire a cache of back dated 1 oz Austrian Silver Philharmonics at an abnormally low market price, and are able to pass the savings along to Golden Opportunities readers as low as $1.99 over the silver spot price in quantity — that’s one of the lowest prices you will find in the country for sovereign-minted 1 oz silver coins today.

The Austrian 1 oz Silver Philharmonic, minted 2008 to 2025, is one of the most popular one-ounce silver coins both in Europe and in the United States. Normally you would expect to pay as much as $3.00 more per ounce for these same silver coins. But due to our extremely well-placed position in the national marketplace, we are able to offer these at an abnormally low premium over their intrinsic silver content — while supplies last. |

| I agree that this is a rare opportunity to get physical silver — not only after silver has been temporarily driven down by this market-wide sell-off, but also through this special deal on Austrian Philharmonic coins at just $1.99 above their melt value. |

| Note: I don’t receive any commission or payment for recommending these coins to you — I want you to know about them simply because this is a remarkable opportunity. |

| And I expect them to go quickly. So I not only recommend that you call American Gold Exchange at 1-800-613-9323 or CLICK HERE (and then click on the red “Backdate” line) to order them...I also recommend that you do so now. |

| All the best, |

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference |

| CLICK HERE

To Subscribe To

Gold Newsletter

Or Purchase Our April Issue |