Nevada’s storied history as a mining locale kicked into another gear in the 1960s…

|

…And it could be shifting into an even higher gear if some upcoming drill programs prove successful.

|

It was back in the ’60s when geologists discovered disseminated gold in large quantities along the state’s “Carlin Trend.”

That discovery led to many others and, for decades now, Nevada has been one of the world’s most productive gold districts.

Today, majors Barrick Gold and Newmont operate a number of large gold mines via a joint venture called Nevada Gold Mines (NGM) along both the Carlin Trend and the Battle Mountain-Eureka Trend to its west.

Over the years, a large majority of the near-surface gold that could be mined profitably has been taken out of the ground, but most believe that the region’s gold potential remains wide open at depth.

|

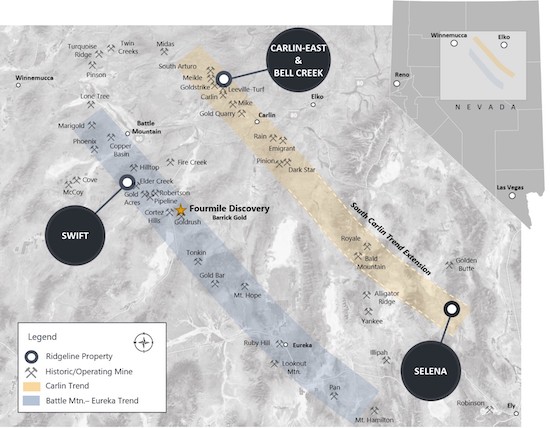

Indeed, Ridgeline Minerals (RDG.V; RDGMF.OTC; 0GC0.FRA) pulled together its four-property, 125-square-kilometer land position in Nevada based on exactly this premise.

|

That property package includes three projects with the potential to host high-grade gold at depth…and a fourth project boasting a growing, shallow-oxide silver-gold discovery.

Three of these projects are located along the Carlin Trend and the other lies within the Battle-Mountain Eureka Trend. These trends are collectively responsible for tens of millions of ounces in gold production.

And the three high-grade targets — each near a major Nevada Gold Mines operation — make Ridgeline a smart-money drill-hole play that could pay off big…and soon.

|

|

Carlin-East:

Possible Extension Of A Recent Discovery

|

Ridgeline’s Carlin-East property along the northern Carlin Trend provides the kind of drill-hole play — one with positively explosive near-term potential — that speculators lust after.

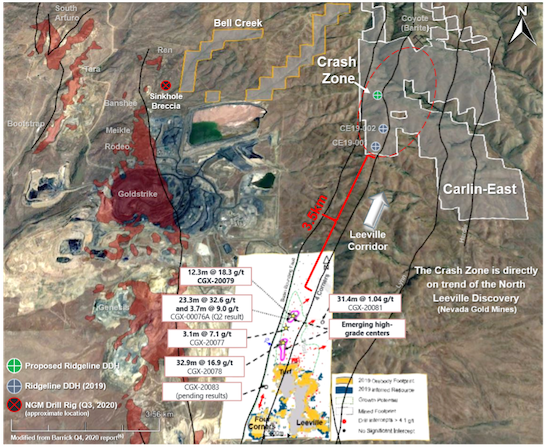

As you can see in the map below, Carlin-East is located north of NGM’s recent big discovery at their North Leeville property, where deep drilling last year hit intersections highlighted by 23.3 meters of 32.6 g/t gold and 32.9 meters of 16.9 g/t gold.

Here’s where it gets interesting: North Leeville looks to be an extension of NGM’s Leeville-Turf mine, along the Four Corners fault zone.

As Ridgeline plans its own drilling program at Carlin-East (that 3,000-meter program is set to begin in June) it will keep a close eye on NGM’s continued work at North Leeville.

|

|

Why? Because Carlin-East’s Crash Zone lies directly on trend with the North Leeville discovery…and could well host the continuation of the Four Corners fault along strike.

The opportunity is simply this: If the drills hit high-grade gold at depth on the Crash Zone…directly on trend with the world-class North Leeville discovery…then Ridgeline shareholders would own one of the most exciting discoveries in recent Nevada history.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Swift:

In The Right Rocks For Cortez District Gold

|

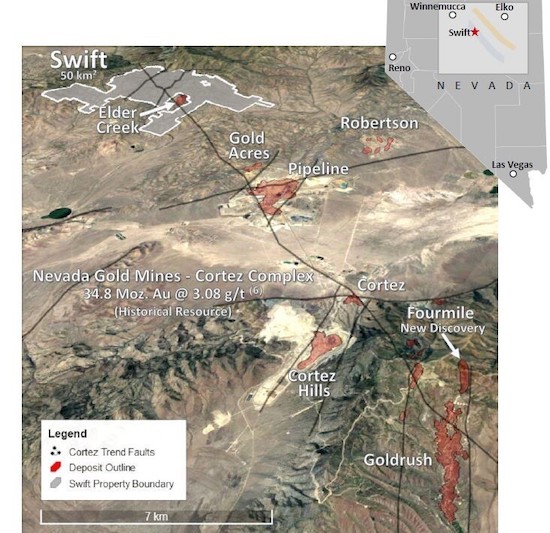

Another project with potential to host significant high-grade gold at depth is the company’s Swift project.

Located in the prolific Cortez district of the Battle Mountain-Eureka Trend, Swift sits near several NGM assets, including the legendary Pipeline, Cortez Hills, Goldrush and Four Mile deposits.

|

|

Both Placer Dome and Barrick had actually owned Swift in the early days of the Cortez district, but didn’t think it hosted the “right rocks” for Carlin-style gold and dropped the project in 2015.

Although it hit only narrow widths of gold and silver at depth (up to 0.22 g/t Au, 860 g/t Ag over 0.20m), drilling by Ridgeline in 2020 did confirm the targeted Wenban Formation rock package.

The Wenban Formation hosts massive gold deposits elsewhere on the trend, including the multi-million-ounce Pipeline mine that lies only a few short kilometers away.

Ridgeline is now updating its geologic model and planning follow-up drilling to see if it can vector in on high-grade gold within this key rock formation on its next program.

|

Bell Creek:

A Stone’s Throw From

A Key Nevada Gold Mines Target

|

Returning to the Carlin Trend, Ridgeline’s Bell Creek project sits within a stone’s throw of the Sinkhole Breccia target that NGM drilled in 2020 to test the extensions of its high-grade Ren deposit (see Carlin-East map).

Ridgeline is in the process of negotiating surface access with NGM to drill Bell Creek, but in the interim, further drilling success at the Sinkhole Breccia could significantly boost NGM’s interest in Ridgeline’s nearby project.

|

|

Bell Creek’s proximity to yet another NGM operation also underscores a key advantage Ridgeline has over other junior explorers in Nevada:

|

Unlike most of its competitors, which are often exploring in more remote parts of Nevada’s key trends, Ridgeline’s projects are in close proximity to key NGM assets.

|

That means the discovery of high-grade gold on Carlin-East, Swift or Bell Creek should immediately attract the attention of NGM as well as other gold miners, and possibly its takeout interest.

|

Selena:

A Valuable Backstop

|

The market typically values silver and gold resources in Nevada much higher than similar resources in other locales across the globe.

|

The good news for Ridgeline shareholders is that the company also boasts a proven silver-gold discovery in Nevada…and one that’s well along the way toward a maiden resource.

|

This growing discovery provides the perfect, lower-risk project to complement the company’s three “swing for the fences” targets.

Recent drilling at Selena has outlined shallow-oxide, potentially open-pittable silver-gold mineralization.

The silver grades returned from that program show potential to exceed the average grades of Coeur Mining’s Rochester Miner, the only open-pit silver mine currently operating in Nevada.

Now the goal is to establish the continuity of that mineralization and establish its presence at greater scale.

|

|

A 3,500-meter drilling program to do just that is beginning within days and will provide Ridgeline with May news flow to feed the market while it tees up its program on Carlin-East’s Crash Zone.

|

A Competitive Advantage:

The Ability To Drill At A Discount

|

All of this brings us to another key aspect of Ridgeline Minerals’ story.

Simply put, deep drilling isn’t cheap. But Ridgeline has leveraged its contacts in Nevada to bring on a leading drill contractor as a founding shareholder in the company.

In exchange for that early equity interest, the contractor has agreed to drill at a 60% discount to its going rate and to ensure drill rig availability — both are huge competitive advantages in these busy times.

|

It’s hard to overstate the advantage that this arrangement gives Ridgeline over its competitors, as it will allow the company to cost-effectively test not just one world-class target at depth, but three.

|

More shots on goal means more chances to make a company-making discovery, and as you’ve seen, all three of its deeper, high-grade targets have headline-making potential.

|

The Drills Are About To Turn

|