| Gold stands fast in today’s headwinds...

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | Gold Stands Fast

| | | With the CPI coming in hotter than expected, stocks are diving while the dollar and Treasury yields are soaring.

It’s the perfect headwind for gold, yet the metal (and silver) are holding their own...leaving mainstream analysts scratching their heads.

Here, from one of today’s most insightful analysts, are the real reasons gold is rocketing to new heights.

| |

April 10, 2024

Dear Fellow Investor, | | It’s another crazy day in crazy times.

| | Today’s CPI beat expectations to the upside, with the headline number for March coming in at a 3.5% annual rate compared to February’s 3.2%.

| | The market reaction was violent: Stocks dove, while the Dollar Index and Treasury yields leaped higher.

| | It today’s Bizarro world, where higher inflation is viewed as bearish for gold (because it encourages hawkish Fed policy), you couldn’t imagine a stiffer headwind for the yellow metal.

So it wasn’t surprising to see it immediately dive over $20 after the release of the CPI data.

What was surprising, at least for the mainstream talking heads in the media, was how gold quickly ate back those losses, even trading briefly in the green. Silver, which has been on a red-hot streak in recent days, essentially duplicated gold’s performance today.

As I write, both have been pushed back down, but I certainly wouldn’t be surprised to see both metals bounce back higher.

The reason? Because the factors driving this bull run in gold are different — and more powerful — than anything we’ve seen before. And the buyers are concerned with other issues than U.S. inflation and Fed policy.

My friend Peter Boockvar is one of the brightest and most insightful analysts around today. I view him as the resident contrarian on CNBC, and a fountain of intelligence and thoughtful opinions.

In one of his morning missives this week, he succinctly outlined the long- and short-term factors driving gold right now:

| | I want to talk gold again and say again that gold is money and therefore a currency, and that is the main reason it is being bought. To grab from the video clip I sent last week, the 2011 exchange between Ron Paul and Ben Bernanke when Paul asked Bernanke, “Do you think gold is money?” Bernanke’s response, “No,” to which Paul said “Even though gold has been money for 6,000 years, somebody reversed and eliminated that economic law?”

Paul then asked, “Why do central banks hold it if it’s not money?” Bernanke said, “It’s a form of reserves” to which Paul asked, “Why don’t they hold diamonds” and Bernanke responded, “Well, it’s tradition, a long- term tradition.” Paul finished by saying “Some people still thinks it’s money.”

Gold is not being bought as a hedge against geopolitical risk, gold is not being bought as a hedge against stocks, it’s not being bought to store with a gun (though some certainty do), it is being bought because people and central banks want an alternative to fiat currencies and [one] that can’t be stolen/frozen or printed, particularly the dollar, and it is therefore a form of money. This is not a call on the direction of the dollar, it is just that central banks in particular don’t want to hold as many dollars as they once did and that trend picked up steam after the US and EU confiscated half of Russia’s central bank reserves soon after they invaded Ukraine.

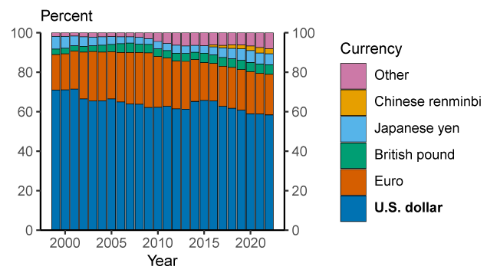

As of Q2 2023, global foreign exchange reserves held in US dollars was about 59%, according to the Federal Reserve. That compares with 62% in the 10 years prior, 66% in 2003 and 71% in 2019 right before the tech bubble imploded and the response of the Fed was to experiment with a 1% fed funds rate which was followed by zero and QE in the great recession that followed. Assume that in Q3 and Q4 that percentage continued to dip and rose with gold as central banks continued their torrid pace of buying gold.

Also understand that as oil continues to gain momentum in terms of transacting in currencies other than the US dollar, such as when the Chinese buy oil from Russia and the Saudi’s, the lessened need for US dollars also gives reason to hold more gold. My friend Luke Gromean in his Friday’s ‘‘The Forest For the Trees’ touched upon this, “‘China and Russia are transacting in CNY, recycling those CNY into Chinese goods, with any net surpluses being stored in gold whose price rises in both CNY and RUB terms.”

From the Federal Reserve, Foreign Exchange Reserves allocation, notice “‘other,”’, https://www.federalreserve.gov/econres/notes/feds-notes/the-international-role-of-the-us-dollar-post-covid-edition-20230623.html

|  | | I also want to touch upon the fact that gold is an inflation hedge against currency debasement using real world examples. In 1970, right before Nixon took us off what was left of the post WWII Bretton Woods gold standard, $1 bought you about 3 gallons of gasoline. Today, that same $1 will buy one about 27% of a gallon of gasoline. In 1970 when gold was price fixed at $35 per ounce, it bought you about 100 gallons of gasoline. Today at around $2,350 per ounce, it buys you about 650 gallons of gasoline. Pretty good protection against inflation.

Let’s do this since 2000 when Greenspan was on the cusp of an unprecedented rate cutting experiment at the time, which spurred gold after a 20-year bear market. One dollar bought you about 2/3 of a gallon of gas while one ounce of gold bought you about 167 gallons. Today, as mentioned $1 will buy you about 27% of a gallon while gold will buy you 650 gallons.

I read that in 1970 the average price of a private year college was $1,562. According to US News and World Report it was $42,162 for the 2023-2024 school year. That’s up 27x. Gold is up 67x since then while the US dollar has lost 96% of its purchasing power. Pretty good protection against inflation.

Let’s take the CPI in totality. Since 1970, again right before we went to an all-fiat financial system, it is up 7.9 times. Since 1970, gold is up 67 times. Is gold not an inflation hedge? Of course it is. There are times where it might lag, but over almost 55 years since the 1971 monetary system changed, it’s done a pretty good job.

Zimbabwe thinks so too. After many years of hyperinflation, they have just replaced its local currency with a gold-backed one. The Governor of their central bank said “We want a solid and stable national currency...it does not help to print money.” Their government said that the new money “shall be anchored in and backed or covered by a composite basket of foreign currency reserves and precious metals received (mainly gold) and valuable minerals.”

| | Great analysis by Peter, and I strongly recommend his Substack service. You can sign up here.

| | What To Do Now...

| | As you can see, the forces driving gold right now are relentless...and we haven’t even gotten the benefit of the inevitable Fed pivot.

After today’s CPI number, many analysts are now predicting that the Fed won’t be able to cut rates this year.

| | But they will — because as the Fed know too well (but isn’t saying), the U.S. economy as well as the federal budget cannot endure interest rates this high.

| | Massive interest rate resets, for federal and commercial debt, real estate and more, are about to crash on the economy like a tsunami. This is why Powell & Co. will be forced to cut rates...and that will turbocharge a gold rally that’s already in progress.

So how can we profit?

Junior mining stocks have historically provided the greatest leverage, and the good thing right now is that this sector has yet to really respond to gold’s big move. (That said, some of our recent recommendations in Gold Newsletter have doubled in price.)

| | In addition to subscribing to Gold Newsletter, you can get up to speed on some exciting junior mining plays by watching the series of interviews that noted authority Kai Hoffman has been doing, along with me, for our YouTube channel.

| | Just click on the links below to watch a few of our most recent interviews.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|  | | | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |