|

| “Without an important contribution from nuclear power, the global energy transition will be that much harder.”

|

| That quote comes from International Energy Agency Executive Director Fatih Birol, and it sums up the future demand-side case for nuclear power and the uranium that drives it.

|

| In an investment world focused on EVs and their lithium-based batteries, uranium can get lost in the shuffle as an energy metal.

That’s changing at this very moment.

|

| In recent months, spot uranium prices that had been languishing for over a decade nearly tripled to $108/lb U3O8, before settling down into the current range around $90/lb.

The price spike reflects a supply side that is very challenged — current mined supply of uranium covers just 74% of global demand, with the rest coming from declining inventories.

The United States is in a particularly precarious position: It represents 28% of global uranium demand...but accounts for just 0.15% of global production.

|

| The U.S. government has made it a priority to correct this imbalance. And Basin Uranium (NCLR.CN BURCF.OTC) has built an impressive portfolio of uranium projects in South Dakota, Wyoming and Utah to take advantage of the growing demand for U.S. uranium.

|

| As you’re about to see, Basin’s flagship project is getting prepped for drilling and Basin is intent on growing its U.S. portfolio through further acquisitions.

It’s a U.S.-focused strategy on uranium exploration that, combined with a drum-tight share structure, holds the promise of significant profits for early shareholders.

|

| Uncle Sam Wants More Uranium

|

| There’s a bipartisan push in the U.S. to wean the country off its dependence on Russia and Russian-satellite Kazakhstan for uranium imports.

|

| The Nuclear Fuel Security Act of 2023 established a Nuclear Fuel Security Program designed to increase domestic uranium production.

|

| And then there’s the U.S. House bill that seeks to ban uranium imports from Russia.

Supporting this effort is the U.S. Strategic Uranium Reserve initiative, which is expected to generate a 20-million-pound-plus uranium stockpile over the next decade.

Combined with a potential increase in nuclear power to support the energy transition, this stockpile promises to place a premium on domestically produced uranium.

And Basin Uranium is poised to capitalize.

|

| Perfect Timing For Basin Uranium’s U.S.-Based Projects

|

| With two projects in South Dakota, two in Wyoming and one in Utah, Basin is ideally positioned for this trend.

The company has built its portfolio by combing government sources of data on some 10,000 different uranium occurrences, and then making strategic acquisitions.

|

| Basin’s focus in building its project portfolio has been to acquire data, interpret it, and then to see if the projects fit the lens of in-situ recovery (“ISR”) mining.

|

| All of Basin’s current projects have the potential to be ISR amenable, which would both reduce their environmental footprint and provide a more cost-effective development method.

ISR is the lowest capex and opex form of uranium mining and the quickest to market in a uranium bull market.

|

| Two Big Catalysts:

An Upcoming Resource And Drilling

|

| Basin is intent on proving up its flagship Chord project in South Dakota in 2024.

The goal is to generate an NI 43-101-compliant resource on the historical resource at Chord. The historical resource prepared by Union Carbide was approximately 4 million pounds U3O8. Updating the resource, assessing the expansion potential and the ISR amenability is paramount.

South Dakota was a hotbed of mining activity in the 1960s, but has lain largely dormant since then.

The next step for Basin is to shepherd Chord through South Dakota’s permitting process, which is currently underway. Basin aims to have drill permits in hand by H2 2024.

|

| At that point, it will drill a significant number of wells on the project to test the grade, expand the mineralization footprint, and test for the parameters that would make ISR possible.

|

| With the uranium market already trending higher again, the results from this work could be market-moving for the company.

|

| Early-Stage, Big Potential

|

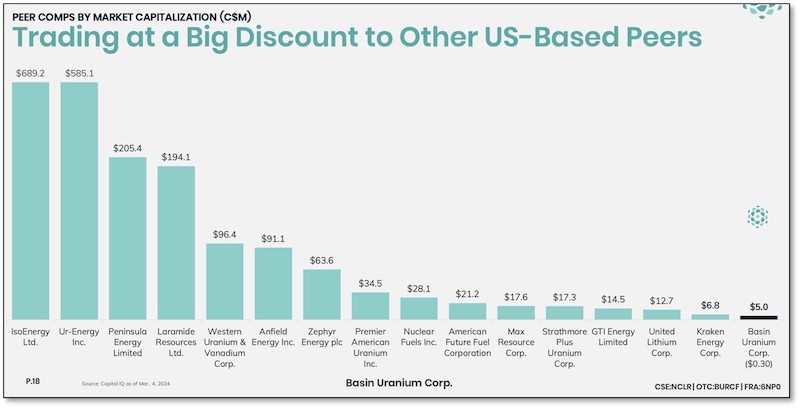

| The powerful run in uranium and uranium equities at the beginning of this year saw a number of larger companies multiply in value.

But the smaller, earlier-stage explorers like Basin have been passed by so far.

However, history tells us that it is precisely these companies that can provide the most upside potential. And with the uranium price creeping back upward now, investors will be looking for the smaller, still-overlooked companies with the greatest potential.

|

|

| Click image to enlarge

|

| For investors looking for the greatest upside, Basin Uranium — with its prime properties, upcoming resource and U.S. focus — will be a highlight.

|

| The Time To Invest In The Sector

|

| Here’s the key to the uranium story: Even if uranium traded at $200/lb. tomorrow, there still wouldn’t be any new production for many years.

Not only that, but uranium represents only about 5% of a nuclear power plant’s operating expenses. That means that demand for the energy metal is price inelastic — the price could soar with little effect on either demand or supply.

The mix of huge supply deficits, geopolitical events like the war in Ukraine, development of small modular reactors and the emergence for the Sprott Physical Uranium Trust promises to keep uranium prices elevated for the foreseeable future.

|

| With Basin intent on developing Chord (and its South Pass project in Wyoming) in 2024, now is the time to start placing your bets on the uranium sector.

|

| And Basin is a bet you’ll want to strongly consider, as it advances its current projects and looks to add new ones in the future.

|