| What gold’s wild ride means...

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | Wild Ride

| | | On Friday, gold soared, then plunged in a stunning, $100 price swing. Here’s what that stomach-churning experience means...and doesn’t.

| |

April 15, 2024

Dear Fellow Investor, | | I was shocked by what I saw transpiring as I watched the gold market on Friday.

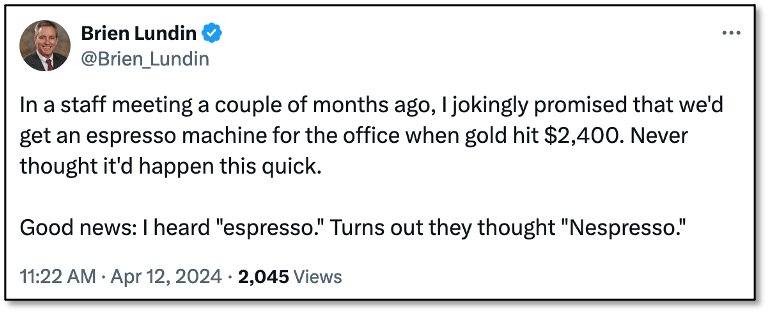

| | Gold had begun to rocket higher in the morning, with major leaps each time I looked. Up $20, then $30, then $50. It finally stopped at $60 higher...reaching $2,431.90...and I posted this on X:

|  | | I got lots of free advice on coffee makers after that post, but I also got chills as I witnessed the vertical trajectory of the gold price.

Then it all changed with a flash.

|  | | As you can see, gold was hit by a tidal wave of selling that pushed the price off a cliff. Instead of up $60 on the day and well over $2,400, it ended up down $28.50.

I wouldn’t have to buy that coffee maker after all...but that was little consolation.

| | Misplaced Worries

| | Friday was a helluva roller coaster ride for gold, but my reaction to the experience might surprise you.

Frankly, I found the price rise scarier than the fall.

Yes, buy stops were being hit on the way up and shorts were being forced to cover. But the move was too much, too quickly, and obviously based on the developing geopolitical crisis as Iran was preparing to attack Israel.

| | Geopolitical events, as I’ve stressed ad nauseum over many years, are the worst reason to buy gold. The spikes are short-lived and the price quickly ends up at or below where it started.

| | This example was about as short-lived as could be, as the price quickly succumbed to profit-taking and steep sell-offs in other risk assets.

At the end of it all, I think Friday’s trading experience tells us little about the current gold market and where the price is headed.

| | Seemingly Insatiable Demand

...From Still-Unknown Sources

| | Like the sharp, off-hours price spike in gold in early December, I believe the volatility on Friday will show up as a mere blip on the longer-term gold charts.

| | What will remain important is the remarkable uptrend we’ve seen since the beginning of March — one that has been nearly relentless and hasn’t come from traditional sources.

| | As I’ve revealed in these Golden Opportunities issues, it’s become apparent that a surge in buying from central banks in general, and the People’s Bank of China in particular, along with heavy demand from domestic China, has been largely responsible for kicking off this amazing move in gold.

However, buying from Chinese citizens has tapered off during the later stages of this rally, while demand from India has fallen sharply. (This has largely been replaced by silver buying in both regions, resulting in a major catch-up price move for the “poor man’s gold.”)

Yet, before Friday’s event, we saw massive, consistent buying in gold that drove the price ever higher despite dollar strength and rising Treasury yields.

Frankly, the buying pressure has smacked of desperation, and my gut tells me that there’s been something else going on other than “just” central bank and Chinese buying.

| | Noted gold analyst Ross Norman agrees, and in a recent post on his Metals Daily site, he notes that “Someone has evidently made a monumental bet on the gold market via the OTC options market.”

| | The global over-the-counter options market is shadowy, and we can only get a little insight into what’s going on by looking into flows and positions on the London Bullion Market Association (LBMA).

Analyzing that data, Norman feels that the positions represent hundreds of tonnes of gold. However, he doesn’t feel this is “good” buying, as the leverage and hedging positions by bullion banks are destined to be quickly reversed at some point.

I agree with Norman on the likely mechanism of the buying, but what about the source and rationale of those positions? Could it be more than a mere paper trade, and a way of securing massive amounts of gold at virtually any price?

This seems increasingly likely to me and, if so, that would be indicative of tremendous amounts of dislocated gold. Or, rather, gold that should be in national reserves but isn’t.

In short, what we’re seeing right now may be related to Frank Veneroso’s seminal work in The Gold Book, which we published in the late 1990s, detailing how gold had been leant out of central bank reserves and to bullion banks, which then quickly sold that gold into the market and invested the proceeds into leveraged investments.

This was the factor behind the ever-descending gold price in the 1990s. And that chicken may be coming back to roost today, with central banks demanding that the “IOUs” in their gold reserves are finally replaced by gold bullion.

This is all speculation on my part, but I do feel there is another factor, or factors, at work driving this remarkable move in gold (and now silver).

| | If that’s the case, then this is not only “good” demand for gold, it represents far more metal than anyone is now considering.

| | As I write, gold has taken off to the upside again, while silver and copper are soaring. The rally is back in force.

The lesson is to ignore a blip like we saw on Friday, and make sure you’re positioned for a metals bull market of a degree and duration that few are yet appreciating.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

|  | | | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |