| A potentially COVID-proof lever on gold & silver |

|

| Please find below a special message from our advertising sponsor, GR Silver Mining. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Unlocking A

Treasure Trove

|

|

Thanks to a recent acquisition that came with more than 500 holes of unreported drill core, GR Silver Mining (GRSL.V; GRSLF.OTC) is perfectly positioned to make news in a COVID-quieted market.

This new property’s data treasure trove — part of a portfolio of advanced, development-stage assets — sets GR Silver up to deliver leverage on stimulus-fueled precious metals markets.

|

|

There’s no doubt that COVID has injected a historic level of uncertainty into the global economy.

|

|

It’s been a harrowing, life-and-death event for those directly affected. From a health perspective, at least, the good news is that we’ll get past this at some point.

|

|

From an economic perspective, however, the fallout from zeroed interest rates, massive money printing and colossal stimulus spending will be with us for years to come.

|

|

In fact, if you’re a gold bug, it’s hard not to be excited by what all this means for precious metals investors.

Simply put, gold and silver are being launched higher, clearly beginning a major new bull market, in anticipation of the repercussions from this massive, global monetary inflation.

The question for investors is how to best position themselves for what’s coming.

If past is prologue, when general investors rotate into the relatively tiny gold and silver mining sector, they’ll snap up the producers first before they move down the risk-reward food chain to developers and explorers.

|

That’s especially true now that COVID-related work restrictions are likely to hamper the news flow of many juniors, at least in the initial stages of the pandemic.

| GR Silver Mining (GRSL.V; GRSLF.OTC) is positioning itself to be an exception to this rule of thumb.

Thanks to its recent acquisition of the Plomosas silver project, the company has further consolidated its hold on Mexico’s Rosario district and added a ready-made, COVID-proof source of news flow in the process.

|

|

Plomosas: C$5 Million Buys A Project With US$48 Million In Exploration And Infrastructure

|

|

GR Silver already had a strong presence in the Rosario district thanks to its control of the San Marcial and El Habal projects in the region, but its addition of Plomosas earlier this year has vastly expanded its hold on this rich mining region.

That hold also includes the Rosario silver-gold project, which is strategically adjacent to the historical, multi-million-ounce Rosario mine (now controlled by Fresnillo plc).

GR Silver managed to buy Plomosas from First Majestic for just C$5 million, a purchase price consisting of C$100,000 in cash, a 19.9% share position in GRSL and a 2% NSR royalty (which includes the option for a 1% buyback by paying US$1.0 million).

Combined with First Majestic’s later work on the project, GR Silver’s version of Plomosas came with nearly $50 million of infrastructure and data. That includes $30 million of underground development, on-site power, a 120-person camp and key buildings and road access left behind by Grupo Mexico.

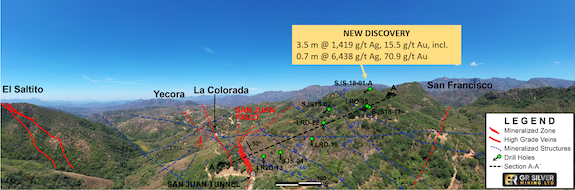

As you can see from the map below, the project has already been extensively worked by past owners Grupo Mexico and First Majestic (US$18.0 million of exploration investment).

|

|

| Plomosas comes with six defined shallow zones of mineralization, with 100,000 meters of drilling, and over 30,000 linear meters of underexplored mineralized veins and structures on surface ready to define new high grade silver and gold discoveries. | Plomosas comes with five shallow zones (defined by an average of 100 drill holes per zone); one shallow, past-producing underground mine; and more than 30,000 meters of identified, underexplored mineralized veins and structures. Taken together, this data defines a district-scale mineralized system.

Grupo Mexico mined one area only for lead-zinc and did not explore for silver and gold. They did, however, leave behind a significant amount of in-place infrastructure. A result of this is the recent discovery of multiple high-grade silver and gold veins at San Juan.

|

|

|

A Ready-Made Source Of News Flow

| Just as importantly for us as investors, Grupo Mexico and First Majestic generated more than 500 holes — $18-million-worth of drill core — whose results they never released to the public.

Why, you may well ask?

Often, big companies do not release drill hole results. As large operators, Grupo Mexico and First Majestic fall into that camp — their stock prices are more attuned to the strength of the broader market and investor perception of their quarterly production and financial numbers than to exploration results.

In short, they don’t have the same incentive as juniors to release exploration-stage assays, even bonanza-grade ones like Plomosas has shown itself capable of generating.

|

The upshot? For a relative song, GR Silver has acquired a project capable of generating a steady stream of news flow for just the cost of validating this recent and historic core at the lab. We say “recent” because some of the holes were drilled from 2016 to 2017.

| Based on management’s initial analysis of this core, it believes it will have enough data to generate a resource estimate for some of the six zones either later this year or early in 2021.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

|

A 47-Million-Ounce Head Start

|

|

Better still, this work at Plomosas will build on the company’s already large, open-pit-amenable silver resource at San Marcial.

Located 5 kilometers south of Plomosas, San Marcial boasts an indicated silver-equivalent resource of 36 million ounces and an inferred silver-equivalent resource of 11 million ounces (47 million silver-equivalent ounces in total).

This resource has the potential to grow the project’s already-impressive silver-equivalent totals via exploration — GR Silver has identified eight high-priority drill targets along the six kilometers of mineralization that have been outlined on the project.

A resource-expansion program for San Marcial is planned for later this year. That effort will both test these targets and probe below the existing resource for gold mineralization at depth.

|

|

Bonanza-Grade Assays In a COVID-Quieted Market

|

|

For now, though, investor attention will be squarely focused on the assays pending from Plomosas.

The first batch of assays released this week from the San Juan zone indicates why.

|

|

The initial assays from that 500-hole-plus backlog were highlighted by Hole 1A (3.5 meters of 1,419 g/t silver and 15.5 g/t gold or 2,930 g/t silver-equivalent).

That hole included a narrower interval grading an astonishing 13,335 g/t silver-equivalent over 0.7 meters, representing evidence of high-grade silver and gold in an area previously only explored for zinc and lead.

These new drill assays confirm the continuation of mineralization up to 300 meters down dip from recent underground sampling at San Juan. Results from that effort hit the market last week and outlined several new discoveries and multiple veins.

With this first batch of drill assays priming the market for the likelihood of more high-grade results to come, GR Silver is in a unique position among its junior brethren.

|

The COVID crisis is inevitably going to slow news flow in the next several weeks for most juniors, but GR Silver will be able to inexpensively crank out news — assays on top of assays — from a project known for ultra-high grades.

|

|

It’s a situation tailor-made for share price appreciation in the current environment, but it’s one that you won’t want to delay taking advantage of — other investors are starting to sniff this opportunity out and beginning to bid up the company’s share price as we speak.

If you like what a post-crisis world is going to look like for gold and silver, you’ll want to consider building a position in GR Silver today.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |