April 21, 2025

Dear Fellow Investor, |

| Gold’s up nearly $100...again...as I write, and even I’m stunned by this rally. |

| This run in gold, now to over $3,400 on a spot basis, has been so remarkable that even the major media are, well...remarking on it. |

|

| That leads, of course, to the talking heads trying to explain it. And, true to form, they’re taking their shots and badly missing.

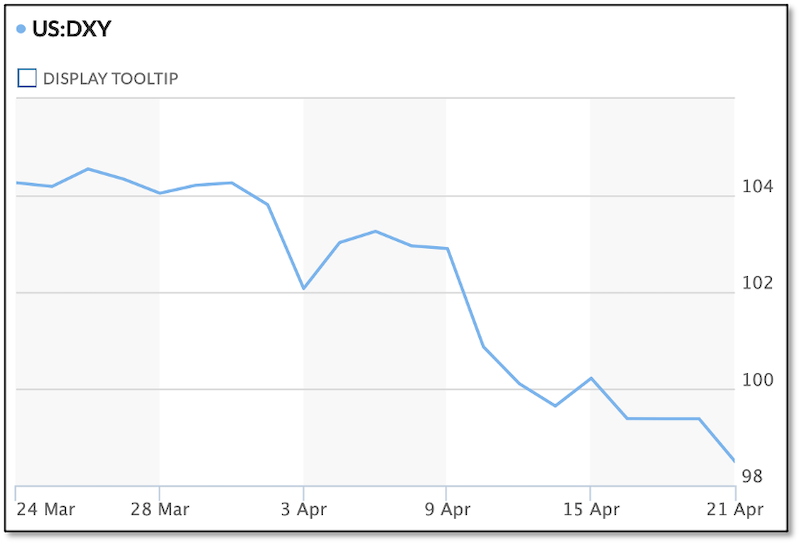

Many are crediting the jump in gold to the drop in the U.S. dollar, and given this slide in the greenback, that’s not surprising. |

|

| Others are blaming this $100 jump on an escalation in President Trump’s rhetorical war on Fed Chairman Jerome Powell. I’m sure this is a factor for some, but you would think it’s obvious that the strategy behind getting Powell gone would be to get interest rates lower. So if that’s what the market is thinking, then why are stocks selling off and the 10-year yield rising?

Then others are saying that today’s jump in gold — and the coincident nose dives in stocks, the dollar and bonds — are due to a continuation of the “selling America” theme that I wrote you about early last week. As the Wall Street Journal summed up: |

| The "Sell America" trade picked back up on Monday. Stocks fell, with the Dow industrials dropping 1,100 points and on pace for their worst April since 1932, and the dollar hit fresh multiyear lows against the euro and other major currencies. Yields on longer-term Treasurys rose and gold surged to a fresh record high. Markets are on edge about President Trump's tariff war as well as his threats to fire Fed chief Jerome Powell. Trump on Monday demanded lower rates in a post on social media, saying costs are trending downward and the economy could slow "unless Mr. Too Late, a major loser, lowers interest rates, NOW." On Friday when markets were closed, National Economic Council Director Kevin Hassett underscored the White House's displeasure with Powell, saying officials were studying his removal. An early set of data from trade bellwether South Korea showed a big drop in exports to the U.S. this month. |

| Give them credit, because that’s closer to the mark in explaining not only today’s big jump in gold, but it’s astounding run so far this year.

In my opinion, anyone who focuses on any single factor behind gold’s surge is missing the big picture. As I also wrote last week: |

| “...gold has been telling us that

it’s not one thing. It’s everything.” |

| As I’ve written for decades, one of the hallmarks of a bull market, in any asset, is when every new data point is interpreted bullishly.

By this measure alone, gold is in an historic bull market...because even if a development sends Treasury yields rising or the dollar strengthening, it’s almost always sent gold rising.

And it’s not just a matter of interpretation — it’s cold, hard facts. |

| It’s a fact that 45 years of ever-easier money and ever-greater debts has built a debt trap that cannot be escaped without a major devaluation of fiat currencies around the globe. |

| Smart investors know this. Gold knows this. And gold’s tremendous run over the last 14 months is not so much a prediction of what is to come as it is a recognition of the current situation.

The good news is that you can protect yourself against the coming great currency devaluation by buying gold now to protect those funds against the decline in purchasing power.

Perhaps even better news is that mining stocks have barely begun to recognize this major new bull market in gold. |

| The stocks in our Gold Newsletter portfolio are just beginning what I believe will be historic moves. It’s not too late — and that’s why I continue to urge you to subscribe now, before the biggest and most profitable gains can be realized.

You can join our very happy and excited family of subscribers now by CLICKING HERE. |

| And tomorrow, you can get a detailed update on this extraordinary opportunity from me and a panel of seasoned experts... |

| Metals And Market Mayhem

Tuesday, April 22nd

11:00 a.m. EDT/8:00 a.m. PDT |

| Tomorrow morning, I’m joining a panel of top experts from the junior mining industry — Rick Van Nieuwenhuyse of Contango ORE, Diane Garrett of Hycroft Mining and Robert Archer of Pinnacle Silver and Gold — along with Daniel Barankin, CEO of the 6ix webcasting group, for an in-depth panel presentation to explore what’s going on this sector. |

| Importantly, we’ll be focused not only on what’s driving the metals higher, but also what you can do about it. |

| You won’t want to miss this presentation — I strongly recommend that you click on the link below to register now. |

| All the best, |

|

| Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference |

| CLICK HERE

To Register For

Metals And Market Mayhem

Tuesday, April 22nd

11:00 a.m. EDT/8:00 a.m. PDT |