| Please find below a special message from our advertising sponsor, Defense Metals. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. | |

Driven by robust demand for their green energy and military applications, rare earth element (REE) plays have the market’s attention.

One key player that it has so far overlooked, though, is

Defense Metals (DEFN.V; DFMTF.OTC) — a company with a deposit rich in the most critical REEs.

As you’re about to see, Defense currently trades at bargain levels…but that seems destined to change in the near future.

| | |

The interesting thing about rare earth elements (REEs) is they aren’t actually all that rare.

|

The fact is there’s plenty of REE mineralization scattered across the earth’s crust.

The problem is REE concentrations large enough to economically extract are rare — exceedingly rare.

That rarity explains why REE deposits are so valuable.

Many, many modern applications require them, which puts accessible, mineable REE orebodies at a premium.

|

That is what makes Defense Metals (DEFN.V; DFMTF.OTC) and its Wicheeda REE deposit in central British Columbia so attractive1.

|

Here’s a project with potentially economic grades of some of the most in-demand REEs…located in an area with a long mining history…and blessed with great infrastructure.

And here’s the important point: Given the global scramble to secure consistent REE supplies, Defense Metals’ overlooked story isn’t likely to stay overlooked for much longer.

Defense Metals is the REE play you’ll want to explore now, before the rest of the world discovers what’s happening.

|

A Compelling REE Resource

|

To have skin in the REE game, you have to have a quality resource, and Defense Metals’ Wicheeda deposit checks that box quite easily.

As of the most recent estimate in 2020, Wicheeda hosts an indicated resource of 4.89 million tonnes of 3.02% light rare-earth oxides (LREO) and an inferred resource of 12.1 million tonnes of 2.90% LREO.

As the table below demonstrates, Wicheeda’s bench-scale flotation mineral concentrate grades compare favorably to world class mines like Mountain Pass, Mt Weld and Bayan Obo.

| |

| 1 See Defense Metals News Release Dated October 23, 2019

2 Verbaan, N., Bradley, K., Brown, N., and Mackie, S., 2015 A review of hydrometallurgical flowsheets considered in current REE projects. In: Simandl G.J. and Neetz, M. (Eds.). Symposium on Strategic and Critical Materials Proceedings. November 13-14, 2015, Victoria, British Columbia Ministry of Energy and Mines, British Columbia Geological Survey Paper 2015-3, pp. 147-162

3 These are commercial operations and the results of Defense Metals’ current results are from controlled lab testing and are not comparable |

In addition to similar mineral concentrate grades, Wicheeda bench scale flotation testing also yielded 85.7% LREO recoveries.

Simply put, this is a fantastic REE resource — one made better by positive metallurgical test results.

And unlike many REE deposits, Wicheeda isn’t located in some far-flung location, but in a very accessible, mining friendly area of British Columbia.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Rich In The Right Rare Earths

|

The true benefit of that location becomes clear when you consider how desperate the world is to find reliable REE sources.

Key commercial applications for REEs include medical imaging, battery production and coatings for cameras and night-vision lenses. Key military applications include high-performance guidance control systems, electronic jamming devices, high-powered laser targeting, and fighter jet engine manufacture.

|

And then there’s the uber-high-growth sector that is the electric vehicle market.

|

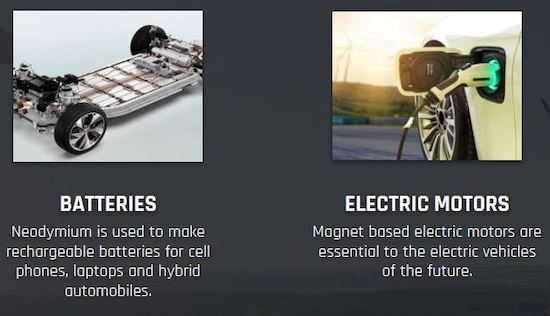

EVs are considered a crucial component in the global effort to combat climate change — and their growing popularity is putting a premium on the REEs that help power their magnet-based motors.

|

|

These motors are in every Tesla that comes off the manufacturing floor, and the key REE inputs for them are neodymium and praseodymium.

Why does that matter to Defense Metals and its investors?

Only this — out of all the key REEs, the rare metals of highest economic interest at Wicheeda are neodymium and praseodymium.

In other words, just as market demand for these key REEs is exploding, Defense Metals boasts a deposit tailor-made to meet that demand.

|

Offtake Partners Are Coming Calling

|

Need proof that Wicheeda’s resource is marketable?

Well consider that in just the last month, Defense Metals has had requests to ship concentrate samples to four of the world’s biggest REE processors.

Defense’s goal is to use these samples as the starting point for negotiations on a possible offtake agreement that can help finance Wicheeda towards a potential production decision.

That these processors are making overtures at Wicheeda’s stage of development speaks volumes for how in-demand new REE supplies are in the global economy.

The myriad crucial commercial and military applications that REEs support make them necessary, almost regardless of cost.

| |

With offtake partners beginning to express interest and management steadily moving Wicheeda along the development curve, now is a great time to begin taking a closer look at Defense Metals.

Considering that the company’ s current market cap hovers around C$20 million, it’s easy to see why DEFN makes such a compelling lever on the world’s scramble to secure stable supplies of REEs.

|

Bottom line: very few exploration-stage REE companies are this far advanced.

|

The trends driving REE demand are irrefutable and irresistible — as is the investment argument for Defense Metals at or near current levels.

| | | | [1] National Instrument 43-101 Technical Report on the Wicheeda Property, British Columbia, effective June 27, 2020 and prepared by APEX Geoscience Ltd. (Steven J. Nicholls, B.A. Sc., MAIG and Kristopher J. Raffle, B.Sc., P.Geo) is available under Defense Metals’ profile on SEDAR (www.sedar.com).

Scientific and Technical Information

The scientific and technical information contained in this document has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, a director of Defense Metals and a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Technical Report

National Instrument 43-101 Technical Report on the Wicheeda Property, British Columbia, effective June 27, 2020 and prepared by APEX Geoscience Ltd. (Steven J. Nicholls, B.A. Sc., MAIG and Kristopher J. Raffle, B.Sc., P.Geo) is available under Defense Metals’ profile on SEDAR (www.sedar.com).

Forward-Looking Information

This document includes certain statements that constitute “forward-looking information or statements” within the meaning of applicable securities law, including without limitation, Defense Metals’ expectations for its deposit, plans for its project, as well as other statements relating to the technical, financial and business prospects of Defense Metals and other matters. Readers are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance

on forward-looking statements due to the inherent uncertainty of such statements. Forward-looking statements address future events and conditions and are necessarily based upon a number of estimates and assumptions. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. Forward-looking statements are subject to a variety of risks and uncertainties, which could cause actual events,

level of activity, performance or results to differ materially from those reflected in the forward-looking statements, including, without limitation: (i) risks related to rare earth elements, and other commodity price fluctuations; (ii) risks and uncertainties relating to the interpretation of exploration results; (iii) risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses; (iv) that resource exploration and development is a speculative business;

(v) that Defense Metals may lose or abandon its property interests or may fail to receive necessary licences and permits; (vi) that environmental laws and regulations may become more onerous; (vii) that Defense Metals may not be able to raise additional funds when necessary; (viii) the possibility that future exploration, development or mining results will not be consistent with Defense Metals expectations; (ix) exploration and development risks, including risks related to

accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration and development; (x) competition; (xi) the potential for delays in exploration or development activities or the completion of geologic reports or studies; (xii) the uncertainty of profitability based upon Defense Metals history of losses; (xiii) risks related to environmental regulation and liability; (xiv) risks associated with failure to maintain community acceptance, agreements and permissions (generally referred to

as “social licence”), including local First Nations; (xv) risks relating to obtaining and maintaining all necessary government permits, approvals and authorizations relating to the continued exploration and development of Defense Metals projects; (xvi) risks related to the outcome of legal actions; (xvii) political and regulatory risks associated with mining and exploration; (xix) risks related to current global financial conditions; and (xx) other risks and uncertainties related to Defense Metals prospects, properties

and business strategy. These risks, as well as others, could cause actual results and events to vary significantly. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, the loss of key directors, employees, advisors or consultants, adverse weather conditions, increase in costs, equipment failures, government regulations and

policies, litigation, decrease in the price of REE, the impact of Covid-19 or other viruses and diseases on the Company’s ability to operate, failure of counterparties to perform their contractual obligations and fees charged by service providers. Investors are cautioned that forward-looking statements are not guarantees of future performance or events and, accordingly are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty of such statements.

Sources:

· www.sedar.com

· www.defensemetals.com | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |