|

In light of the new Bloomberg Businessweek Magazine cover this week, “Is Inflation Dead?” (just as oil trades at a six-month high on supply issues), and the WSJ article titled “Fed officials contemplate thresholds for rate cuts,” I’m going to comment a bit here on the inflation debate, since it has a direct influence on Fed behavior.

I believe there is a faulty and incomplete view of the government inflation stats that has been and still is driving Fed policy. I’m not going to get into the curse of the magazine cover.

It’s nothing new for me, but I’m still amazed how superficial the inflation discussion is among Fed officials and among many others. This 2% inflation God they’ve created, that we all need to pray to and a manna we must all reach at all costs, has become a dangerous goal.

Let’s start with the basic concept that “inflation” can be defined as too much money chasing too few goods. I’ll add this, inflation is a tax. I’m now going to touch upon a few disconnects and misunderstandings.

1) The Fed gets an A+ for creating “too much” money, but what they don’t understand is that it has created “too MANY” goods via excess capacity in many different areas that have and are financed by that easy money.

So all that monetary easing actually laid the basis for lower goods prices that the Fed has tried to inflate. In last week’s industrial production figure for March, capacity utilization was 78.8%, still below the 50-year average of 80% in the 10th year of this economic expansion. Do they realize this?

2) The Fed has chosen to focus on the PCE measurement of consumer prices instead of CPI. As stated here many times, healthcare is the biggest component of PCE, where much is driven by Medicare and Medicaid reimbursement rates. So we have the Fed making monetary policy based on an inflation metric whose biggest component is price-fixed by the government. Superficial analysis.

The CPI measures actual out-of-pocket medical spending. Core CPI has been 2%+ for 13 straight months through March. Through January, core PCE has seen one print above 2% since 2012. Thus, we have monetary policy being driven by a cherry-picked measure of consumer price inflation. Why CPI instead of PCE?

3) Asset price inflation of course is not part of any Fed discussion on where “too much money” ends up, even though their prints are all over the prior two booms and busts. In the search for consistent 2% annual inflation this time around, the world’s central banks have blown the bubble of all bubbles in global bonds in the current monetary boom. Bank profitability has suffered as a result and savers have gotten slammed.

Also, if “financial conditions” matter to monetary policy makers when they are too tight, why is it completely forgotten when they are too loose?

Golden Opportunities continues below...

4) The biggest cost of living for most is housing. Anyone catch the mid 2000s home price inflation driven by exceptionally low rates at the time? That’s been replaced now by rental increases that have run north of 3.5% per annum for years and home prices that are back to record highs in many markets. That Millennial and/or first-time home buyer doesn’t want to hear about the Fed’s whining that inflation is too low and they are not hitting their target.

5) Hedonic adjustments are fooling the Fed and others into thinking inflation is too low. This is how the BLS defines it: “In price index methodology, hedonic quality adjustment has come to mean the practice of decomposing an item into its constituent characteristics, obtaining estimates of the value of the utility derived from each characteristic, and using those value estimates to adjust prices when the quality of a good changes.”

Thus, the BLS is determining whether the “utility” you get from new technology is more or less than the increase in the price of the car. If yes, the “price” magically declines and vice-versa, even though in real life people pay with actual money.

To quantify, Kelley Blue Book said the average vehicle price finished 2018 at $32,544. That is up 14% over the past five years. It is up 28% over the past 10. According to the BLS measure of CPI, the price of a new car/truck is DOWN by 0.3% since 2013 and up by just 11% over the past 10 years.

Going back 20 years, the average new vehicle price in real life is higher by about 65%, while the BLS in fantasy land says it is up by only 2%. YES, the BLS said the average price of a vehicle is up by ONLY 2% over the past 20 years, not per year but in total. This is not reality for the average household consumer and budget, but the Fed is basing monetary policy off it. The high cost of a vehicle has consumers stretching out payments to seven years.

U.S. CPI — NEW CARS & TRUCKS Price Index

6) As any consumer of WalMart, Amazon or anything else, the average U.S. buyer embraces lower prices and deals. After all, WalMart became the biggest private-sector employer in the country on a very simple motto, “Every Day Low Prices.” Would they have made it if prices went up 2% each year?

As many goods prices within technology fall every year, what items do Fed members believe should rise by more than 2% to average out at 2% for everything? In 1980, a fully loaded IBM personal computer cost $3,000. If it went up in price 2% per annum since, it today would be about $6,400. On March 20th, Jay Powell said low global inflation was “one of the major challenges of our time.” Imagine if a PC today costs $6,400. That would be the major challenge of our time.

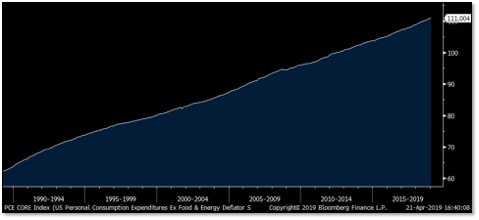

7) Finally, this is a chart of PCE inflation over the past 30 years. The cost of living has only gone straight up. This is not stability.

CORE PCE INDEX

In conclusion, I discuss these things to try to widen the discussion and thought on inflation and try to make silly the Fed’s obsession with an increase of 2% inflation per year (however narrowly they define it and ignore all the assets that they inflate in price) — and the ends of the earth they’ve gone to get it.

I beg the Fed for some introspection and to stop their faulty analysis of inflation. While Charlie Evans is worried about the Fed’s credibility in achieving 2%, the average WalMart shopper could care less and would not be happy being told by him that a 2% annual increase in their cost of living would serve them well.

Reality is quite different than what the Fed’s econometric models spit out.

Editor’s Note: The article above is an example general market commentary by Peter, and it’s important to note that his subscribers also enjoy specific analysis of every major economic data point released throughout the day.

Quite frankly, it’s the kind of analysis that institutional trading desks can pay thousands of dollars a month to access.

However, Peter also offers essentially the same information to individual investors through his Boock Report service, issuing on-going commentary throughout the trading day.

Better yet: Peter has authorized a sizeable discount to Golden Opportunities readers for his Boock Report service. If you want to get the same quality analysis as the biggest hedge funds, you should take advantage of this opportunity by clicking on the link below.

Finally, you can hear Peter’s latest views, in person, at this year’s New Orleans Investment Conference, being held November 1-4. Click here to register now at the lowest early-bird pricing, and enter promotional code FREEGOLDCLUB for a free Gold Club upgrade.

CLICK HERE

To Claim Your Special Discount To

The Boock Report

|