|

The mainstream media loves to point to cut-and-dried explanatory bullet points whenever the PM’s get smoked but it is as simple as doing an overlay of the U.S. dollar against gold to see what it is that the algobots see.

Before we have a gander at the charts below, let me do the honors of laying out in bullet form exactly how the media perceives the recent take-down.

• Kitco: Dollar rally, reduced geopolitical tensions send gold and silver lower

• Goldseek: Gold heads for third straight loss as dollar, Treasury yields climb

• Reuters: Gold slips to two-week low as rising bond yields support U.S. dollar

• Bullion Vault: Gold and Silver Fall, Ratio Turns Up as US Bond Yields Rise Near Four-Year High

They all parrot the most obvious of phrases while ignoring the singular most-impactive influence on the metals since 2000. And that, my friends, is the algobots.

Everything in today’s trading arenas is reactive. Forget the butterfly flapping its wings in Botswana affecting milk prices in Edmonton. Pattern-recognition software is trained to identify word clusters that contain economical or geopolitical significance and, once identified, signals are given to the “mechanic” (or high-frequency trader) — after which entire stock exchanges are buffeted around like a cork in a South Pacific monsoon.

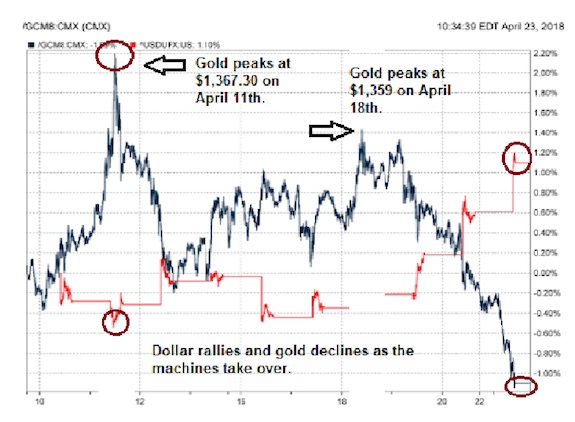

That is what is taking place now with gold now off over $40 since the April 11th peak. The machines see the strength in the US dollar and they react with little or no consideration of the actual reason behind that strength, such as elevated inflationary expectations and tightening of the U.S. labor market.

Inflation is to the bond market as an honest market is to a bullion bank trader; they are both anathema and they wreak havoc.

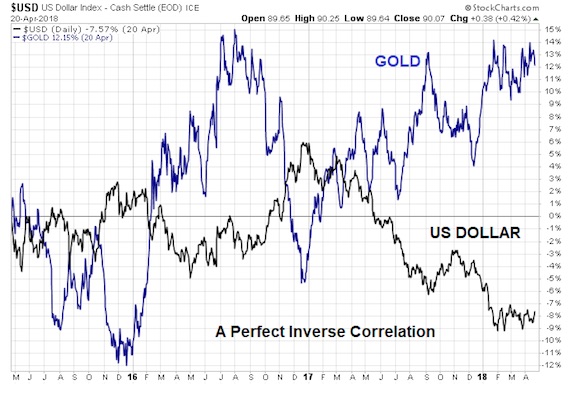

Dollar-Driven Pullback Inverse Correlation

The next two charts show the relationship between interest rates and Forex relationships.

Rising interest rates make dollars more competitive on the basis of yield, while the reverse is also true. This latest oversold bounce in the USD was mirrored perfectly by an upside reversal in the 30-year treasury yield and, while it might be argued that the latter caused the former, there is a definite chicken-and-egg food fight going on in the cafeteria of global interest rates and forex movements.

Whatever the case may be, the machines decided that the strong dollar was a great excuse to sell gold and silver, with declines of .87% and 3.03% respectively. With July silver down at $16.70 and the SLV at $15.67, silver equities are going to have a tough time this week as will the USLV (triple leverage ETN for silver, off 8.85%). I am going to try to replace the 50% position which was sold in Fortuna Silver (FSM; US$5.73) at $6.03 as posted last week but patience has to be a virtue.

The call options sold Thursday north of a buck are back to $.70 and while I am sorely tempted to “BTFD” in here, it is difficult to gauge just how far the USD can rally before it runs into a wall.

To be sure, the errors I have made in the past have been in being over-zealous in pulling the trigger so I am forced to remember the old adage that was drilled into me in the early ’80s about buying back positions that have been successful: “NEVER RELOAD!”

The COT chart for the USD has me really scrutinizing the efficacy of betting against a multi-week rally in the greenback.

The black circles are clearly compressed structures where both Commercials and the Large Specs are carrying relatively small short positions. You can see quite clearly how massive divergences occurred at the major tops north of 100 and how they disappeared in mid 2014 in the high 70s, and in mid-2016 at the 92-level, just before major rallies.

What we are going to need badly is the elimination of the inverse correlation. It has happened before in 2005 and 2010, but the track record of gold versus the strong USD is not good. Watch the USD very closely, and if we get a three-day close above 92, I will be re-evaluating positions.

The maddening part of the past two trading sessions is that we looked poised to attack $1,365-$1,375 resistance (until the dollar decided to spike higher) with the shares gaining momentum and retail participation heightened.

In a mere two trading sessions, the HUI went out on the lows having given up 180 and the TSX Venture is back under 800 with today’s 1.22% whipping. That being said, the gold market has found major demand every single time it has pulled back to $1,300-1,310, so today’s $1,326 is not that far away.

Silver has found support in the $16.15-$16.20 range countless times in 2018, so while that could be the optimum entry point, make no mistake, I do NOT want to see silver break $16.60 lest I am forced to refer to her as the ugly-freckle-faced-red-haired-delinquent-stepchild again.

For now though, she remains the golden-haired, violin-virtuoso with milk-and-honey complexion and sweetness of youth.

Would it that it STAYS as such.

Michael J. Ballanger

Editor and Publisher

Gold and Gold Miners

Toronto, Canada

Follow Michael on Twitter @Miningjunkie

(Nothing whatsoever in the above article should be construed, interpreted, or used as investment advice. The above content is the opinion of the author and is not meant in any way to advise anyone on investment decisions, or be interpreted as advice on any strategy, investment product or plan).

|