| Alaska’s next gold mine — high-grade and open-pit

| | | Please find below a special message from our advertising sponsor, Contango Ore. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| | | Junior Explorer And Senior Producer Join Forces In Alaska

| |

Contango Ore (NYSE-Amex: CTGO) offer investors a unique vehicle to cash in on the cash flow from a high-grade, open-pit mine and the upside potential of an historic underground mine.

| | | |

The junior mining space is packed with companies exploring for big-time gold deposits.

|

It’s rare to find one that’s actually found such a deposit…and is on the verge of getting tens of millions in cash flow from its gold resources.

|

But that’s just what you get with Contango Ore Inc. (NYSE-Amex: CTGO) — a company that’s targeting free cash flow of $60+million/year…starting in just two years…from its Peak Gold joint venture with Kinross Gold Mining (70% Kinross, 30% Contango) in Alaska.

The Peak Gold JV controls the Manh Choh gold project, which Contango discovered and brought to Kinross. Manh Choh is a high-grade (6 g/t), open-pit deposit with exceptional low-cost and low-capital requirements.

Ore will be simply mined at site and then trucked to Kinross’ Ft. Knox processing plant.

No mill nor tailing facilities will be required to be built at site. This saves a lot of money, and years of permitting and construction time, and minimizes overall execution risk. In addition, Ft. Knox has been in production for 25 years; its staff is capable and experienced.

Simply put, Manh Choh is anticipated to become one of the highest-grade, open-pit gold mines in the world. And soon.

|

Unusually Tight Ownership

|

Rick Van Nieuwenhuyse, CEO of Contango, is a long-time Alaskan mining veteran and a guardian of shareholder interests. CTGO only has 6.75 million shares outstanding — an incredibly low total for such an advanced company.

Thus, its share price is higher than most junior mining companies you’ll find, at around $25/share, which translates to a market cap of +/- $170 million. Against that consider the company’s formidable cash position of about $30 million…and that aforementioned free cash flow once production begins.

Moreover, when production commences in 2024, remarkably, this $60 million+ in annual free cash flow to Contango is passive income, similar to a royalty or streaming company.

The company anticipates significant free cash flow per share starting in two years — $6 to $10/share. To say the least, this is rare, probably unheard of, for a junior gold developer. In fact, it’s rare for any public company.

| |

The CEO’s initial ideas for use of these funds is approximately 50% exploration/50% dividends to shareholders. As you’re about to see, the company has superb exploration potential at its other projects, as well as at Manh Choh itself.

|

With fewer than 10 million shares outstanding, shareholders are jazzed by the prospects of an ongoing, meaningful dividend.

|

None of this is lost on Kinross. There is the prospect that Kinross, as well as other miners, may bid to acquire Contango’s 30% of the Peak Gold JV, or to acquire Contango altogether. At the start of this year, Kinross held $1.9 billion in cash.

A take-out would, of course, accelerate the potential profits for shareholders

|

How The Partnership Works

|

Kinross is the manager and operator of the Peak Gold JV.

The JV consists of Kinross (70%) and Contango (30%) as owners of the Manh Choh project, which includes the known resources of 1.3 million ounces of gold and the 875,000 acres of lands leased from the Tetlin Tribe, plus 13,000 acres of state mining claims.

Each partner pays their pro rata share of development costs until production is achieved at Manh Choh. And by the way, as addressed below, CTGO will have no trouble paying its 30% of construction and other development costs.

When production commences, CTGO receives 30% of net revenue after all-in sustaining costs of approximately $750/oz — based on June 2021 guidance from Kinross — with about 66,000 oz. of gold production to Contango’s credit each year.

|

That translates to approximately $60 million/year in free cash flow, with Kinross doing all the work.

|

It's a sweet deal for both sides. Kinross paid $93 million in 2020 to buy their 70% interest from Royal Gold and Contango, with $32 million having gone to Contango. Explorer and miner coming together to join forces results in a sweet deal, especially for shareholders.

Contango’s CEO Rick Van Nieuwenhuyse earlier served with Placer Dome (bought out by Barrick) as VP Exploration.

He founded and was CEO for many years of NovaGold, which discovered the giant (40 million ounce of gold!) Donlin Creek Gold project in Alaska. He then served as CEO of Trilogy Mining and developed the large copper/zinc/precious metal Ambler mining district in Alaska. These are all quality companies.

Rick lives in Alaska and knows how to get things done there. So does Kinross. Manh Choh is another notch in his belt with hand-picked partner Kinross, taking advantage of the under-utilized Ft. Knox mill with long-term, experienced mining staff.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Manh Choh:

The Returns Could Be Even Higher

|

If the quick story for Manh Choh seems exciting, it gets even more so when you consider the upside and near-term catalysts the project checks off:

|

• A JV feasibility study is anticipated in H2 this year — and it will include about 13,000 meters of infill drilling, now completed but not yet released to the public.

• Contango’s preliminary economic assessment (PEA), completed prior to the deal with Kinross, showed an NI 43-101 resource of approximately 1.3 million ounces of gold grading an impressive 4 g/t, mostly inferred.

| | | | Click image to enlarge

|

• After the infill drilling, Kinross has stated that the resource size is likely to remain similar, but with a higher grade and lower tonnage resulting from using a higher cut-off grade to pay for the truck ride to the Fort Knox mill. This results in a 6 g/t average head grade expected to be delivered to the Fort Knox mill for the current five-year mine life.

• Manh Choh is anticipated to become one of the world’s highest-grade open-pit gold mines.

• Guidance from Kinross from June last year was that the capital expenditure to start production would range between $105 million and $130 million. CTGO funds its 30% share of these costs through to production.

• Kinross’ plan is to produce 220,000 oz gold/year for five years, CTGO’s share is 66,000 oz gold/year.

• Importantly, the JV is also initiating 3,000 meters of exploration drilling at Manh Choh this summer. Exploration potential is very high. Several areas are ready to drill based on geophysical and geochemical work. Typically, the best place to find new reserves is next to the existing mine, so with 688,000 acres of highly prospective land for the Peak Gold JV to explore, the owners see a lot of upside.

• A positive feasibility should act as a significant catalyst for Contango and its share price.

• While inflation is rising — and this includes for miners — gold is rising to offset increased costs. In this instance, the price of gold is likely to far more than offset cost increases. (Also, remember that there is not that much to build (no mill, no tailings) so there is not that much to inflate!)

• An independent, positive PEA assumed $1,500/oz gold, and the same gold price is expected to be used in the feasibility study. This presents considerable upside potential once production begins.

• Permitting was initiated last year and is well underway. Management does not anticipate major issues here.

• Manh Choh is located on private land owned by the Tetlin Alaska Native tribe. They will receive a substantial royalty and are fully on board.

• Manh Choh is located just 10 miles from the Alaska Highway which ties directly to the Ft. Knox mill along the all-season paved highway.

|

Add it all up, and investors get a tremendous value with Contango.

But there’s more: In addition to all of the above, the company has additional high-potential gold projects in the hopper.

|

Contango’s Lucky Shot High-Grade Gold Project

|

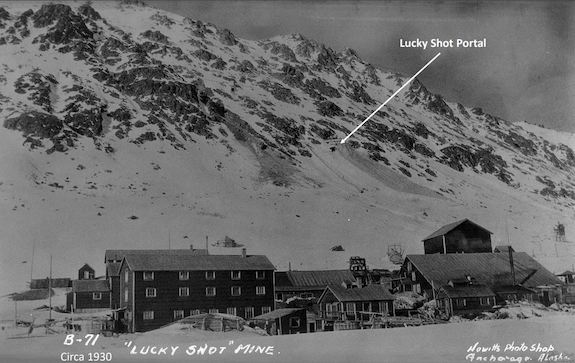

As stated, Rick has explored for gold, mostly in Alaska, throughout his career as an exploration geologist and executive. He hand-picked Contango’s second gold project, the Lucky Shot mine, 45 miles northwest of Anchorage.

Lucky Shot was in production between 1926 and 1942. It was shut down not because it ran out of ore, or because it was faulted off or there was too much water— production ceased because of the War Act and President Roosevelt using an executive order to shut down all gold mining in the U.S.

The Lucky Shot mine itself produced 250,000 ounces of gold grading on average an amazing 40 g/t (1.6 oz./ton). That’s extraordinarily high-grade production for an underground mine. The adjoining deposits on either side, the War Baby and Coleman mines, were also in production, and are now controlled by CTGO.

|  |

In fact, the Willow mining district had over 30 operating mines, all producing gold from high grade veins (averaging 1 to 2 oz/ton) and in total produced over 600,000 ounces from the 1910 to 1942. Most of these historic mines are now on lands controlled by Contango.

In 2016, a prior company had established a measured and indicated resource of 156,000 ounces gold grading 18 g/t. Although today this is considered an historic resource, it is a great place to start.

| |

The plan at Lucky Shot is to refurbish and extend the existing Enserch underground tunnel approximately 700 to 800 feet and then drift parallel to the Lucky Shot vein in the footwall for about 1,500 feet.

This will allow the company to drill-test the down dip projection of the vein. Initially, drill stations will be every 200 feet and a fan of drill holes will be drilled from each drill station. Further in-fill drilling can be accomplished using the same underground infrastructure.

|

Drilling is expected to start in the summer and continue into next year. The target is to establish 500,000 to one million ounces of high-grade gold over the next one to two years and then to develop a mine plan.

|

CTGO has the budget and skilled exploration personnel to make a hit with Lucky Shot and the surrounding earlier mines. By the way, the deposit is about the same distance to the Ft. Knox mill as Manh Choh.

CTGO controls three additional gold exploration properties — Shamrock, Eagle-Hona and Triple Z. All three properties will be explored this year with the objective of establishing drill targets to be tested in 2023.

| |

Contango’s market value of $170 million is in range for a gold developer with a strong project and address.

|

As mentioned, what’s unusual is that the shares outstanding are very low — just 6.75 million, 6.85 million fully diluted — with a compensating higher share price and less liquidity.

|

In situations like this, the committed speculative investor frequently exercises patience to build a good position.

| |

Contango recently completed a non-secured convertible debenture for $20 million with legendary investor Warren Gilman and his investment company, Queens Road Capital.

Gilman is advisor to Lee Ka-shing, Asia’s richest entrepreneur with an approximate net worth of $40 billion, according to Forbes, 2021. Gilman is a definite Asian influencer based in Hong Kong.

Interest is 8%/year and the debt converts to shares at $30.50/share, with several provisions for protecting both parties. Conversion of the entire debt to shares could increase shares outstanding by 666,000.

In addition, last year CTGO filed a shelf registration to raise up to $100 million, none of which has been initiated. Investment banking firms that support the company are RBC, Sprott and Cantor Fitzgerald.

In short, adequate cash will be available for both Kinross and Contango to advance the Peak Gold JV.

| | |

Contango Ore is an entrepreneurial wonder — the company is piloting a new and potentially highly lucrative way to specialize in the discovery, exploration, expansion and development portions of the minerals sector.

It is not a royalty company. It is not a streaming company. It is not a producing miner.

|

But as a junior partner in a compelling project with a major mining company and positioned for a serious ongoing payout, it combines the best of all worlds in one company.

|

There are several ways to value CTGO, and they each show potential for tremendous upside over the coming year.

Lucky Shot drifting and drilling; feasibility study for Manh Choh; exploration drilling at Manh Choh; and the price of gold — these are key catalysts to follow.

As for value: One analyst uses a 10-times 2024 free cash flow model; another analyst uses a royalty model; and yet another analyst uses 70% of estimated total future free cash flow discounted back to the present.

Each of these methods demonstrate superior potential for CTGO as compared to current share price and market capitalization given success on the ground, and underground, this year.

| | | | |

© Golden Opportunities, 2009 - 2022

| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |