| Spending restraint just evaporated… | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| Spending Restraint Evaporates | |

The pace of federal spending has just accelerated to levels that not even the most pessimistic analysts would’ve predicted, as President Biden is set to announce yet another multi-trillion-dollar spending plan.

The implications for Fed policy, the dollar and gold are compelling.

| |

I predicted that the Biden administration was going to follow up its $2.3 trillion “infrastructure” plan with yet another spending binge.

|

But I didn’t expect them to open up the checkbook before that infrastructure plan was even approved.

In blackjack, this is called “doubling down.” In betting, however, the reason to increase your risk is to increase your pay-off. In this case, there’s no pay-off to begin with.

Let’s consider the details just rolled out this morning by the Biden administration…

| |

In his latest spending binge, marketed as the “American Families Plan,” the administration is proposing another $1.8 trillion in spending on child care, education and paid leave.

Those are ideals that, in a vacuum, few would argue against. And I’m sure they tested very well in focus groups. I won’t go into the details of the spending plan (there really aren’t any yet) or into the politics of these proposals.

Instead, let’s delve into the clear and obvious ramifications for investors, savers and the economy.

Consider how Biden & Co. are proposing to pay for this latest spending spree:

|

• Raise the top income tax rate from 37% to 39.6% (for households with income above $400,000).

• Raise the top rate on capital gains from 20% to 39.6%.

• The Obamacare surcharge of 3.8% would not only be retained, but expanded to other types of income, including business and S corporations.

• Thus, the top rates on income and capital gains would rise to 43.4%, from 23.8%.

• One aspect of the “death tax” would be dramatically increased, with the elimination of the step-up in basis at time of death. Instead, assets would be immediately treated as sold — and taxable — at time of death, resulting in the forced sale of many family estates, farms and businesses.

• Real estate tax structures would be dramatically changed, with the ability to exchange properties without incurring capital-gains income being capped. As the Wall Street Journal notes, this move “could significantly alter the commercial real-estate industry.”

• The plan would double IRS enforcement staffing and require banks to report more detailed information about your personal and business banking activity, so get ready for even greater intrusions into your financial privacy.

| | Golden Opportunities continues below... | | | SPONSOR: |

| TSXV:EMPR | OTCQB:EMPYF

Strategically Partnered to Create Value through Gold and Silver Investments | “One of the reasons why I invested in it [Empress] early on is that fact that you are not out there with everyone else trying to bid on royalties or streams, you are actually creating royalties as part of financing packages that mines and projects need….and we have already seen that bear fruit”

“I am very positive and bullish on the company and what we are going to be seeing from Empress in the days and weeks ahead….”

– Brien Lundin, April 23, 2021 |

| Watch the full video interview with Brien Lundin and

Empress Royalty CEO, Alexandra Woodyer Sherron | | Empress Royalty (TSXV: EMPR | OTCQB: EMPYF) is a new precious metals royalty and streaming company focused on the creation of unique financing solutions for mining companies. Empress has a portfolio of 16 investments and is actively focused on finding industry partners with development and production stage projects who require additional non-dilutive capital. The

Company has strategic partnerships with Endeavour Financial, Terra Capital and Accendo Banco which allow Empress to not only access global investment opportunities but also bring unique mining finance expertise, deal structuring and access to capital markets. Empress is looking forward to continuously creating value for its shareholders through the proven royalty and streaming models. | | empressroyalty.com | |

Greater Costs…And Zero Returns

|

The Biden administration optimistically projects that their new tax hikes would raise $1.5 trillion over the next 10 years. Even if true, this wouldn’t pay for the first of his multi-trillion-dollar spending plans, much less this third one.

And of course, it won’t even raise that much. As the Wall Street Journal recently noted, even the Congressional Budget Office (certainly no bastion of free-market economics) estimates that any capital gains tax rate above 28% will lose more money than it returns.

|

Of course, there’s a very valid argument that the ideal capital gains rate is zero — but any such free-market ideals are being blown away by the force of the new “go big” gale of rhetoric coming out of Washington and the media water-carriers.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

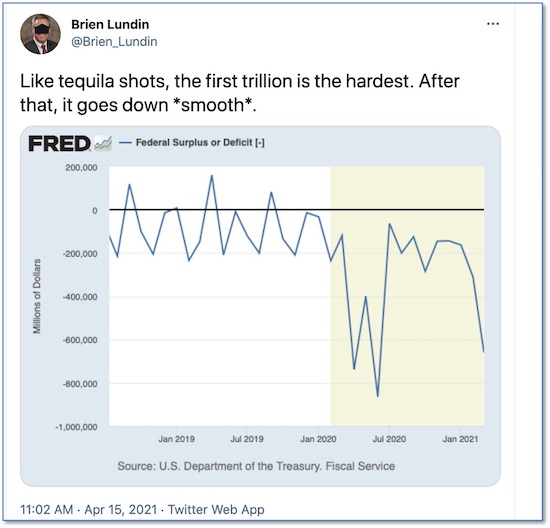

Consider that this latest $1.8 trillion proposal comes fast on the heels of Trump’s $900 billion stimulus passed at the end of last year (way back when Congress was repelled by the “trillion” barrier)…the $1.9 trillion Biden stimulus…and the $2.3 trillion Biden infrastructure spree.

It just gets easier and easier once you get started. As I recently tweeted:

|

|

The bottom line is that whatever spending restraint there might have been, from either side of the political aisle, has now evaporated.

Simply put, the Democrats have learned their lesson from wasting the first two years of Obama’s presidency. They aren’t going to waste this crisis, or their majority in Congress, this time. They’re going to get their agenda passed, to the maximum degree, while they can.

So you can bet there’s even more coming.

Which begs the question, what will be the repercussions of this complete disregard of fiscal responsibility?

The answer is obvious. Whatever they might want to do in terms of monetary policy, the Treasury will be forced to issue ever-greater debt to pay for these monumental spending plans and the Fed will be forced to buy those securities.

In short, trillions of new dollars will be added upon the trillions already being created, exacerbating the out-of-control trends already in place.

|

Because of the towering size of the federal debt (and its accelerating growth rate), interest rates must remain well below the rate of inflation, essentially forever.

|

That means negative real rates, again essentially forever, which is in turn the recipe for much higher gold and silver prices.

If you aren’t already prepared, you need to be. As a first step, I’d recommend that you subscribe to Gold Newsletter now. I’m writing our May issue at this moment, and I’ve got no less than three exciting new junior mining stock recommendations that I’m going to reveal.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

P.S. Coincidentally, there’s another thing you can do — attend a fantastic online event being presented tomorrow by our friends Rick Rule and Albert Lu.

Dubbed “Robinhood, Reddit and The Rise of the Retail Investor,” you can bet that they’ll also touch on the extraordinary new spending and financial privacy plans being put forth.

Rick and Albert have gathered a great group of speakers, including Doug Casey, John Hunt, David Stockman, Nick Giambruno, Tim Taschler (Sprott Global) and more, for lively presentations, panels and Q&A sessions. I’m planning on stopping in myself!

Again, this event is tomorrow. So I urge you to CLICK HERE now, or on the banner below, for more details.

|

| | | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |