10-Million-Ounce Gold Deposit Gets Approved

Alert:

Euro Sun Mining (ESM.TO; CPNFF.OTC) has been granted a rare mining license to top their Romanian mine with an amazing 10.1 million ounces of gold.

Dear Fellow Investor,

A gold deposit containing one million ounces is considered to be world-class.

So what does that make a deposit with 10 times that much gold?

Perhaps dramatically undervalued and primed for a substantial re-rating.

Consider that Euro Sun Mining (ESM.TO; CPNFF.OTC) owns 100% of the massive 10-million-ounce Rovina Valley Project in west-central Romania — a developed and secure nation that is a member of the EU and NATO.

This isn’t a pie-in-the-sky exploration project. The Rovina Valley Project is already established, already has an economic study completed and — very importantly — is already permitted for production.

This is a perfect place to operate a gold mine.

This is an established and prolific mining region with no less than three large gold mines located within 40 kilometers (25 miles) of each other. There's an extraordinary amount of gold already discovered in the region — over 40 million ounces in this Tethyan Gold Belt.

This is like Nevada...or Red Lake, Ontario...Johannesburg, South Africa. Except that nobody knows about it!

Yet.

Checking The Boxes...

Consider that Rovina alone is already ranked #14 in the world for gold deposits. And seven or eight of those ahead of Rovina will almost certainly never see production.

Euro Sun’s CEO, Scott Moore, has no interest in locations that won’t see production. The last four assets he owned are all in production.

And when you look at everything this mine and region have to offer, it’s hard to imagine that his streak will be broken:

• The deposit is perfectly situated, near a Romanian mining town with a population of 13,000.

• Road and rail transportation are close at hand, ready to carry the mine’s product to market.

• Another huge advantage: The cost of power in Romania is dirt cheap at just $0.07 per kilowatt hour.

• The geology is uncomplicated — it’s got just what you want, size and simplicity.

• An independent Preliminary Economic Assessment (PEA) completed just recently for the first stage of mine construction shows operating costs at just $752 per ounce...capital costs at only $352 million...average annual gold-equivalent production of 139,000 ounces...and a pre-tax internal rate of return of 15.4%.

(That puts Rovina Valley’s operating costs in the lowest 25 percent of the industry.)

• Developing this mine will be very simple — nobody must move, there’s no cyanide and no wet tailings. (Dry stack tailings are rapidly becoming the new standard for mining, and the Euro Sun team is embracing that.)

This is a rare situation. Particularly so when you consider that there was one big roadblock until just recently.

The Big Piece To The Puzzle

Most investors don’t realize that Europe still has billions in gold locked away, with hundreds of mines sitting around just waiting for re-activation.

The problem? Acquiring permits can be labor-intensive and sometimes impossible, thanks to EU regulation.

Back when permits were available, Barrick Gold, the world’s most valuable gold miner, got in on the action: The company pumped in $20 million to develop Rovina.

Now Rovina is owned by Euro Sun…and Euro Sun has done what was once considered impossible — it just got its hands on a mining permit.

The mining license from the Romanian government was approved in November 2018 — the first license to have been given out since 2003.

This is a huge achievement. And there are other advantages...

For one, consider that the Rovina mine has been classified as a “highly scalable” asset, with an immense growth potential, according to Cantor Fitzgerald.

That’s partly because the project is anticipated to be developed in stages, to keep the construction costs low.

But also because huge, “marginal” gold resources like that have historically provided great leverage to the gold price — because their value can soar as the gold price rises.

They provide tremendous bang for the buck as a gold investment.

And Rovina offers leverage not only to gold, but also to copper:

The recently updated resource estimate offers a view of the potential riches: 396 million tonnes of measured and indicated ore in three bodies, containing not only 7.05 million ounces of M&I gold resources...

...But also 1.4 billion pounds of copper...

...or 10.1 million ounces of gold-equivalent resource, all in measured and indicated categories.

There’s big, and then there’s huge. Rovina is huge.

A Track Record Of Making Money For Investors

CEO Scott Moore has shown the market and shareholders time and again he is one of the best financial minds in the mining game, worldwide, regardless of commodity.

Moore specializes in brownfields development, not greenfields, which is discovering a new deposit and turning it into a mine 10 years or more later.

You see, he and his team buy an unloved asset with some warts on it, and do all the tough work, i.e. a new mine plan, permitting, financing, etc. Anything in-the-ground or above-the-ground, Moore’s team has shown they can add tremendous value in a short amount of time.

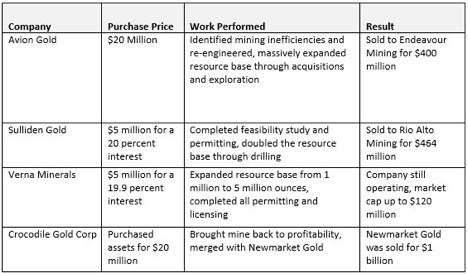

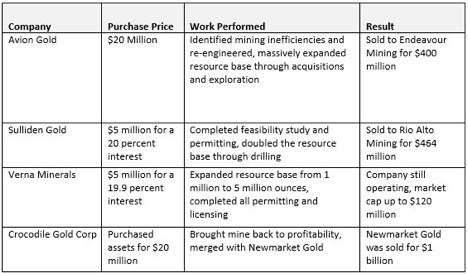

Here is a quick list of some of his recent successes in gold:

Now remember this, with Rovina, he now has 10 million ounces of gold equivalent resources, in a European country.

You see all that money Scott has made his shareholders in the last decade? He never had an asset this large. Think what he and his team can do with this.

The 10-million-ounce Rovina deposit is one of the most sought-after gold assets in the world. Moore bid no less than four times for this deposit before convincing the seller to part with it. Last year, Euro Sun was $1.80/share with this asset and no permit!

Now it’s all coming together:

• SIZE — 10 million ounces of gold equivalent, in Europe, permitted for production, in an area where large scale mining has been done for over 100 years.

• Only 71 million shares out and cashed up with a recent financing

• Management bought the most recent financing (and their average cost is still close to $1/share — higher than today’s price!)

• CEO Scott Moore and his team have an incredible track record in adding value for their shareholders — their last four projects are now in production

• Cheap valuation vs. peers

If you’re looking for a bet on gold — one with tremendous size and leverage to the gold price — you need to take a hard look at Euro Sun Mining now, before more news comes out.

Click here to learn more about Euro Sun Mining

and its Rovina gold project

IMPORTANT NOTICE AND DISCLAIMER

PAID ADVERTISEMENT. This communication is a paid advertisement. Viewergy LLC, and their owners, managers, employees, and assigns (collectively “the Publisher”) is often paid by one or more of the profiled companies or a third party to disseminate these types of communications. In this case, the Publisher has been compensated by Euro Sun Mining Inc. to conduct public awareness advertising and marketing for Euro Sun Mining. Euro Sun Mining paid the Publisher two hundred eighty five thousand US dollars to produce and disseminate this and other similar articles and certain banner ads. This compensation should be viewed as a major conflict with our ability to be unbiased.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and on an interview conducted with the company’s CEO, and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

SHARE OWNERSHIP. The owners of Viewergy LLC owns shares and/or stock options of the featured companies and therefore has an additional incentive to see the featured companies’ stock perform well. The owner of Viewergy LLC will not notify the market when it decides to buy or sell shares of this issuer in the market. The owner of Viewergy LLC will be buying and selling shares of the featured company for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies, the success of the companies’ drilling excursions and mining operations, the size and growth of the market for the companies’ products and services, the companies’ ability to fund their capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

INTELLECTUAL PROPERTY. All trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.

|