How To Find The Next Big Gold Disovery

There’s a clear, time-tested recipe for finding big gold deposits, and Westhaven Ventures (WHN.V; WTHVF.OTC) is following it perfectly.

So much so that they might find more than a big gold deposit — they could establish...and control...a major new gold district.

Dear Fellow Investor,

There are few investments that offer the upside potential of junior exploration stocks.

We’ve seen this tiny sector yield life-changing winners time after time —stocks that soar many times over in value after their drills hit gold.

But there are risks as well. And to maximize potential while minimizing downside, investors need to follow a check list of key attributes.

• Does management have a track record of discovery success?

• Are management’s interests aligned with shareholders?

• Is the company’s exploration program funded?

• Does the flagship project offer significant exploration upside? (Bonus: Does it have the potential for a district-scale property position?)

• Infrastructure — are exploration and development costs low?

• Are there near-term catalysts that could lift the stock?

There are literally hundreds upon hundreds of junior exploration stocks that you can buy. But if you use this check list, you can narrow that field down to a manageable list of potential investments.

In fact, there’s one company — Westhaven Ventures (WHN.V, OTC: WTHVF.OTC) — that quickly rises to the head of the pack.

Consider how it scores on our check list:

Track Record: Westhaven offers an award-winning (Canadian Mining Hall of Fame, Yukon Mining Hall of Fame and PDAC's Prospector of the Year) group of explorationists responsible for multiple discoveries.

Management’s interests aligned with shareholders: Westhaven’s directors and officers own 40% of outstanding shares.

Exploration funded: A Drill program is underway at this very moment, testing a newly discovered gold-mineralized structure with high-grade potential.

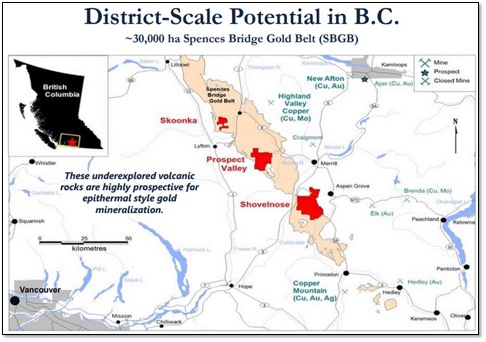

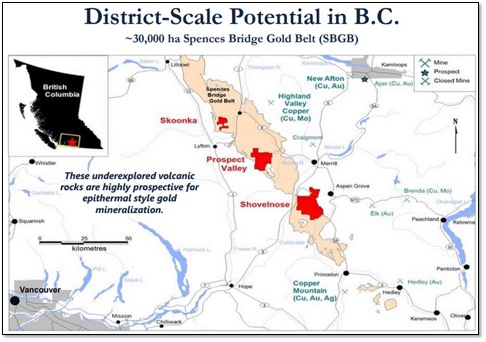

Significant exploration upside (with district-level potential): Westhaven controls a 30,000-hectare land package on an emerging gold belt where limited drilling has already produced results including 20.2 grams gold over 12.8 meters and 26.8 grams gold over 3.3 meters.

Near-term catalysts: Results are on the way from the current drill program.

Infrastructure: Westhaven’s projects are road accessible and close to power, rail, major highways and logistical centers.

Flying Under The Radar...For Now

Yes, it looks like Westhaven ticks all the boxes.

Of course, one of the other keys to junior mining success is getting in ahead of the crowd. If everyone already recognizes a company is on the right track, it’s going to be selling at a premium.

That can’t be said of Westhaven. Due to the company’s non-promotional nature — and the fact that its legendary management team doesn’t have to constantly beat the bushes for money — this exploration outfit has been flying under the radar.

But with drill results on the way, that could change in a flash...especially when investors look under the hood to see how superbly Westhaven completes the junior mining checklist...

An Extraordinary Track Record

Not only is Westhaven Ventures exploring British Columbia’s newest gold belt, it’s also led by veteran mine-finder Gren Thomas, president, CEO and director, along with a team of seasoned financial and technical professionals.

Investing with management teams that have had prior discovery success tilts the odds in an investor’s favor as perhaps no other criterion.

Bottom line, you want to invest alongside explorers who know how to make discoveries. So consider that Westhaven’s CEO, Gren Thomas, is renowned for founding Aber Resources, the company that discovered the Diavik Diamond Mind in Lac de Gras, Northwest Territories.

Diavik is now one of the world’s richest diamond mines, producing 6 million-7 million carats of large, white gem-quality diamonds annually.

The discovery of Diavik took Aber Resources and successor company Harry Winston Diamond Corporation from C$0.50/share to a peak of C$50.00/share — a 100 times return.

Lots of companies talk about the potential for a 100-bagger. Westhaven is run by a group that has achieved such an extraordinary return, and knows what it takes to do so.

Investing Along With You

It’s key for management of junior mining companies to own shares in the company they are running, so you know they’ll act in the best interests of shareholders.

If you win, they win. And vice versa.

You’ll be hard pressed to find a management team more aligned with shareholders, as Westhaven management — which includes Directors and officers of the company — own 40% of the equity.

That alone is a strong indication they’re positive about the prospects for the venture. After all, there are many reasons for management to sell a stock, but only one reason for them to buy it...which is that they think the stock is going to rise.

“The best place to find a mine is beside one.”

An age-old mining adage holds that the best place to find a mine is right around another one.

Westhaven fits the bill here as well, with 100% control of a very large, 30,000-hectare land package in the Spences Bridge Gold Belt. While established to some degree with gold mineralization throughout the belt, this region is relatively underexplored compared with other areas like BC’s “Golden Triangle.”

But Westhaven’s experienced management team has good reason to believe this region has district-scale potential that could rival or surpass better-known areas.

First, it’s not virgin territory, as it already features Teck’s Highland Valley Copper Mine, New Gold’s New Afton Mine, Copper Mountain’s Copper Mountain Mine, and four historical, reclaimed mining operations. It’s actually rich with current and historical operating mines.

Westhaven’s current geological thesis is that the area may contain a high-grade epithermal gold deposit similar to Yamana Gold’s El Penon mine in Chile, which produced 161 thousand ounces of gold and 4.28 million ounces of silver last year alone.

Another analog: The epithermal system that formed Newmont’s massive Cripple Creek mine in Colorado. This mine has produced 23 million ounces of gold and has a current production profile of 451,000 ounces of gold per year. Cripple Creek has been in production since 1976, employs 700 staff, and is the largest gold mine in the state of Colorado.

In other words, Westhaven is hunting for elephants here, which is a term often used when management is going after a giant mineral system. In this case, a gold epithermal system in Southern BC.

A New Discovery...

Westhaven is drilling at this every moment, focusing on an exciting new discovery at the Alpine South Zone on the 100% owned Shovelnose Gold Property, located within the Spences Bridge Gold Belt. Importantly, Westhaven is fully financed and permitted for this drill program.

The new discovery was just announced on January 16, after the company had completed a seven-hole program that hit 85 meters of 0.52 g/t gold (Hole 6) and 5.7 meters of 2.5 g/t gold (Hole 7).

Given what the company is targeting, these first assays are highly encouraging.

Consider what the exploration legend himself, Gren Thomas, has to say about these results:

“The newly discovered Alpine South zone is approximately 1,000 meters in potential strike and is open to the northeast and southwest where the ground magnetic survey ended in June of 2017. This is the most significant discovery made to date at Shovelnose.

“This new discovery comes after 10 years of persistent exploration for the source to a number of epithermal showings and a gold bearing silica cap. This is a large geophysical and topographical feature previously untested and contains considerable widths of auriferous veining which could be a feeder for the previously found gold showings.”

In other words, if the current drilling hits, the market is going to take notice of Westhaven in a very big way.

The good news for shareholders is that they won’t have to wait long....

News On The Way Right Now

Here’s the situation in a nutshell: Westhaven has already identified a new potentially high-grade feeder zone on the Shovelnose property and a drill rig is following up on this zone at this very moment.

Astute investors are aware that mineral exploration is one of the highest-risk asset classes one can invest in.

But they also know very well that the best time to buy a discovery oriented stock is right before they are about to drill or follow up on an area of known mineralization.

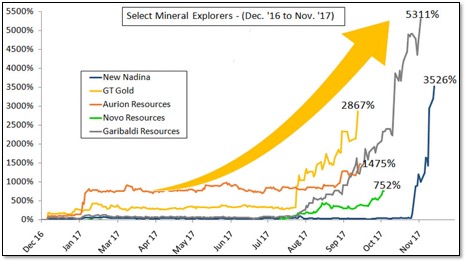

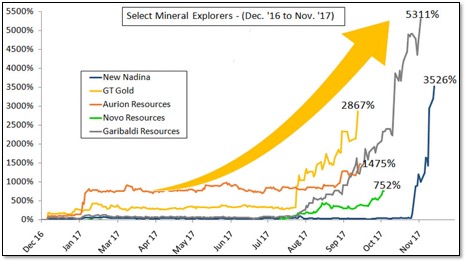

As you can see from this chart of discovery plays from just 2017, the rewards from getting into a discovery story early can be enormous.

Will Westhaven be the next big exploration success story?

It certainly could — and soon as the drill results from the current program come in.

More good news: The company has a very large property position, one of the most experienced and successful management teams in the industry and a target-rich environment that they’ll be exploring for some time to come.

This mitigates the risk in this aggressive exploration company.

If you’re looking for a high-potential gold exploration play — one that could have a commanding position in an an entirely new gold district — Westhaven is a company you need to consider.

And soon.

CLICK HERE

For More Details On

Westhaven Ventures (WHN.V, WTHVF.OTC)

And Its Current Drill Program

|