|

Dear Fellow Investor,

If you want to make a fortune in gold, it’s easy to find a great recipe:

You just need to look at what happened the last time gold went on a bull run — back in early 2016.

Back then, it was clear which stocks moved first and fastest as the gold price started to rise.

Simply put, it was those companies that boasted significant, developable gold resources in good jurisdictions. These were the first off the shelf when higher gold prices brought the broader investing public back into the sector.

Consider that I first recommended Sabina Gold & Silver to my Gold Newsletter readers in August of 2015 — near the very bottom of the bear market in gold.

I loved the story. The company boasted a district-scale, high-grade gold project in Canada with a large confirmed resource and a stellar management team.

Fast forward a few months, in early 2016, gold went on a tear, rising about 20%. But that paled in comparison to the performance of Sabina’s stock:

The share price nearly quintupled from my recommended entry price.

Now that’s leverage.

Today, with the Fed having very publicly halted its interest rate hikes, gold sits on the edge of another potential big breakout. The good news: Sabina’s share price has fallen back to bargain levels.

And, if anything, the company’s story has only grown more compelling in the intervening three years.

Millions Of Ounces Of High-Grade Gold

Sabina’s flagship is the Back River gold project in Nunavut...which boasts a huge, 7.3-million-ounce resource.

Better still, it has a phased plan for developing that resource that will allow it to scale production along with gold prices.

The current, feasibility-level plan for Back River calls for the project to produce ~200,000 ounces of gold per year for 12 years. Assuming a gold price of $1,150, that plan would generate an after-tax IRR of 24.2% and an after-tax NPV, discounted at 5%, of C$480.3 million — and it would do so for very doable initial capex of C$475 million. We are already in a better gold price environment than when the feasibility study was done at US$1150/ounce,but if gold prices continue to head higher, so will the after tax IRR and NAV of the project.

And that’s the key: The value of this project absolutely soars as the gold price rises....

Outstanding Gold-Price Leverage

The Back River project essentially gives those who invest in Sabina at current levels a very inexpensive “call option” on rising gold prices. And better yet, that call option never expires.

The infographic below demonstrates my point.

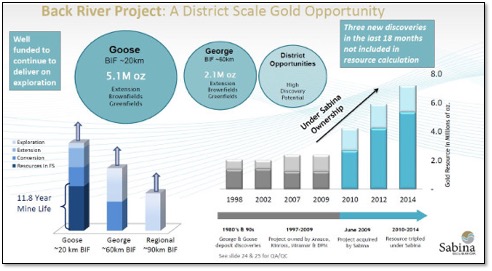

You see, between the Goose and the George deposits alone, Back River contains more than 7 million ounces of gold.

But as the chart on the bottom left shows, only 2.3 million ounces from Goose is included in the current plans. That’s because the development of the project is currently scaled to start off small and grow from there.

But boy will it grow.

In fact, there’s the opportunity to not only increase production from Goose, but to add in ore from George and all the other high-value targets on this massive project.

District-Scale Exploration Upside

It’s this last point that gives Sabina and Back River an upside that’s truly uncapped.

Since the company took ownership of the project in 2009, it has more than tripled the project’s global resources — and that doesn’t even include the three new discoveries Sabina has made over the last 18 months or the expansion drilling they’ve been doing, which aren’t included in the resource at all.

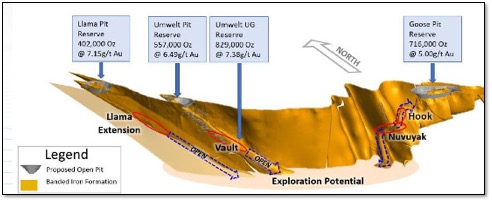

There’s tremendous potential left to be tapped. For one thing, the company’s drilling program has added sizeable, high-grade targets below the Llama and Umwelt pit shells, and these targets remain open at depth.

Consider the upside resource potential remaining to be drilled off at Back River:

• As the map above shows, Llama and Umwelt both contain high-grade, open-pit resources to support the larger open-pit deposit at Goose to the east. (And look at the grades of those open pits — each over 6 g/t gold.)

• The underground resource at Umwelt includes an additional 829,000 ounces of gold...and the newly discovered Vault zone continues the mineralization below the current resource outline.

• Sabina has also outlined an exciting new deposit called Nuvuyak which they believe could be the extension to the Goose open pit. The discovery hole from Nuvuyak last year returned an eye-popping 39.5-meter intersection grading 11.6 g/t gold!

• And it may all be connected: Sabina geologists suspect that the Vault and Nuvuyak zones may represent a large-scale mineralized trend that extends all the way from the Goose Main pit, through Nuvuyak to the Umwelt Vault zone.

• As big as all this may be, it’s just the beginning. In total, Back River contains more than 80 kilometers of strike potential, with numerous targets remaining to be drilled.

Add it all up, and this is a gold district with legitimate, multi-generational potential.

In other words, the world-class, high-grade gold resource at Back River has the potential to grow much, much larger with further drilling.

Undervalued…But Not For Long

With a gold resource grade of 6.1 g/t ( 72% of which is open-pittable), Back River represents one of the highest-grade undeveloped open-pit projects in not only the Americas, but the world.

Now, it might seem like a lot to expect the share price to duplicate its torrid performance of 2016, the last time the gold price ran higher.

But there’s an argument that it could actually do better this time around.

That’s because, in the three years since Sabina hit its 2016 highs, the company has significantly de-risked Back River.

It’s secured all the needed permits (this is huge)...built a port near Goose...constructed an ice road between that port and Goose Main...and is working on a fixed-bid engineering, procurement and construction (“EPC”) contract that gives it confidence in the capex estimation. They have also completed their agreements with the indigenous people – they have their social license but more importantly, the support of all communities and different levels of government for this project to move ahead.

The bottom line is that Sabina now checks all the boxes of a top-tier lever on rising gold prices: a high-grade gold resource in a safe jurisdiction, optionality to scale up production and tons of exploration upside.

Once gold — and Sabina’s share price — begins another big move, the crowd will rush in. I suggest you give this company a hard look now, before that happens.

CLICK HERE

To Learn More About Sabina Gold & Silver

|