|

| Today’s market offers investors an ideal time to be in diamonds.

|

| Russia, for whom diamonds are a significant export, has fomented a trade war with the European Union and the G7 countries over its invasion of Ukraine.

The EU banned direct imports of Russia diamonds as of Jan.1, 2024 and banned Russian-origin diamonds via third-party countries as of Mar. 1, 2024.

The ban promises to raise the price of diamonds sourced from places other than Russia and to make companies with advanced-stage diamond projects valuable assets indeed.

|

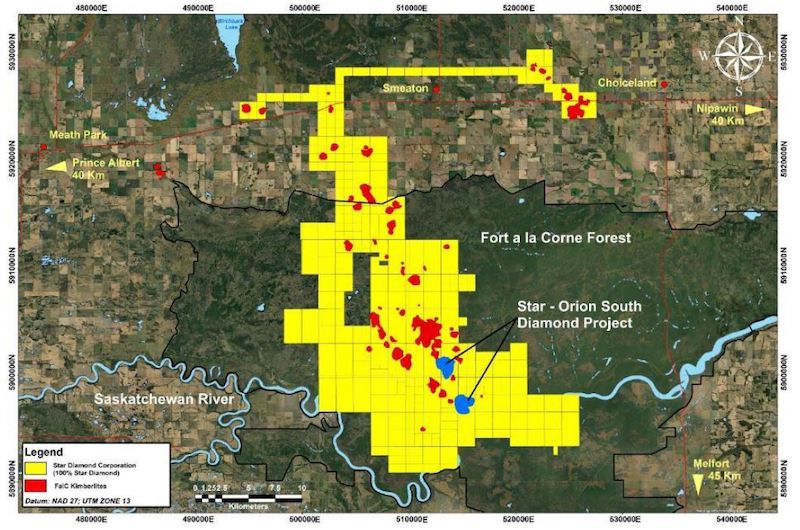

| One such company is Star Diamond Corp. (DIAM.TO; SHGDF.OTC), which recently took back the 75% of its Fort a la Corne diamond district that it didn’t already own.

|

| Fort a la Corne is in Saskatchewan and hosts the world-class Star-Orion South diamond deposit.

With the EU sanctions set to drive up diamond prices, especially from safe jurisdictions like Canada, Star Diamond plans to update the resource estimate for Star-Orion South and generate a prefeasibility study on the project over the next few months.

The company is currently trading at a fraction of Star-Orion South’s estimated valuation, making now a great time to begin looking at this well-positioned diamond play.

|

| A Perfect Storm

|

| The timing could hardly be better for Star Diamond, as a perfect storm is brewing in the diamond market.

The United States had already placed sanctions on the Russian company Alrosa in 2022. According to Reuters, Alrosa is “the world’s largest producer of rough diamonds by volume with 30% of the market.”

Now that the EU has also implemented a ban on Russian diamonds, including those coming through third-party countries, the next step is to develop a sourcing method that can determine a diamond’s origin.

|

| By Sept. 1, purveyors of diamonds in the EU and in G7 countries will need to see where their diamonds are coming from.

|

| While the implementation of that system is still to-be-determined, it’s clear that a huge segment of the global diamond market will soon require diamonds to come from places other than Russia.

|

| A $2 Billion Deposit

|

| With the market very much in its favor, Star Diamond now fully controls the Fort a la Corne district in which the Star-Orion South lies.

The 75% interest owned by diversified commodities major Rio Tinto became available when the company elected to get out of the diamond business.

In return for giving back its interest in Fort a la Corne, Rio Tinto is taking a 19.9% equity interest in Star Diamond.

|

|

| For its part, Star Diamond received full control over a project that a 2018 preliminary economic assessment estimates is worth $2 billion with a 19% base-case IRR.

|

| The deal with Rio Tinto means that Star will benefit directly from the $300 million Rio Tinto spent during its time on the project. It will also take control of a bulk sample plant, a trench cutter drill and all the project data Rio Tinto had amassed during its time operating the project.

|

| Simply put, the transaction puts the world’s largest undeveloped diamond deposit completely back under the Star Diamond umbrella.

|

| A Diamond Market Rarity

|

| Diamond projects have to go through a long exploration process to determine their viability.

The Star-Orion South deposit stands out as a vetted diamond project with 30 years of exploration and more than $1 billion in expenditures to its credit.

Without ever drilling another hole in the project again, Star Diamond is in a position where, once all approvals are in place, it will just have to scoop the earth off the deposit and start mining the orebody.

|

| That advanced-stage status makes the project a rarity in the diamond exploration sector.

|

| Within the next three to five years, Star Diamond could be producing from Star-Orion South, a deposit estimated to produce 66 million carats over a 38-year mine life.

The project’s location near power and road infrastructure and a ready-and-willing labor force makes it a must-own for those looking to leverage the sanction-squeezed diamond market.

|

| Taking Full Control At The Right Time

|

| As mentioned, the timing here for Star Diamond could hardly be better.

The company is in the process of putting together a revised resource estimate on Star-Orion South that will feed into an upcoming prefeasibility study.

Within the next two years, Star Diamond will have the deposit at the feasibility stage.

|

| At that point, the company will be the owner of a shovel-ready diamond project that hosts the world’s largest undeveloped diamond deposit.

|

| In the market developing for diamonds, that makes Star Diamond a company to begin doing your due diligence on in the near future.

|