| Gold and silver poised at key points...

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

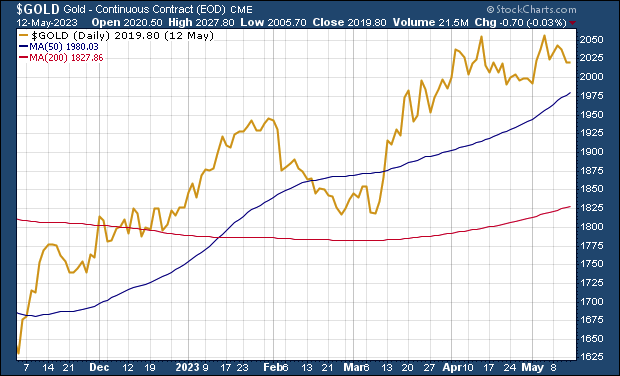

Gold and silver, along with just about every other asset class, are biding time in anticipation of the Fed’s next move.

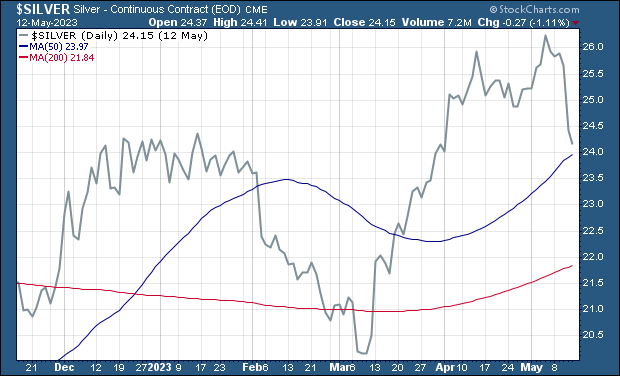

Silver, however, is poised just above support at its 50-day moving average, and needs to bounce from here.

| | | |

I’ve been writing over the past couple of months about how this new bull market in gold and silver will progress in waves, generally synchronous with the ebb and flow of views on imminent Fed policy.

|

We’re in the trough of one of those waves right now, as the post-Fed meeting “high” has faded and the markets are looking for new signals that a pause is truly in the offing at the next meeting in about a month.

As you can see, despite a few days in the red last week, gold remains above that key $2,000 level.

|  |

Our immediate concern, however, is with silver. On an active futures basis, it has dropped to just below support at the 50-day moving average.

|  |

I’m hopeful that silver will bounce off this support, but after last week’s successive down days, the current trend is not our friend.

|

Note, though, that these futures charts are updated as of Friday’s close. For the record, spot gold is up about $7.00 today as I write, while silver has gained about 10¢. That’s certainly helpful.

Also encouraging, the gold stocks are up nicely today, and they were generally up on Friday as well, despite gold and silver ending in the red on that day.

|

Despite the games that are so often played in the paper gold and silver markets, it seems that smart money is continuing to bet on a sustained uptrend in the metals.

| | The Markets Are Telling Us That Something Looms Ahead...

|

Again, we’re in the trough of a wave right now in the metals, as well as other assets, with every bit of economic data being interpreted in terms of how it might influence the FOMC at its next meeting.

But beyond these waves there’s a rising tide that’s evident from gold’s longer-term behavior.

While all investment markets are predictive mechanisms, I’ve long believed that gold is the most sensitive of them all.

|

We would do well to remember that gold began rising in the early summer of 2019 — well before any Wuhan scientists had even begun to cough.

| |

Was gold predicting the Covid pandemic? Perhaps...but more likely it was forecasting the upcoming repo market crisis and the Fed’s launching of $500 billion in QE in late August.

Fast forward to more recent times, and we see that gold began rising in early November. In my opinion, the metal has been predicting the end of the Fed’s rate-hike cycle and, at least, a pause.

I’m starting to wonder, though, if gold has been predicting a pivot as well.

You see, in addition to gold, the bond market is a remarkably accurate predictor of future events. And right now, as crazy as it seems, fed funds futures are predicting a 100% chance of a quarter-point rate cut at the Fed’s September meeting.

At the very least, the bond market is predicting a recession. But at that point, we would only have the second-quarter GDP number in, so even a “technical” recession could not yet be confirmed.

So it seems to me that fed funds futures are predicting some sort of a major dust-up or crisis, from whatever source, by September. And if the bond market is expecting that, then this would also be what gold has been pricing in.

I’ve been stressing that we don’t go, with the figurative flick of switch, from the easiest monetary policy in human history to one of the harshest rate-hike cycles ever seen without breaking something. And probably a number of things.

I don’t know precisely what gold and bonds are telling us will happen — whether it will be a continuation and expansion of the banking crisis or something else breaking.

|

But I know that I want to be positioned in gold, silver and quality junior miners when it all comes to a head.

|

On that score, all of our recommended juniors in Gold Newsletter remain buys, and even more so as a result of this recent market weakness. I’m a bit frustrated personally at the moment, however, because I’ve deployed all of my current risk capital into the junior market.

That said, I would suspect that anyone who isn’t so positioned and is desiring to take advantage of the current advantageous pricing in the juniors should act before the Fed’s June 14 meeting.

I’m confident they’ll announce a pause in the rate hikes at that point, and the metals and miners will respond quite positively.

To get full access to all of our Gold Newsletter recommendations and continued coverage, CLICK HERE to subscribe now.

| |  |

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |