|

Dear Fellow Investor,

We’ve seen the emergence of disruptive new technologies yield fortunes for far-sighted investors over the past couple of decades.

But there have been few new trends as easy to see...or to capitalize on...as the one you’re about to discover.

You see, the battery technology of the future revolves around vanadium. It promises to send demand for this critical metal soaring in the years just ahead, and has already multiplied the price more than six times over.

The same thing could happen to the share prices of companies controlling key vanadium resources.

Which is now putting the spotlight on American Battery Metals (ABC.CSE; FDVXF.OTC), the company that holds the third largest vanadium resource in the world.

Smart Money Flows To The Next Big Technology Play

Despite the seemingly obvious and inevitable strains ahead for global vanadium supplies, only a handful of companies are ready to capitalize on this exciting new trend.

Because of that, vanadium’s price per ton is forecast to continue soaring.

Already, demand for vanadium has tripled over the last 18 months. Now it’s forecast to double again this year — and will keep growing like that for years to come.

The demand is fueled by a single mega-trend: energy storage.

It’s nothing less than the birth of a brand-new industry.

Vanadium Demand Destined To Grow 3,100% Before 2030

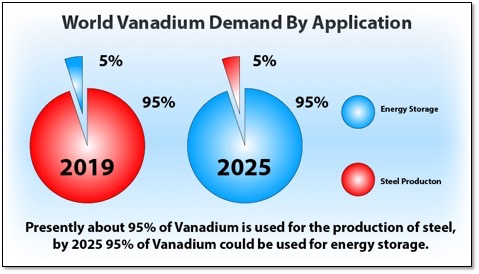

So imagine this “pizza pie” flipped around: The tons of vanadium flowing to the steel industry today, representing the vast majority of vanadium demand, will represent only a minor slice of the market by 2025.

It is because of this remarkable shift in use and surge in demand that noted industry watcher Vanadiumprice.com is forecasting a 3,100% surge in vanadium demand.

That would not only send vanadium prices soaring, but also shares of companies like American Battery Metals that control key vanadium resources.

And this is one trend you can count on. It’s practically competition free — because it solves problems that the lithium-ion and cobalt batteries used in electric vehicles and small storage plants can’t handle.

You see, vanadium forms the core of giant batteries that store energy created by clean energy sources like solar and wind power.

Most investors are aware that minerals, such as lithium, are used at the core of current batteries. Investors who were early on the lithium play made tremendous profits.

But now smart speculators are already turning to vanadium. For example, visionaries like Bill Gates and Jeff Bezos are already taking their stakes in “flow” batteries, for which vanadium is the key ingredient.

• Bill Gates says the breakthrough batteries cure one of the world’s most pressing crises...

• Jeff Bezos, Jack Ma and Richard Branson and other tech leaders are betting $1 billion on this undisputed disruptive technology...

• Forbes says vanadium is the crucial metal powering a “breakthrough” energy storage battery...

• ...And now one company is reopening the historic mine in Utah where massive vanadium reserves were once ignored.

Temple Mountain:

Ready to Make Energy History Again

American Battery Metals is in an advantageous position because its Temple Mountain, Utah mining site positions it to be a potentially huge player in the race to find and supply vanadium to North American battery makers.

Moreover, President Trump understands vanadium’s huge place in America’s future and wants to promote domestic supplies.

Because of that, he placed vanadium on the U.S.’s list of “Critical Minerals.”[i] These are defined as minerals (other than fuels) that:

• Are “essential” to the United States’ “economic and national security

• Are “vulnerable” to supply chain disruption

• Would have significant consequences for our economy or national security.

Vanadium made this list because most of it is mined in China, Russia, South Africa and Brazil.

That’s why American Battery Metals is stepping forward as a company that could supply the flow battery industry with both a large and reliable supply of U.S.-mined vanadium.

American Battery Metals’ Temple Mountain site has potentially vast supplies of vanadium that neither China nor Russia can control. These are supplies that don’t depend on South Africa’s politics or Brazil’s corruption.

And it won’t be the first time Temple Mountain made technology news.

Nobel prize winner Madame Marie Curie got her first samples of uranium from Temple Mountain — the very samples that led to her discovery of radium.

This is where American Battery Metals now has the option to take 100% ownership on 52 lodes.

American Battery Metals’ prospective stake in Emery County, Utah, lies on land owned by the U.S. government. Under Trump’s orders the company should have little problem getting a significant mining operation up and running.

This 1,074-acre tract was actively mined before World War II with historic mineral reports showing vanadium values as high as 4.97%, which is considered superb.

PLUS:

The Third Largest Vanadium Resource In The World

The American Battery Metals story doesn’t begin and end in Utah. Remarkably, the company also controls another key vanadium resource in a safe jurisdiction.

And this resource is huge: The Viken Project located in Jämtland County, Sweden ranks as the third largest vanadium resource globally.

Just 570 kilometers north-northwest of Stockholm, readily accessible by paved highway with ample access to infrastructure (power, water, labor and transportation), the Viken Project is host to a National Instrument 43-101 (“NI 43-101”) polymetallic mineral resource.

That in-situ vanadium (V2O5) resource totals 163 million pounds in the Indicated classification and 16.7 billion pounds in the Inferred classification.

The project has seen a significant amount of work already, with a 2010 Preliminary Economic Assessment (PEA) outlining an open pit mine for vanadium, molybdenum and nickel.

This was followed by an updated PEA in 2014 to evaluate the use of bio heap leaching. More recently, E.U. Energy has engaged P&E Mining Consultants Inc. to evaluate a more efficient footprint, lower CAPEX, vanadium-focused operation with the potential for significant by-product metal production.

And a strong supply of domestic vanadium could be music to Bill Gates’ and Jeff Bezos’ ears. They know exactly what the flow battery means to the world’s top companies, major utilities, and entire countries.

That’s why Gates’ Breakthrough Energy Ventures fund is already betting big on energy storage batteries.

The Alt-Energy Industry’s Biggest Management Hurdle Solved

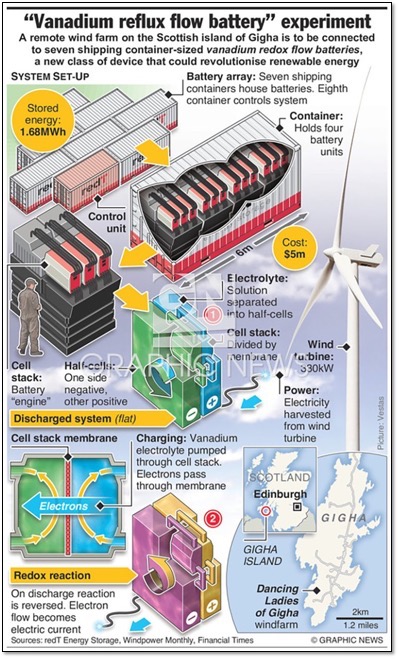

The flow battery is a cutting-edge design for energy storage. But it’s well beyond theory — the technology is proven and already in place. That’s why this is the perfect moment to invest in companies that supply the one thing it must have to succeed: vanadium.

Flow batteries are already proving their worth on remote islands, in harsh deserts, in frozen subarctic outposts and near busy, industrial urban centers.

Research & Markets predicts flow batteries will be a billion-dollar industry by 2023. It’s expanding 32.7% a year now. There’s nothing else like it going on in alt fuels today.

This is a mega-trend that changes everything about the vanadium market.

This is the technology that is set to change local solar and wind generation from community-scale to state- and region-wide transmission. It will allow storage in places where everything else is a problem because temperature extremes don’t matter.

Long idles are no problem at all.

And unlike lithium, cobalt, and every other rechargeable storage technology, the flow battery goes on, and on, and on. When Li-ion batteries drop dead, the flow has years of life in it.

Five Reasons American Battery Metals (ABC.CSE; FDVXF.OTC) Should Be on Your Radar Now

1) Made in the USA – U.S. demand for vanadium is outpacing every other country. That’s why the rare all-American Temple Mountain property is so appealing.

2) 100% Rights with Royalties – When American Battery Metals closes the pending deal for 52 vanadium lodes, it owns mining rights to 98% of the project. And that means its shareholders max out their potential.

3) Vanadium-Rich Country – Temple Mountain is uranium country, which means vanadium is likely there too. But we already know that because historic reports show vanadium sampling grades up to 4.7%.

4) The Billionaires Know – Bill Gates, Jeff Bezos, Michael Bloomberg, they’re all in battery technology now.

5) Growth Tops Everything – the EV car battery boondoggle is over. The need for cheap, efficient and safe energy storage is the next critical hurdle in the world’s transition to renewable energy. And this is why demand for flow batteries — and vanadium — is projected to soar in the years just ahead.

CLICK HERE

To Learn More About American Battery Metals (ABC.CSE; FDVXF.OTC) Now

|