| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

Gold soars through major resistance at $1,850.

The sentiment shift we’ve been expecting appears to be in progress, as investors are turning to gold as an inflation hedge.

| |

For the first few months of this year, stocks and crypto were soaring and no one was too worried about inflation.

|

And when they did worry about inflation, they bought…more stocks and crypto.

Along the way, I counseled gold bugs that they should recognize two realities:

|

1) Gold’s double-bottom in March was very important, and the long correction seemed finally behind us. And…

2) Despite having bottomed, until investors remembered the age-old truth that gold is the best protection against inflation, we shouldn’t expect the metal to post a strong rally.

|

It appears that the latter dynamic is in place, at least for today, as gold is soaring through important resistance levels while every other asset class is going south.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| |

Importantly, gold has broken through the key $1,850 level, and with a vengeance.

|

|

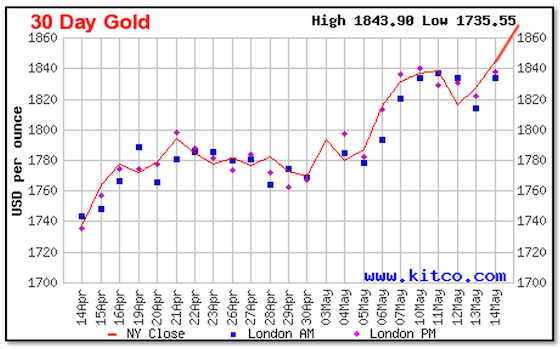

As you can see from the chart above, gold teased us over the past week rising to and just above $1,840. Today it carried that momentum, and then some, to not only break through the ceiling at $1,850, but well beyond.

In fact, the price scale for this Kitco chart, updated through Friday’s closing prices, can’t handle today’s price surge. I added that bolder red line to indicate today’s move, and it goes right off the chart.

| | Golden Opportunities continues below... | | |

| |

Obviously, as we’d expected, this break through $1,850 (as well as the 200-day moving average at $1,854) keyed some buy stops and accelerated the move. As I’d recently alerted you, gold’s 14-week stochastic moved to a buy indicator as the upward momentum has built, and this latest rally should have a whole host of other technical indicators now flashing red buy alerts.

As I always caution when gold breaks through a “big number,” it’s not uncommon for the metal to not only test that level but fall back through it and eventually need a few tries to finally get through..

It is encouraging that gold has already put in a big cushion above $1,850. As I write, it’s risen $22 to over $1,866..

It’s also encouraging that silver is leveraging the move, rising above $28 at this moment. Also, the Dollar Index has turned lower, helping gold’s move, but the 10-Year Treasury yield is actually higher today..

That gold has rallied so strongly in the face of rising yields makes the move that much more impressive..

The base metals are up as well, so it seems that this is a major reaction to the recent red-hot inflation numbers…and the all-important shift in sentiment that we’d been hoping for…all coming together..

In short, it’s a great time to be a gold bug.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

P.S. While junior gold stocks are up strongly today, history tells us that there’s huge room for them to run in a big gold rally.

As I said last week, if you want to take advantage of the new bull run in gold, silver and junior miners, you should continue educating yourself on the market and the best specific opportunities.

If you’re not already a Gold Newsletter subscriber, then you obviously nead to sign up asap to discover my latest recommendations in junior miners (the three new picks I revealed in our May issue are just beginning to move now). Simply CLICK HERE to join Gold Newsletter now.

And once again, you should also attend the best investment conferences in the sector. We’re about to reveal an extraordinary line-up for this year’s New Orleans Conference — being held in person from October 19-22 — so keep an eye out for this news and a link to register.

And as you’ll see again in this issue’s sponsor note, you also have an opportunity soon to attend a new, free virtual conference being produced by my friends at Soar Financial. This will be a high-quality event and I urge you to sign up for it to make sure you’re included.

| | | | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |