| North America’s next Tier One gold asset is still a bargain

| | | Please find below a special message from our advertising sponsor, Goldshore Resources. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| | | Targeting 10 Million Ounces Gold in Ontario

| |

And that’s not all. Goldshore Resources’ (GSHR.V; GSHRF.OTCQB) full near-term target is to develop the next Tier One gold asset in all of Canada.

A Tier One asset is a massive resource with a highly economic PEA, a mine life of 10+ years and all-in sustaining costs below $900/oz.

| | | |

Investors — and certainly shareholders — demand action, and a management team that gets things done.

|

The right management team can achieve in one year what most companies get done in three to seven years.

The shareholder’s funds go further and get more achieved with the right management. They raise the money to get the job done right. They have the geological and technical expertise to ferret out next actions and to turn corners within budget.

|

In this rare situation, next actions can get exciting for shareholders, and there’s rarely a let-down.

|

Here we have primary example #1 of exactly this phenomenon in the gold sector — Goldshore Resources Inc. (GSHR.V; GSHRF.OTCQB).

Headed by experienced mining executive Brett Richards, Goldshore is backed by recognized directors and an advisory board who are not only invested but mean business in advancing this company.

|

Consider: How many junior golds do you know that are well on their way to completing 100,000 meters of drilling before the company had been public for one year?

|

Goldshore is.

And of course, you need a massive project yielding lots of gold to justify that kind of drilling.

And Goldshore definitely has that….

|

The Right Project In The Right Location

|

Goldshore controls the famed Moss Lake gold project in Ontario. The project area is halfway between New Gold’s Rainy River gold mine and Thunder Bay, just north of Minnesota, just south of Hwy 11. Drilling can be done year-round.

In fact, as we speak, the company is adding more drill rigs, now up to seven rigs in operation from four. By July, 10 rigs will be turning, with a goal of completing 100,000 meters of drilling before the end of this year.

The fact that this management and board were able to secure the project also speaks volumes.

|

The competition to acquire Moss Lake from Wesdome — with its historic four million ounces of gold and an historic, positive PEA by Wesdome from 2020 — was legend.

|

Wesdome knows and has met with the mining teams of North America, and when the dust settled, they went with Brett Richards and the Goldshore board.

And respected Wesdome is now a strategic shareholder, holding 22% of GSHR. Their VP of Exploration Michael Michaud — who knows the project the best — is a director of Goldshore.

One more key thing to know: Goldshore is moving quickly, and the market is not keeping up. This company appears seriously undervalued.

In June 2021, less than a year ago, Goldshore acquired the Moss Lake project and went public simultaneously. The team has a lot to work with here.

|  | | click image to enlarge

|

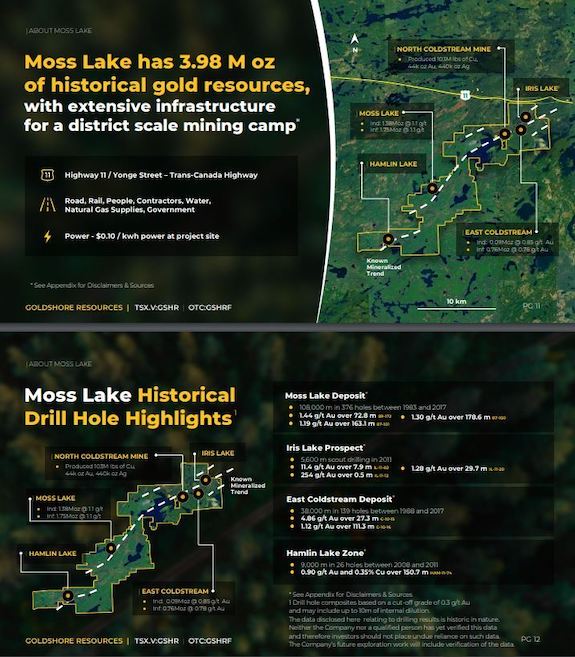

Over a 12-mile strike length, the Moss Lake gold project is about the same size as Manhattan. Here an extended deformation zone has been intruded by several mineralizing events. The project consists of:

|

• Two gold zones with historic resources from independent NI 43-101 reports compiled in 2013 and 2011 — the Moss Lake deposit and the East Coldstream deposit. These are huge, with an historic indicated resource of 1.5 million ounces at 1.08 g/t gold and an inferred resource of 2.5 million ounces at 0.98 g/t.

• One prior producing copper/gold mine, the North Coldstream mine, with reported production grades of 1.89% copper and 0.56 g/t gold

• A fourth zone, the Hamlin zone, with strong earlier drill results including 150.7 meters grading 0.9 g/t gold and 0.35% copper.

|

Again, these are world-class historic resources. Just as important though, Goldshore has the tools to make the most of this large project:

|

1. Cash — as of a month ago, C$20.8 million.

2. Ramping up to 10 rigs in the field, targeting 100,000 meters of drilling by the end of 2022 — in-fill, extension and new exploration drilling, all three concurrently and in phased sequence.

3. The results of a recent VTEM Plus geophysical survey demonstrating 29 new areas with signatures similar to the mineralized zones, for developing into new drilling targets. These new targets extend the area to receive drilling from 1-1/2 miles to 6-1/2 miles.

4. More than 500 earlier drill holes by a number of companies to be consolidated and developed into structural models of the several mineralized zones.

5. New assays from portions of the prior 500+ drill holes that were not assayed earlier, adding to the resource and models of the zones with resources.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Drilling Is Making Its Mark Already

|

On March 2 this year, GSHR reported results from Hole MMD-21-008 in the Moss Lake deposit area:

|

58.85 meters of 6.30 g/t gold from 103.3 meters within a broader zone grading 0.81 g/t over 274.7 meters.

|

On May 5, the company reported:

|

128.3 meters of 1.05 g/t from 121.3 meters depth in hole MQD-22-014, also in the Moss Lake deposit area.

|

Given the extraordinary pace of drilling, we can expect many more catalysts like these over the coming weeks and months.

| |

Brett Richards and the rest of the Goldshore team have a lot of work to get done, and they have a clear-cut target for what to achieve: To develop the next Tier One asset in Canada. The criteria to qualify as ‘Tier One’ are stiff:

|

• 10+ million ounces of gold resource

• Average annual production potential of 500,000+ ounces of gold/year

• Lower half of the cost curve, AISC below $900/oz.

• Life of mine at a minimum of 10 years

|

Luckily, the team was formed to meet this challenge.

As mentioned, a strong management team heads Goldshore, including the directors and advisors.

Consider the “dream team” that’s been assembled. For the company’s Board of Directors and Advisory Board, please click here.

| | | | | click image to enlarge

| |

As large as it already is, Goldshore is young and still undiscovered by the markets. Public for less than a year, the company is clearly well on its way to defining a serious gold resource in a great location for a major mine.

|

With 135 million shares out (150 million fully diluted), the company’s market cap is still below US$50 million…despite the millions of historic gold ounces it is defining right now.

|

Goldshore’s current market value is in the range of junior gold stocks that may have a discovery but are far from a very large defined resource or from updating a prior positive preliminary economic assessment (PEA) or starting prefeasibility near the end of this year.

The company is developing so rapidly, it is far ahead of market awareness. When scouring for new excitement in this sector, it’s not hard to include the elephant in the room: Goldshore Resources.

|

CLICK HERE

To Learn More about Goldshore Resources

| | | |

© Golden Opportunities, 2009 - 2022

| Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |