| A gold story built for these times |

|

| Please find below a special message from our advertising sponsor, GoldMining. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

The Covid crisis has catapulted investors into a brave new world of seemingly bottomless fiscal and monetary stimulus.

The table is set for a generational gold bull market, and with its massive hoard of in situ gold, GoldMining (GOLD.TO; GLDLF.OTC) is an ideal vehicle for leveraging rising prices for the yellow metal.

PLUS: A new webinar to explain the new bull market in gold and how you can leverage the yellow metal’s gains....

|

|

Covid has accelerated trends that have been decades in the making and put the yellow metal squarely on general investors’ and fund managers’ radars.

As they look for the best way to ride the wave of stimulus the Fed and Congress have generated in response to the crisis, gold looks primed for a multi-year bull market.

|

We’ll have negative real interest rates and massive currency deprecation as far as the eye can see, an environment that could drive gold to record heights over the next few years.

|

So, what’s the best way to take advantage of gold’s day in the sun?

Major and mid-tier producers have already taken off. That’s typical, as the general market first looks to those companies that can most readily monetize higher prices.

But there’s another type of junior that’s been close on the heels of the producers in terms of generalist investor interest, and that’s the “optionality” plays.

|

These are companies that have used down-cycles in gold to amass large portfolios of projects with established resources.

|

The resulting banks of gold-in-the-ground they accumulate become never-ending call options on gold and give investors a way to maximize their gains on gold bull markets.

And I can’t think of another company that’s executed this strategy more effectively than GoldMining Inc. (GOLD.TO; GLDLF.OTC).

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

|

A Massive Accumulation Of Gold In The Ground

|

Led by industry stalwart Amir Adnani, GoldMining used the gold bear market that lasted much of the 2010s to amass a multi-million-ounce gold portfolio.

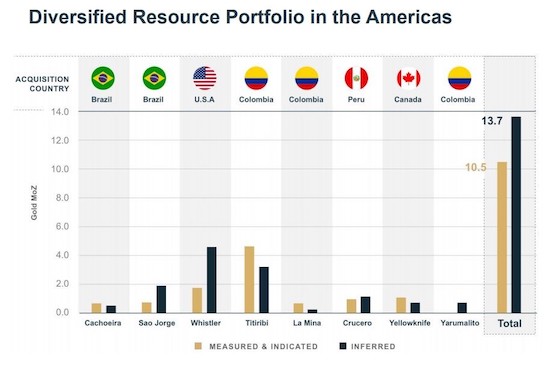

The company’s focus was on projects with gold-focused resources in safe jurisdictions and, over the past decade, it has acquired 10.5 million ounces of measured and indicated gold and 13.7 million ounces of inferred gold.

These resources are contained in an array of high-quality projects that larger companies could easily bring to construction decisions.

|

|

|

Quality Projects Bought On The Cheap

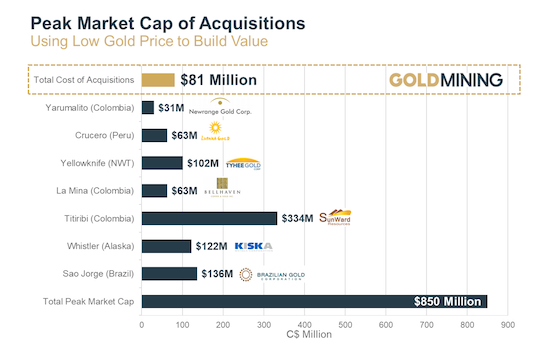

| The recent bear market for gold provided GoldMining an opportunity to accumulate this large gold portfolio for pennies on the dollar.

As the graphic below demonstrates, for a cumulative purchase price of C$81 million, the company built a portfolio of projects of such quality that their prior owners had a peak cumulative market cap of C$850 million.

|

|

Key assets in that portfolio include:

Sao Jorge (Brazil): With 715,000 ounces of indicated gold and 1.04 million ounces of inferred gold, Sao Jorge boasts an excellent infrastructure set-up.

Cachoeira (Brazil): Three deposits have been defined on this project with a total of 285 holes (31,302 meters). The deposits remain open down-dip and the eastern side of the resource-hosting shear on the project has been only lightly explored.

Colombia Projects (Titiribi, La Mina & Yarumalito): Including the recently added Yarumalito project, this collection of projects holds 5.31 million measured and indicated ounces and 4.76 million ounces of inferred gold resources.

Crucero (Peru): An orogenic gold deposit in an underexplored gold belt that contains 993,000 indicated ounces and 1.15 million inferred ounces.

Yellowknife (Canada): Located in Northwest Territories, this project came with $60 million of infrastructure and more than 230,000 meters of prior drilling. It lies along the high-grade Yellowstone Greenstone Belt and contains 1.06 million measured and indicated ounces and 739,000 inferred ounces.

Whistler (Alaska): This southwest Alaska project boasts 1.77 million ounces of indicated gold and 4.6 million ounces of inferred gold. Its porphyry deposits are bulk mineable.

Almaden (Idaho): As GoldMining’s most recent acquisition, Almaden is a great example of the company’s bargain-hunting prowess. GOLD bought the project for just $1.15 million in cash and shares and is well on the way to producing a resource estimate later in 2020.

| |

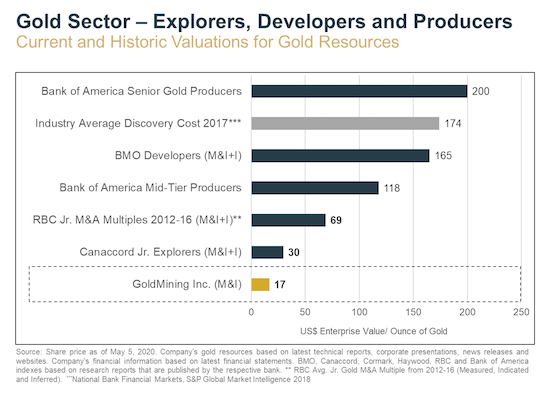

With a market cap of just over C$230 million (US$160 million),GoldMining Inc. (GOLD.TO; GLDLF.OTC) is trading for around US$17/ounce of measured and indicated gold resources (and significantly lower if you include inferred resources).

|

That valuation alone argues for a re-rating of the company’s share price in the current environment.

|

|

But then you factor in the chart below, and you see why GoldMining’s portfolio of developable gold projects would make such tempting takeout targets.

|

|

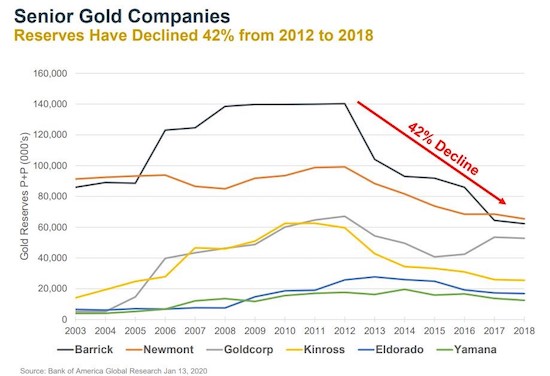

As you can see, in the face of gold prices that have multiplied many times over since 2003, the industry’s major producers have been experiencing a rapid decline in their reserve bases.

With the high-gold price, low-interest environment we’re currently in, it wouldn’t surprise me at all to see a buyer for one or more of GoldMining’s projects.

| Attend This Free Webinar To Learn More

About Today’s New Gold Bull Market

And How GoldMining Inc. Is

Poised To Take Advantage Of It

|

Simply put, GoldMining Inc. (GOLD.TO; GLDLF.OTC) is a situation where the right strategy is meeting with ideal market conditions, and I’m very bullish, both on gold in general and this company specifically.

| | | CLICK HERE

To Register For Our Webinar On June 4

And To Learn More about GoldMining Inc.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |