| Now permitted and on the path to production

| | | Please find below a special message from our advertising sponsor, Ximen Mining. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| |

| Now Permitted

And On The

Path to Production

| |

The impending end to the Fed’s rate hike cycle has gold bugs on the hunt to maximize the bullish gold environment likely to follow.

One company they’ll want to look into is Ximen Mining (XIM.V; XXMMF.OTC), a gold explorer now permitted to turn high-grade gold exploration into production...and money.

| | | |

Gold is primed for a big breakout.

|

Prices have retreated just a bit from all-time highs just over $2,000, but the metal remains poised to head higher from here.

Consider that the Fed is clearly nearing the end of its interest rate hike regime, and it still doesn’t have inflation back to its 2% goal.

That alone should be enough to send gold higher...but add in a looming recession as just one of the reasons why the central bank may have to cut rates later this year, and you have a recipe for much, much higher prices for gold.

As gold bugs look around for ways to capitalize on the trend, they would be well-advised to take a long look at Ximen Mining (XIM.V; XXMMF.OTC).

That’s because Ximen has a real chance to turn higher gold prices directly into cash flow.

With gold trading at levels that are making money for miners of nearly all cost profiles, Ximen is working to convert a highly mineralized area next to the historic Kenville gold mine it owns in southeastern British Columbia into cold, hard cash.

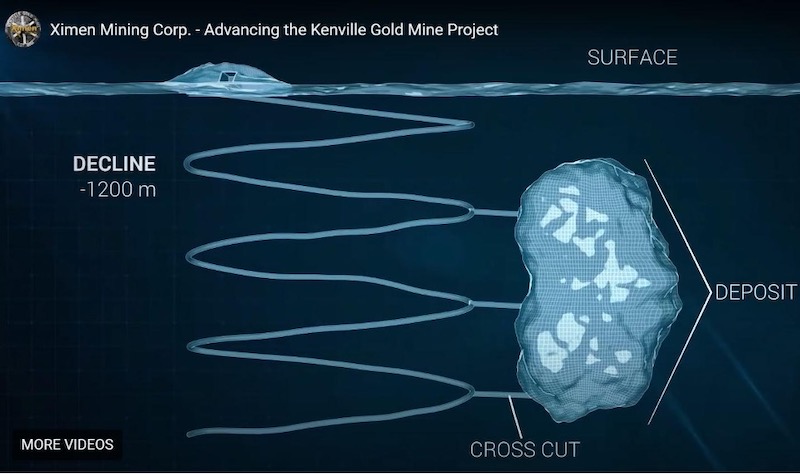

As you’re about to see, Ximen is about to drive a decline down to the sweet spot of some of the highest-grade gold veins drilled on the property to date.

Kenville’s Gold Mine Manager Lloyd Penner, who was the last man to take ore out of the Kenville Gold Mine, is the experienced miner executing the permitted decline into the extension of the newly discovered gold vein extensions.

The permitted development plans will progress, aiming to complete a bulk sample of 10,000 tons of 0.5 ounce per ton gold ore. The project will then transition into small-scale production, with a target of 125 tons per day of 0.5 ounce gold per ton by the twelfth month from the start of the decline.

The next step is to complete the final conditions for the permits in hand and then initiate developing the portal.

The site is powered by utilizing green energy from the Kootenay Dam facility and all the underground drilling will be completed with pneumatic drills run off compressors from surface.

The Kenville Gold Mine aims to be one of the greenest gold mines in southern BC. The company is ready to begin and owns the all the new equipment necessary to implement its operations.

If things go well they will quickly turn the operation in to a zero-capex mine...and hand investors a potentially powerful lever on rising gold prices.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A Proven History

Of High-Grade Gold

|

Located 10 kilometers from the town of Nelson, the Kenville Gold Mine was BC’s first underground operation. Established in 1888 it began production in 1890.

The mine intermittently generated material rich in gold (0.37 oz./ton) as well as silver.

Then in the 1990s Lloyd Penner, then a younger underground miner, was the last man to remove ore from the mine.

After the new extensions were discovered Mr. Penner became the mine manager and has been overseeing all the details to bring this gold mine back into production.

| | | | Click image to enlarge

|

Drills tagged into a new, untouched vein system to the south and west of the previous veins that were being mined. This new area spans 750 meters in strike and 250 meters down dip, and is still open.

And the grades were spectacular — ranging from 26.6 g/t to 88.1 g/t gold.

But with gold entering a bear market, work to follow up on this discovery got put on hold. Then in 2018 the permitting process was initiated and after four years the permits to complete the decline arrived in April 2023.

Now, with gold hovering near the $2,000/oz mark, Ximen is looking to monetize the discovery of the extension of the Kenville Gold Mine and has a conceptual mine plan targeting to ramp up to 125 tons of 0.5 ounce gold per day by the twelfth month of starting development of the decline.

|

The Plan To Turn Kenville Gold Mine Cash-Positive

|  |

If the material generated by bulk sample proves to be as rich as past drilling suggests, it would provide Ximen with justification to proceed to production and a potential cash flow stream to outline still more high-grade gold at the Kenville gold mine.

And given that the sizeable structures outlined by that drilling appear to be wide open, that cash could allow Ximen to convert to a zero-net-capital model.

That means Ximen investors would get all that upside at Kenville Gold Mine essentially for free.

| |

The plan is well under way at the Kenville Gold Mine and now with permits in hand Ximen is currently preparing to begin driving the decline into the mineralized area.

Plus, over the past decade Ximen has put together a portfolio of gold assets and past gold producers that make up the potential portfolio of 8 million ounces of gold exploration assets, a majority of which the Company now owns 100%.

With the value implied by the Kenville Gold Mine alone, these additional precious metal projects are like free lottery tickets. With future work on these projects at some point, it will almost certainly be value accretive for Ximen.

In short, the time is now for you to start doing your due diligence on Ximen Mining.

This is a gold company with a chance to re-rate strongly as development at the Kenville gold mine approaches and the yellow metal continues its upward march.

| | | | Cautionary Note:

The Company notes that there is no current mineral resource estimate for the property. The Company intends to proceed with a new decline to access a prospective area indicated from surface drilling, and to do sufficient underground drilling and development to justify proceeding to a bulk sample and trial processing. The Company would also like to clarify that a decision to proceed to extract mineralized material from the mine for processing is not based on a feasibility study. The Company cautions that, in such cases, there is increased uncertainty and higher economic and technical risks of failure.

| | | |

© Golden Opportunities, 2009 - 2023

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |