|

Dear Fellow Investor,

Every gold explorer dreams of hitting big intersections of ultra-high-grade gold.

Ximen Mining has done just that — with, as you’ll see in a moment, amazing drill intersections in the company’s portfolio of 100% owned precious metals properties. These intersections included the January 2019 news – 7.28 meters of 129 g/t gold, renowned to be one of the top ten precious metal intercepts announced in 2019.

Ximen also just closed on an acquisition last week with an already-established high-grade precious metal resource.

Better yet, the company is aggressively following up on all its projects right now with plans for drilling and development. Bottom line, this means news, and lots of it.

This is the kind of excitement that investors look for. But that isn’t all that Ximen offers. The company has taken a long look ahead and actually taken important steps toward producing whatever gold it finds.

Drilling Down From The Big Picture

Gold may be in a holding pattern right now, but that isn’t keeping some forward-thinking companies from preparing for the yellow metal’s next big surge.

Those that get their strategies in order now are likely to reap the benefits when gold prices come roaring back to life…likely later this year.

You see, with the Fed now on a decidedly dovish track, it’s only a matter of time before it returns to rate-cuts and more money-printing QE. In fact, the market is betting on that right now.

And when it happens, the result should be a gold rally similar to the one we saw in the 2000s and again after the 2008 financial crisis. Investors made fortunes during those moves.

The companies that will perform well in that environment are those that can establish a mineable gold resource with a clear, financeable path to production.

By that measure, it appears that Ximen Mining is preparing its operations to deliver leverage on rising gold prices.

Checking The Boxes:

A Safe Jurisdiction...

It starts with having quality projects in safe mining jurisdictions. “Safe” means that the government in question supports mining, has mining-friendly laws and regulations and isn’t a kleptocracy.

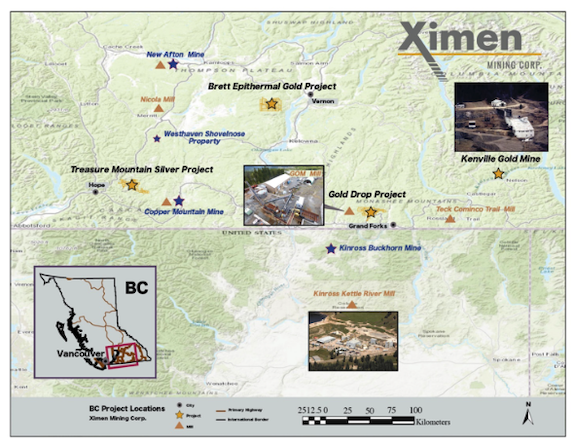

Applying that yardstick, British Columbia Canada, where Ximen’s core projects reside, is a high-value destination.

The provincial government is well aware that natural resources are the linchpin of the area’s economy. Indeed, former provincial premier Christy Clark is on record as saying: “In our province there is absolutely no doubt that the resource industry is the foundation of our prosperity.”

This is a part of the world rich in natural resources, and those that serve in its government know its important to protect the goose that lays the golden eggs.

...With A History Of Gold Production...

Speaking of which, the south-central and south-eastern portion of British Columbia in which Ximen’s projects are located has a long and profitable history of gold production.

Led by its Brett Epithermal gold project near Vernon, the company’s portfolio lies in an area with many past and current mining operations. That portfolio includes not just the Brett Epithermal Gold Project and Ximen’s newly acquired Kenville Gold Mine with existing resources, but the Gold Drop Project (currently optioned to GGX Gold Corp.—GGX.V, GGXXF.OB ) and Treasure Mountain Silver Project (Currently optioned to New Destiny Mining Corp.—NED.V). These Option partners provide a steady, annual flow of cash and stock back to Ximen while the projects are being advanced.

A good example of this region’s potential is the New Afton mine, located just west-northwest of Brett, which contains reserves and resources of 2.2 million ounces of gold, 6.9 million ounces of silver and 1.8 billion pounds of copper.

As well Ximen’s recent acquisition of the Kenville gold mine near Nelson, BC, gives it a gold property with history of past production being the first Loade Gold Mines ever put into production in BC starting in 1888, and a current resource. What’s exciting is this mine is within trucking distance from a mill that Ximen has an inside track on (more on that just below).

Of course, Ximen’s properties aren’t near New Afton’s scale — yet. But if there’s a management team that can make it happen, it’s the group at Ximen.

...And Led By A Talented Team

Serial entrepreneur Mr. Chris Anderson heads up the team at Ximen. Mr. Anderson has more than 30 years of experience in public and private company corporate development and has helped the companies he has led raise tens of millions of dollars. With a focus on resources assets. His track record has placed him in management teams that have taken projects into permitting and production.

Buttressing Mr. Anderson’s business background are three key players:

Dr. Matthew Ball: Dr. Ball is Ximen’s VP of Exploration and a past President and COO of the nearby Bralorne Gold Mine. He knows the region’s Greenwood district well. His expertise should help the company unlock the value of its projects in this part of BC.

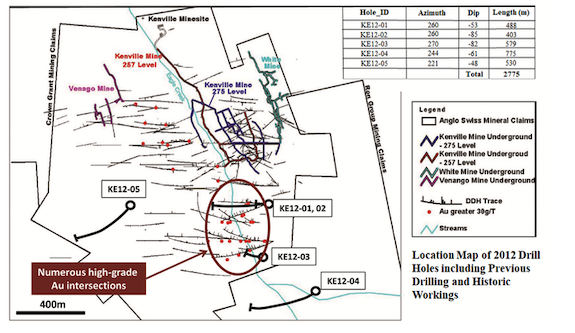

Lloyd Penner: A recent addition to the Ximen team, Lloyd Penner lives in Nelson and knows the Kenville Gold Mine intimately. Being an underground miner for over 30 years, The Kenville Gold Mine has been his personal pet-project. In recent years, Mr. Penner led drilling that resulted in a new discovery of what is believed to be the extension of the original Kenville high-grade gold veins.

Alex McPherson: Mr. McPherson is advising on the company’s Gold Drop Project, a property that lies adjacent to the Dentonia Mine, which he personally mined. Mr. McPherson has been a contract miner in the region for over 40 years.

With a team that has intimate knowledge and production experience in the region which Ximen is operating, the company is well-positioned to unlock the value of its projects.

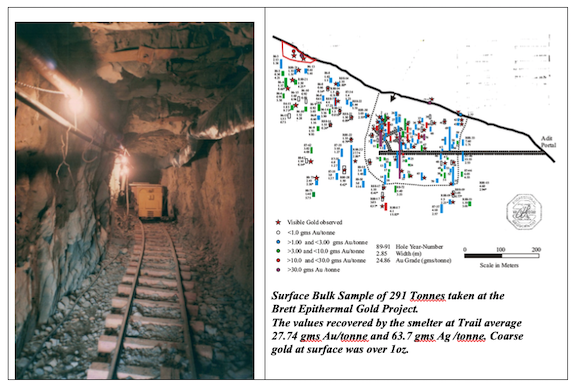

Brett Epithermal Gold Project – Image of inside the portal and cross section showing drilling and a surface bulk sample.

Plus: A Solid Plan To Slash Production Costs

That’s especially true when you realize that Mr. Anderson has just taken over as Interim CEO and Director of Golden Dawn Minerals.

Golden Dawn’s Greenwood Mill lies within a few kilometers of Ximen’s Gold Drop project and within reasonable trucking distance of its newly acquired Kenville Gold Mine and the Brett Epithermal Gold project. A lot of the cost of financing a new mine comes from the building of a processing plant.

The Greenwood Mill lies in close proximity to three of Ximen’s projects.

Simply put, if the team at Ximen can outline a significant resource at any one of its nearby projects, the company’s close relationship with Golden Dawn and its Greenwood Mill give it a visibly financeable path to production.

Clearly, by putting himself in this position, Mr. Anderson sees near-ideal synergies between Ximen’s projects and Golden Dawn’s infrastructure.

A New Project That Could Quickly Advance

Ximen’s recent acquisition of the Kenville gold mine in the Nelson Mining Camp has given it an exciting, advanced-stage exploration target to work with.

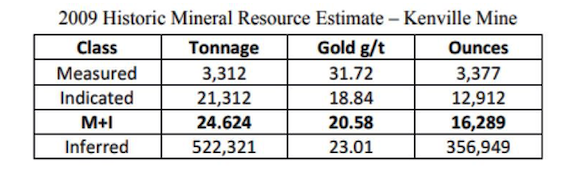

Discovered in 1888, Kenville was British Columbia’s first hard-rock gold mine. Up until 1954, it produced 2,029 kilograms of gold (along with silver, lead, zinc, copper and cadmium).

Fast forward to the 21st century, and the mine deposit’s quartz veins were outlined with 13,000 meters of drilling in 2007 and 2008.

That work resulted in a resource estimate of a super-high-grade gold deposit (16,289 ounces of measured and indicated gold grading 20.58 g/t and 356,949 ounces of inferred gold grading 23.01 g/t).

With Lloyd Penner on the team, they have someone intimately familiar with Kenville. In recent years, Mr. Penner led drilling programs that resulted in a new discovery of what is believed to be the extension of the original Kenville high-grade gold veins. This post resource-estimate work also identified at least four new veins with strike lengths of up to 700 meters.

At those grades, it won’t take much more drilling success to substantially add to Kenville’s resource.

With key infrastructure completed on the project and permits getting ready for underground development, Kenville could very soon surprise the market with its upcoming plans.

Following Up On Ximen’s High-Grade Discoveries

Plus, experienced and successful investors in the junior mining sector are always looking for short-term catalysts that can take a company’s share price higher in the near term.

They won’t have to look hard to find a couple of big ones with Ximen between the underground development work and drilling planned at the Brett Epithermal Gold Project, and the recently acquired Kenville Gold Mine. The company’s option partners are also currently hard at work drilling the Gold Drop Project where recent results included 7.28 meters of 129 g/t gold. Furthermore, Ximen just put news out that a drilling and exploration program has commenced on the company’s Treasure Mountain Silver Project.

Ximen’s relatively tight share structure ensures that success on this front or from Kenville could send the company’s share price much higher.

If you want in on this aggressive junior explorer/developer before those results hit the news wires, you’ll want to own a piece of Ximen sooner rather than later.

CLICK HERE

To Learn More about Ximen Mining

|