|

| Boron is a critical element in the global economy.

|

| Applications for this fifth lightest of all elements include high-end fiberglass, ceramics, solar photovoltaic glass, wind turbine magnets and blades, defense applications and satellite construction.

|

| As you can tell from that list, boron has a variety of uses directly related to the unstoppable decarbonization trend.

|

| And with boron production dominated by Turkish company Eti Maden and global conglomerate Rio Tinto — and an end-product market dominated by China — the U.S. finds itself with the need to re-shore as much of this market as possible.

That market will be partially filled by Rio Tinto’s open pit borate mine in California, but picking up the slack in the global market will be 5E Advanced Materials’ (FEAM.Nasdaq) nearby Fort Cady Integrated Boron Facility.

Given China’s heavy investment in Eti Maden, more specifically advanced materials used by the military, the U.S. will be keeping a close eye on Fort Cady as 5E brings this development-stage project into production.

|

| As you’ll see shortly, the economics for a boron/lithium producing facility at Fort Cady are eye-popping — projecting to hundreds of millions per year in earnings — and major catalysts are in the works that could send 5E Advanced Materials’ market cap soaring.

|

| Full commercial production could begin as early as 2026. And with the company set to unlock Department of Defense funding and see boron added to the U.S. critical minerals list, this is the ideal time to look at 5E Advanced Materials.

|

| The Growth Picture For Boron Looks Bright

|

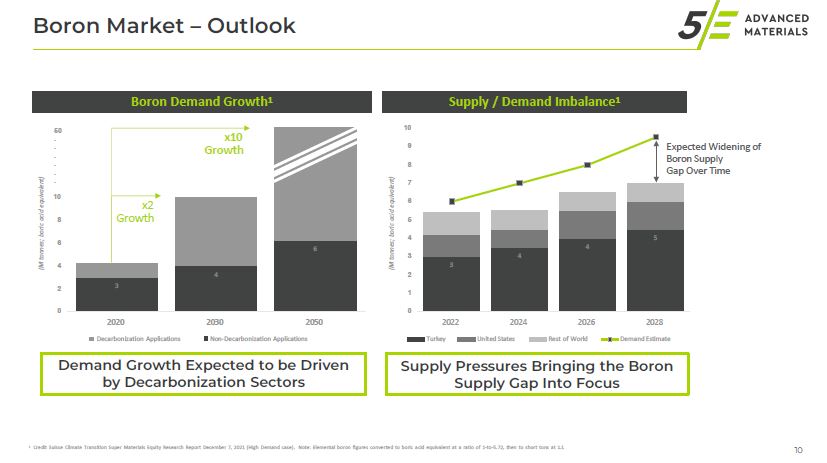

| The two charts below show why the outlook for boron looks so promising.

|

|

| The first chart shows the positive impact of the decarbonization trend on the boron market.

As you can see, the trend will drive a doubling of 2020 demand by 2030. By 2050 the demand will increase by 1000 percent.

The second chart shows that, unlike some other critical minerals, supply pressures are already beginning to impact the boron market. An existing supply deficit will reach a critical point by 2028.

In the supply scenario envisioned by this chart, Turkey will continue to dominate borate supply, but the United States will increase its supply as well, aided by the 90,000 tonnes per year of boric acid Fort Cady will bring on by 2026.

In this healthy market for boron, 5E Advanced Materials and its Fort Cady project look like solid bets on a decarbonization future.

|

| The Numbers Create a Great Narrative

|

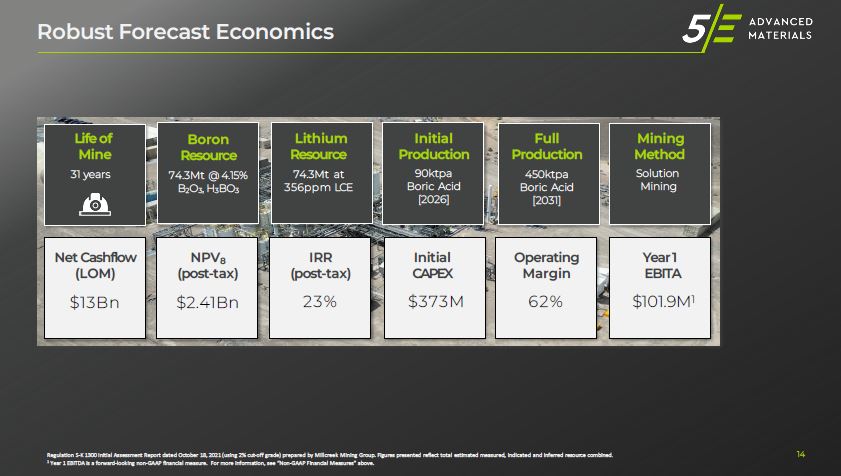

| The company has a three-staged development plan for Fort Cady that will see it producing 450,000 tonnes per year of boric acid and 5,500 tonnes per year of lithium carbonate by 2031.

|

| That production level would allow 5E to generate $682 million per year in EBITDA.

|

| Moreover, as the graphic below shows, the low-environmental-impact operation at Fort Cady will generate $13 billion of free cash flow over a 31-year mine life.

|

|

| The project has a post-tax net present value, discounted at 8%, of $2.41 billion, an operating margin of 62% and a post-tax IRR of 23%.

|

| And yet 5E Advanced Materials continues to trade at a market cap of around only $150 million...just 1/16th the project’s NPV.

|

| Clearly, there’s a lot of upside yet to be captured in the company’s current valuation.

|

| That Rare Junior Miner

That’s Going Into Production

|

| One reason that value is likely to be realized sooner rather than later is the fact that 5E Advanced Materials is already in production at Fort Cady.

It starts with a 2,000-to-9,000-tonne production run that began in April and will provide materials for sale, bench-testing on higher-end materials and samples for potential customers.

|

| Mega-market-cap companies are already contacting 5E to get their hands on those samples and looking to Fort Cady as a potential future supply source.

|

| 5E plans to be operating as a 90,000-tonne-per-year facility by 2026 and to double the production to 180,000 tonnes per year by 2028.

Some financing hurdles need to be cleared, including securing DoD funding, before this production becomes a reality, but the road ahead is tangible for 5E to become one of the few junior miners to go into full commercial production.

|

| Value-Building Catalysts Straight Ahead

|

| In the interim, two key catalysts straight ahead. The first is shipping test boron samples to create potential customers. The second is government support from the DoD, the Department of Energy... and a decision to declare boron a critical material.

|

| The funding support should be forthcoming, given the bipartisan focus on reducing U.S. dependence on countries like China for raw and finished materials.

Moreover, 5E believes boron is right on the cusp of getting its critical material designation from the U.S., a categorization that will open up additional funding.

|

| Bottom line: 5E Advanced Materials has a boron-lithium project in Fort Cady that looks well on its way to production and generating significant annual cash flows.

With major catalysts in the pipeline that could move 5E’s share price higher at any time, you’ll want to begin doing your due diligence on this critical materials “gold mine” soon.

|