| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

.png)

| | Gold Newsletter Preview: | |

With the bottom now well behind us, gold’s rally is gaining steam.

| |

The waiting game seems to be over.

|

In my various commentaries and media appearances over the last month, I noted how listless the gold bug community had become. These ultimate gold bulls, the hardest-dying of the die-hards, were anything but bullish on the yellow metal’s prospects.

Yes, that double-bottom was impressive. But the gold bugs had been beaten harshly by the market every time they’d gotten excited over the previous eight months, and they either expected another set-back or didn’t want to jinx the rebound by getting their hopes up.

The most positive prediction I could find among my friends was that gold might merely grind sideways into the summer, and that no one should get their hopes up for much more than that.

|

I actually found this notable lack of enthusiasm to be very encouraging, noting that it was perhaps the most fertile ground for a bull market that one could hope for.

|

And so it has been, as gold has quietly gained $115 over the last 30 days, decisively breaking through key resistance levels at $1,800 and $1,850 along the way.

Now, with the metal having just surpassed yet another big number at $1,900, investors are just starting to get excited again.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Big Drivers Along The Way

...And More To Come

|

Gold was helped during its rise over the past month by a number of important factors.

The most compelling, and interesting, of these was the April CPI data, showing an 0.8% increase in April for the headline number and an 0.9% increase for the core rate. These were against consensus expectations, respectively, of 0.2% and 0.3%.

That headline number equated to a 4.2% rate of inflation year over year.

Most importantly, as I noted in these pages, the increase was in the month-over-month reporting — not, as Fed Vice-Chair Clarida strangely argued — to the year-over-year base effects coming from comparisons to the pandemic lows.

In other words, this is real, rubber-meeting-the-road price inflation, and not some statistical anomaly that will disappear as new data comes in.

While gold stumbled the day that this CPI data came in, it quickly got its footing and began rallying.

I’ll cut to the chase: In my view, the age-old idea that gold is the best hedge against currency depreciation/inflation — an idea that has fallen out of vogue over the last decade as central bank monetary policy has driven every asset class — is regaining favor.

|

In other words, gold is increasingly being viewed as the ultimate inflation hedge.

|

That factor alone is bullish for gold, but other forces are also aligning behind the yellow metal.

Both the dollar and Treasury yields have been generally falling over the past month, with the Dollar Index falling to an “80” handle and shakily resting about a point over long-term support. A break through support could prompt a tumble in the index that would be very beneficial to gold in the short term.

As far as Treasury yields go, the entire yield curve is not only steeply negative on an inflation-adjusted basis, but has fallen quite significantly over the last month and previous year.

When you have falling Treasury yields combined with surprisingly hot inflation readings, you get a nose-dive in real yields that is enormously bullish for gold.

All of this begs the question, how far can gold go on this run?

Well, a long ways. Depending upon how you define this bull market, and whether you include the inevitable corrections along the way, the next few years should take gold much, much higher.

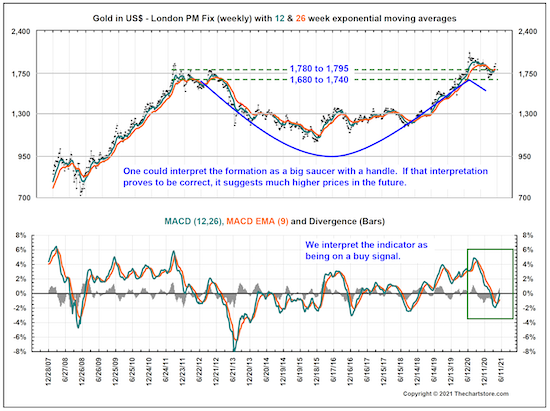

This is illustrated by the following chart from Ron Griess of TheChartStore.com, showing gold with its 12- and 26-week exponential moving averages. This chart perfectly illustrates the massive saucer bottom that has been formed in gold since the 2011 peaks, and the “handle” that the price has been tracing out over the last year or so.

|

|

This is an extremely bullish technical pattern for any commodity or asset.

There’s some uncertainty in using this pattern for an upside price target, and you can see that Ron is merely noting that “it suggests much higher prices in the future.”

|

However, judging from the depth of the “cup,” the bottom of which should be around $1,040, and the height of the “handle” around $1,780...this formation is predicting a move to the general vicinity of $2,500.

|

We’ll take that, for a first go at it.

It might seem a bit presumptuous or ungrateful for me to consider such a move as an opening gambit in this gold bull market. But let me remind you of what’s going on in the world today, with complete disregard for the repercussions of ever-easier monetary policy and unrestrained fiscal spending.

Whether it’s this cycle or the next, these policies of massive central bank rescues on any economic or financial market hiccup will eventually lead to the discrediting of the dollar and every other fiat currency.

This will leave gold and silver as the last bastions of value, and relative valuations that will greatly exceed $2,500.

In the meantime, the resource stocks are now, finally, beginning to wake up as this rally in gold and silver has been sufficiently sustained to spring investors into action. There’s still time to get positioned at depressed levels, but that window is closing.

The good news is that our just-released June issue of Gold Newsletter features dozens of top junior mining stocks, including two high-powered new picks:

|

• A red-hot drill-hole play with huge upside. These types of plays typically also carry higher risk, but in this case that risk is mitigated by a large, historic resource of hundreds of thousands of ounces of gold grading over 10 g/t.

But that old resource isn’t up to current standards and can’t be talked about. So the company is drilling — at this very moment — into that resource to prove its validity.

The results could come any day, and could send the share price of this micro-cap company soaring.

• A superbly positioned play on high-flying copper. This company already controls a large, high-grade copper resource with rich gold credits to boot. But it’s just on the verge of being big enough to demand the attention of the major miners now scouring the globe for new copper projects.

A drill program underway right now has the promise of getting the resource over that hump...and the first drill results are expected before the end of this month.

This is one of the few well-positioned copper companies that has yet to respond to the surging copper price — but I predict that’s about to change in a big way.

| |

You can get all the details on these new, red-hot stock picks by subscribing to Gold Newsletter now.

|

To get a full year of Gold Newsletter…and get immediate access to our exciting June issue packed with valuable investment intelligence and details on dozens of exciting junior mining plays…simply click on the link below.

|

With the gold and silver rallies gaining steam now, I doubt that it will be long before the market catches up to all of these over-looked junior mining plays.

I strongly urge you to act now to make sure you’re positioned.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |