| A treasure trove of lithium — in the U.S.

| | | Please find below a special message from our advertising sponsor, Cypress Development Corp. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| | | A Treasure Trove Of A Critical Mineral

| |

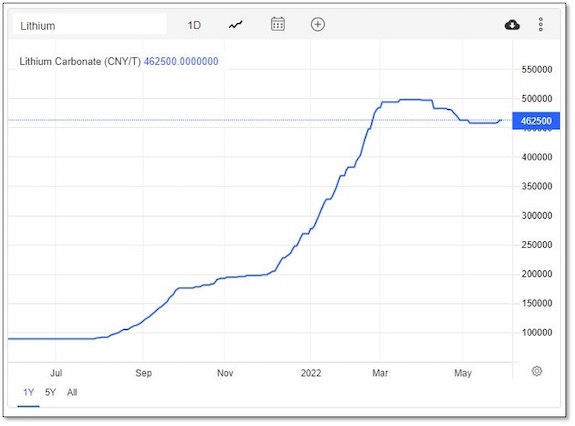

Lithium prices have soared more than 500% over the past year, as production struggles to keep pace with EV demand.

It’s the perfect set up for Cypress Development Corp. (CYP.TSXV; CYDVF.OTC), the company with a massive lithium project in Nevada.

| | | |

The green energy boom has combined with inflation and supply chain disruptions to send lithium prices through the roof.

|

As a key component in the batteries that power EVs, lithium has become in demand as auto manufacturers continue to add more EVs to their vehicle offerings.

| | |

Per the chart above, that demand is going to grow dramatically over the next few years, reaching levels as much as five times current demand.

That means lithium prices will have to also multiply...as well as the values of the companies producing it.

|

Add in the U.S. decision to name lithium a “critical mineral” and you have ready-made demand for large, domestic sources of lithium — like the one Cypress Development Corp. (CYP.TSXV; CYDVF.OTC) has with its Clayton Valley project in Nevada.

|

As you’re about to discover, Clayton Valley has the size, the economics, and the access to infrastructure to become a long-lived lithium mine, one conveniently within easy shipping distance to Tesla’s gigafactory in Nevada.

| |

The excitement around lithium is palpable these days, as concerns about supply shortages and inflationary pressures have sent prices through the roof.

|  |

The above chart of lithium carbonate equivalent spot prices (measured in Chinese currency) shows the dramatic turn lithium prices have taken.

With the Biden administration intent on electrifying the government’s fleet of vehicles and pushing the U.S. toward EVs more broadly, it’s easy to see how lithium has stayed on the president’s list of critical minerals.

|

But here’s the danger: China is the primary producer of lithium batteries and has gone on a buying binge in recent years to lock up the brine-hosted resources in South America that are one of the world’s key sources of lithium.

|

The fact is the U.S. currently produces less than 2% of the world’s lithium...and the government is desperate to secure more domestic supplies of this valuable resource.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

A Domestic Source Of A Critical Mineral

|

And a domestic source of lithium is exactly what Cypress Development’s Clayton Valley project offers.

Located adjacent to Albemarle’s Silver Peaks brine operation (the only lithium producing mine in the U.S.), the project is just south of Tonopah in west-central Nevada.

Cypress’ Clayton Valley project boasts 1.3 million tonnes of 905 ppm lithium (6.3 million tonnes LCE) in resources and 213 million tonnes of 1,129 ppm lithium (1.28 million tonnes LCE) in reserves.

| | |

This is a vast project, and according to the company’s 2021 prefeasibility Study, the project has the capacity to produce at 15,000 tonnes per day over a 40-year mine life. A mine at Clayton Valley would produce an average of 27,400 tonnes of LCE per year.

Simply put, this is a massive deposit that could make a major contribution to the U.S. drive for energy independence.

|

With Compelling Economics

|

And consider this: The spot market for lithium is currently trading at $80,000/tonne LCE, and yet the base-case price for Cypress Development’s prefeasibility study on Clayton Valley is just $9,500/tonne LCE.

Even with that conservative price, the project’s after-tax net present value, discounted at 8%, is an impressive $1.03 billion. After-tax internal rate of return (IRR) is a rich 25.8% and initial capex is $493 million. The mine would have operating costs of just $3,387/tonne.

Better still, these numbers are extremely sensitive to the price of lithium. Taking into account that current spot levels are much higher than long-term contract prices for lithium, it’s still very conceivable that Clayton Valley could lock in long-term prices upwards of $15,000/tonne.

When you realize that even at $14,250/tonne, the project’s after-tax NPV jumps to $2.14 billion and its IRR to 41.3%, you can see how continued pressure on lithium supplies will play right into Cypress Development’s hands.

| |

Of all the Nevada lithium projects under development right now, Clayton Valley is one of the most advanced.

|

A feasibility study on the project is due to be completed by the end of the year, and a pilot plant is currently efficiently running with the goal of producing a lithium product by the end of the second quarter.

|

Cypress secured the needed water rights to make Clayton Valley a go in December 2021, a real coup for the company in water-limited Nevada.

The mine design upcoming for Clayton Valley will include the addition of the adjacent resources purchased from Enertopia. Off-site treatment of a solution to produce a final lithium product from the pilot plant is expected by the end of this month.

In other words, things are moving quickly now.

Longer term, with the U.S. desperate to secure domestic supplies of lithium and the Biden Administration willing to throw money at the problem in the form of grants, Cypress Development appears to be in the proverbial catbird’s seat.

|

Its multi-decade lithium resource in one of the world’s best mining jurisdictions makes Cypress Development a company that belongs on any investor’s radar.

|

And with key development milestones about to be hit in the days ahead, the time to look at this opportunity is now.

| |

CLICK HERE

To Learn More about Cypress Development Corp.

| | | |

© Golden Opportunities, 2009 - 2022

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |