In 1991, a series of natural conditions occurred simultaneously to produce a hurricane so intense, America’s national weather service labelled it “The Perfect Storm.”

|

The storm and the Andrea Gail, a ship that it sank, become the subject of a book and movie by the same name.

|

Now we see the approach of a perfect storm of the financial kind, as a series of events appear set to occur simultaneously.

|

Inflation is accelerating as everything from microchip shortages to a lack of farm labor combine with massive increases in America’s money supply and government deficit spending.

The U.S. dollar has begun a multi-year bear market and as one fire is put out in Israel-Gaza, another much larger one — China versus the U.S. — threatens to ignite over Taiwan and the South China Sea.

A commodities super cycle is clearly underway; gold has broken out and is up $200 in the past six weeks.

Each of these events is reinforcing the profound effect of the other. And for those investors that are prepared, its impact has the potential to be exceptionally rewarding.

|

Ideally Positioned To Deliver Huge Gains

|

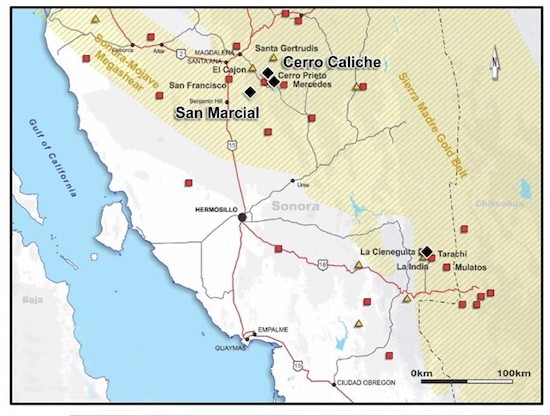

Sonoro Gold (SGO.V; SMOFF.OTC) is one way investors may prosper as these events unfold.

Sonoro expects to begin producing gold at its Cerro Caliche gold deposit as early as the first quarter of next year.

In short, the company’s transformation from a highly successful explorer to the ranks of high-growth gold producers is imminent.

The securing of project debt, followed by construction of its planned 15,000 tonne-per-day heap leach mining operation, is only months away. Building the mine is expected to take only around five months.

Bottom line: The timing for investors could not be better, as Sonoro looks set to start gold production just as gold is beginning a renewed and powerful move.

|

|

|

Consider that building a mine at the Cerro Caliche was originally conceived and assessed as likely viable when gold was less than $1,500.

...And that nearby mines with similar deposits, such as Argonaut Gold’s San Agustin Mine, are making record profits with half the gold grades Sonoro expects to mine. It is more than reasonable to expect the Cerro Caliche mine to be highly profitable too.

|

Simply put, Sonoro Gold offers investors a relatively low-risk opportunity to leverage the gold bull market — and the company’s recent share price rise gives some indication of this potential.

|

Consider that during the past two months gold is up 12%...while during the same period Sonoro’s shares have gained by 87.5%.

|

Sonoro Offers Leverage To Rising Gold Prices

|

Making the transition from explorer to developer, and ultimately gold producer, does not require a rising gold price to produce exceptional profits. But when gold does rise at the same time, it can multiply the profit potential.

Imaru Casanova at gold giant VanEck Investment Management estimates that an 11% increase in the gold price can translate into a 30% or more increase in cash flow for gold producers.

But small cap producers usually trade at three or four times cash flow. Given this, the leverage possibilities of a company like Sonoro Gold are obvious.

|

A Team That Knows How To Create

Shareholder Wealth

|

The team that leads Sonoro has made fortunes for investors.

Take Sonoro’s VP of Exploration Mel Herdrick. Over his multi-decade career, he’s discovered no less than six major gold and copper deposits.

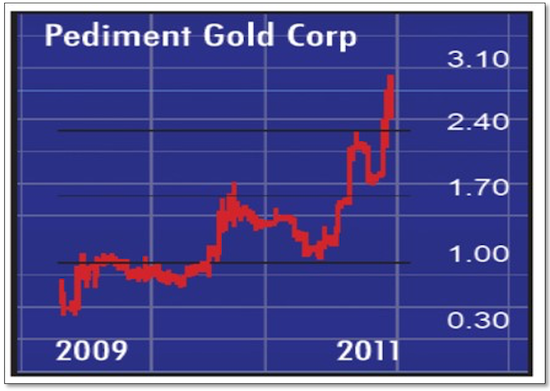

Hendrick’s work to develop the La Colorada and San Antonio deposits led to the takeover of Pediment Gold at almost 10 times its 2009 share price.

|

|

Sonoro’s VP of Operations, Jorge Diaz, is one of the original Glamis Gold Mine developers.

|

Glamis first started producing gold with its Picacho mine, a much smaller heap leach mine than what Sonoro is developing.

|

However, Glamis used the income wisely to acquire and develop mines...fueling an astounding growth rate...and was eventually taken over by Goldcorp for $8.6 billion.

Most recently, Diaz led the development of another major mining success — the giant Mulatos Mine, which has already produced more than two million ounces of gold.

|

|

On the heels of developing Mulatos, Diaz expects the Cerro Caliche to be his next major success, a tall order considering what he has already accomplished, and great news for Sonoro shareholders.

|

Big Upside With Relatively Little Risk

|

Sonoro’s team is set to hit the ground running following the delivery of its preliminary economic assessment (PEA) this July.

It is already in discussions regarding project finance, expects to start construction by September and, by early next year, be in production. Each of these milestones add to the likelihood of outsized shareholder profits.

Glamis Gold is a classic example of what going into production can mean to a company’s share price.

|

Despite its original mine’s small size (only 24,000 oz./year), its shares soared from C$0.80 to C$5.00 when it started production.

|

And after K92 Mining acquired a mothballed mine in Papua New Guinea from Barrick in 2016, until it started production it was basically an orphan. Its shares traded — when they traded, which was not very often — at around C$0.40.

K92’s shares currently trade around C$8.40, and it is one of the Toronto Stock Exchange’s best performers.

This is the kind of potential presented by Sonoro.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

As Major Catalysts Approach,

Time May Be Running Out

|

Sonoro has already completed a considerable amount of work to fast track Cerro Caliche’s development and is predicting exceptional economics.

As analysts crunch the data to compare Cerro Caliche to similar deposits in the area, the project’s exceptional potential is becoming increasingly apparent.

|

|

Sonoro’s recent record trading volume and rocketing share price may indicate that sophisticated investors have done their own calculations and concluded they should not risk paying a substantially higher price by waiting until Sonoro releases a PEA.

|

The timing is critical, because things are now moving quickly: In the next two months, Sonoro will likely announce results from metallurgical studies, release an updated 43-101 resource estimate and issue that PEA, which will disclose economic parameters such as IRR, operating costs, cash flow and capex.

|

After the resource estimate and PEA, the next catalysts will be the closing of the debt financing, the start of mine construction, and then the start of gold production in the first quarter of 2022.

|

A Future Takeover Target?

|

It is early days but, given the difficulty of finding mineable gold deposits and then putting them into production, the number of smaller gold producers is shrinking rapidly as larger companies buy them for their gold reserves.

|

Given that Sonoro management expects a material increase in Cerro Caliche’s existing 201,000-ounce resource, Sonoro is becoming increasingly attractive.

|

Management paused drilling in April when it estimated it had outlined enough gold to supply a 15,000- to 20,000-tonne-per-day operation for at least five years.

Two of Sonoro’s neighbors, Alio Gold and Premier Gold Mines, were taken over by larger gold producers during the past year. And going back further, Argonaut Gold acquired Mel Herdrick’s Pediment Gold.

As this trend continues, companies like Sonoro are likely to increase in value until they are eventually acquired.

Will it be bought out at a big premium like Herdrick’s Pediment Gold or will it grow first like Glamis Gold? Either way, it will be exciting!

|

Exploration And Low-Risk Development Upside

|

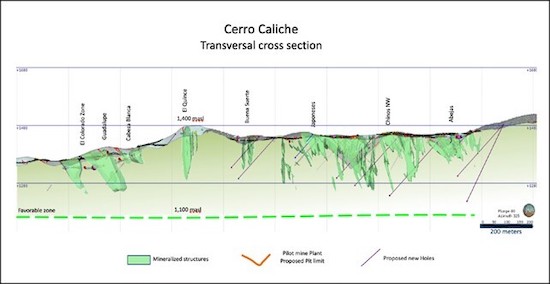

Cerro Caliche’s gold mineralization covers roughly five square miles and consists of fully 18 known shallow or at-surface oxide gold zones, many of which surround the project’s eight former artisanal high-grade gold mines.

The current 201,000-ounce resource was calculated using a 72% gold recovery rate. Subsequent metallurgical tests indicate the recovery rate is likely higher.

|

|

And the potential for additional gold discoveries remains vast.

Consider that only 20% of the known surface gold zones have been drilled — so there is tremendous room for growth, as well as solid potential for not only high-grade gold targets, but also the considerably lower-risk shallow gold mineralization.

|

Drilling is showing that many gold zones are linked together, increasing the potential for the development of lower-operating-cost “super pits.”

|

Herdrick developed Pediment’s La Colorada project as an open pit heap leach gold mine because the shallow mineralization was the lowest-risk route to take. He notes, though, that its high-grade potential has always existed.

And, indeed, a few weeks ago, a major discovery was made just below La Colorada’s main pit, with gold grades up to 383.0 g/t.

Like La Colorada, Cerro Caliche has multiple high-grade gold targets; but for now the low-risk business of creating a cash flow and growth center is management’s priority.

That said, Cerro Caliche’s size and grade potential keep increasing. Recent results include 15 meters of 2.0 g/t gold, narrower high-grade intercepts up to 6.7 g/t, and an exceptionally long intercept of 74 meters of 0.61 g/t.

|

Leverage “The Perfect Storm” —

7 Reasons To Consider Sonoro Gold

|

A perfect storm is driving an historic, multi-year gold bull market, and Sonoro is ideally positioned to benefit.

Very rarely do so many critical events coincide in a way that create a low risk way for investors to make massive profits. But this is just what appears to be happening…

|

1) Gold and gold stocks have broken out and are in a major bull market, providing Sonoro and its shareholders with a very favorable tailwind.

CLICK HERE to read more.

2) As this is occurring, Sonoro Gold will deliver a PEA after which it’s on track to finance, build and begin producing gold by early next year

3) History indicates that when junior explorers become producers, their valuations tend to go up — a lot

4) Based on this expectation and Cerro Caliche’s most probable economics, a highly respected analyst just called for a $2.00 Sonoro share price — and that’s if gold’s price stays the same. CLICK HERE to read more.

5) Sonoro should have great leverage to gold once cash begins to flow — as gold moves higher it should justify a much higher share price target for Sonoro

6) Exploration and development upside is considerable, as 80% of the Cerro Caliche’s known gold mineralization has not yet been drilled. CLICK HERE to read more.

7) Management’s multi-decade track record of developing successful mines increases the odds that they will be successful with Cerro Caliche too. (Will Sonoro shares do as well as Pediment Gold or better?)

|

Bottom line: With multiple share-price catalysts imminent, Sonoro Gold could take off at any moment — which means time is running out to buy at bargain prices.

|

|