| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | | Gold Newsletter Preview:

| | Causation Creates Correlation

| |

Gold has been waiting for a spark to start a trend in either direction.

The odds favor a move higher, eventually — but I expect more steep sell-offs in stocks...and therefore more volatility in the metals and all other assets.

| | | |

Gold — along with nearly every other asset class — is waiting for some catalyst to jump-start a move.

|

And on all evidence, when that spark happens, it’s likely that all the markets are going to head in the same direction, at least initially.

|

The reason? Because once again, the Fed and its monetary policy (now represented by its newfound determination to tighten) remain the overwhelming driver for nearly every investible asset class.

Since the 2008 great financial crisis, I’ve often commented on how easy-money policies from central banks have floated every asset class upward at the same time. One result of this artificial pumping of the markets is that investments that had been historically uncorrelated, and therefore helped reduce risk in diversified portfolios, became positively correlated.

In short, when central banks are doling out easy money, all correlations begin trending toward “1.”

|

And surprise, surprise — that’s also the case when central banks begin taking that money back.

|

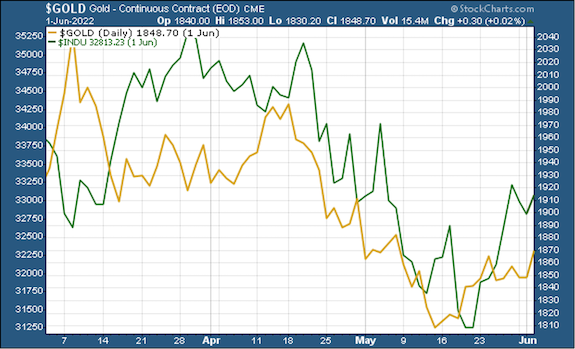

As you can see from the accompanying charts, for example, gold has traded in near lock-step with U.S. stocks (represented here by the Dow) and the Dollar Index (with the dollar scale inverted to show the close inverse correlation). In other words, gold and the stock market suffered the same decline, and are now trading sideways...while the dollar has strengthened against its fiat competitors, with that move also moderating in recent days.

| | | Gold vs Dow Jones Industrial Index

|  | | Gold vs Dollar Index

|  |

The take-away? Central bank policy continues to drive virtually all the markets.

Quite frankly, I think this means some bouts of weakness ahead for the metals. That’s because I expect additional rounds of panicked selling in the stock market, as there’s been no sign of capitulation amongst investors.

Investors have not faced the fact that the Fed is committed to fighting inflation far more aggressively than anyone had anticipated...and that those efforts will be far less effective than anyone (except you and I) could have imagined.

|

So, until we have capitulation — an exhaustion of selling — we will have more free-falls in the stock market. And those liquidity vacuums will force selling in every other asset class, including gold and silver.

|

Still, the effects on the metals from the periodic liquidity drains over the past few months had been lessening, and I don’t believe gold should be affected as severely going forward. Therefore, while I’m not very bullish on the metals for the near term, neither do I foresee a major decline.

And longer-term, the one factor that should overwhelm everything else will be the Fed’s impotence on inflation, and its eventual retreat from tightening. And that should happen far sooner than I’d originally expected.

This, I expect, would mark the launching point of the second phase of the bull market in gold.

In the meantime, our hopes for big gains will rest not on a rising tide of higher metals prices, but on the achievements of individual junior mining companies. And there’s a lot of potential there.

In fact, earlier today I unveiled two new exciting junior mining stock recommendations in our June issue of Gold Newsletter:

|

• One is a company that has “rediscovered” an historic gold deposit...and in the process is delivering astounding drill results like 6.28 g/t gold equivalent over 32 meters.

Despite these results, the company is still trading at bargain-basement levels, as if it hasn’t discovered anything!

Better yet: It’s about to drill a deep geophysical target that could be the source of all the historic gold...and is a direct analog to a billion-dollar deposit not far away.

• Our second new recommendation is a still-tiny company founded by a geologist who has helped build no less than three major junior mining successes in a row. His new venture was able to snap up 10 exciting anomalies in a proven mining district, including multi-kilometer-long mineralization drilled by a previous company.

The best part: The company is about to launch drill programs on at least five of these prime targets in the days just ahead. And its market cap is so small that just a sniff of success could send the share price soaring.

|

I reveal all the details on these exciting opportunities in the June edition of Gold Newsletter — released just hours ago.

| |

You can learn all about these red-hot junior mining plays by subscribing to Gold Newsletter now.

|

To get a full year of Gold Newsletter…and get immediate access to our exciting June issue packed with valuable investment intelligence and details on dozens of exciting junior mining plays…simply CLICK HERE or on the link below.

|

I strongly urge you to act now to discover these exciting new recommendations and get positioned before they make big news in the days just ahead.

| All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

|

CLICK HERE

To Get The

June Issue Of

Gold Newsletter

| | | | |

© Golden Opportunities, 2009 - 2022

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |