| Want assets that grow every day the sun rises? |

|

| Please find below a special message from our advertising sponsor, Harvest Returns. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Play The Trend As Old As Time Itself |

|

In a Covid-rocked world that has spawned unprecedented market volatility, Harvest Returns offers individual investors the opportunity to bet on one of history’s most stable trends.

|

|

In times of crisis, when many economic sectors crater, demand for food remains relatively stable.

|

People will always prioritize food in their budgets, which ensures that grocery stores, and the farms that supply them, do not necessarily suffer the same demand destruction as other sectors.

While investors can easily invest in the grocery sector, investing in agriculture and natural resources directly can be more difficult.

Institutional investors have long benefited from recession-resistant investments in these sectors, but regular investors looking to profit from farming and timberland have found their options limited.

That is, until now.

You see, one innovative company — Harvest Returns — has created a turnkey investment platform that allows individual investors, for as little as $5,000, to invest in vetted agriculture and timberland projects.

|

Wager On Global Population Growth…

|

It’s an inviting entry point into an investment class that offers both diversification and a way to bet on continued population growth.

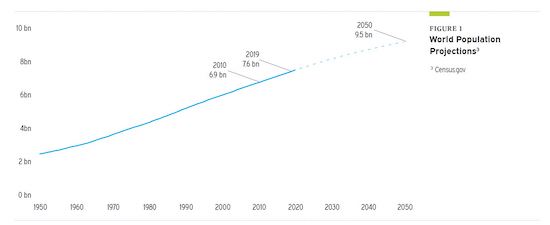

A quick glance at the chart below underscores why this is such a safe bet.

|

|

As you can see, according to the U.S. Census, the number of people on the planet is expected to grow from 7.6 billion in 2019 to 9.5 billion in 2050.

|

|

That’s almost 2 billion additional people that the world’s farms will need to feed in the decades ahead.

|

And while populations are likely to remain relatively stable in the developed world, growth in the developing world is forecast to charge ahead.

This quote nicely sums up the impact of these trends.

“In the next 40 years, humans will need to produce more food than they did in the previous 10,000 put together.”1

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

|

…And The Shrinking Availability Of Arable Land

|

Adding to the pressure of population growth is the relative decline of arable land available for food production.

Countries with robust food supply chains find population growth and urbanization is eating up the land needed to feed the world’s people.

There are opportunities for agriculture growth in developing regions like Sub-Saharan Africa, but the transportation and irrigation infrastructure is often lacking.

Thus, the potential for property price appreciation for agricultural projects is quite good, not to mention the income from crop yields and livestock sales.

Higher land prices appear almost baked into the cake — a classic supply-and-demand case where the nutritional needs of a growing population meet the declining availability of arable land.

|

|

Enjoy Investments That Grow Every Day The Sun Rises

| Harvest Returns offers investors the ability to make targeted investments in real assets like income-producing agriculture.

The firm has access to investment opportunities in a wide variety of agricultural products, including row crops, tree crops, livestock, timber and indoor agriculture.

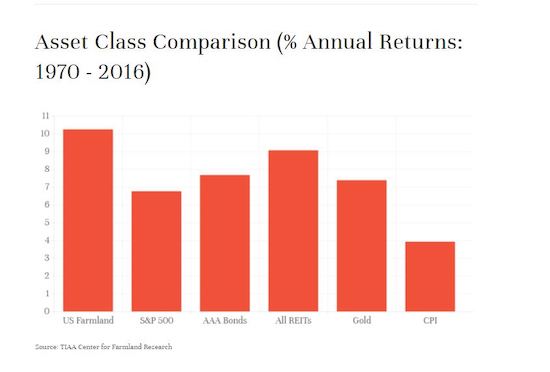

The chart below gives you a sense of how well U.S. farmland performs over the long-term.

|

|

|

As you can see, over the course of several economic cycles, agricultural investments have outperformed a variety of different asset classes and provided a hedge against inflation.

|

In a time of financial uncertainty, humanity’s perennial need for food makes investments in real assets like farmland an avenue to profits and safety.

|

A perfect example is the grain market: Since World War II, returns on grains have been uncorrelated to stock markets. They offer steady returns from annual harvests and a long history of land price appreciation.

|

Diversify Like An Institutional Investor

|

Pension funds, university endowments and other institutional investors have long used agricultural investment vehicles to diversify their portfolios.

Harvest Returns’ portfolio of farmland and timberland assets now allows individual investors access to this space as well.

|

These are long-term investments, vehicles that can provide protection from Covid volatility in the broader market and growth in times when returns in other asset classes can be hard to come by.

|

For those looking to maximize the tax benefits of the Tax Cuts and Jobs Act of 2017, there’s also the Harvest Returns Sustainable Agriculture Opportunity Zone Fund.

This fund looks to invest in projects that meet the Opportunity Zone definitions set up by the law. Available to accredited investors only, investments in qualifying projects can be highly tax-advantaged.

Whether you’re interested in this vehicle or more targeted investment in a vetted agricultural opportunity, Harvest Returns allows you to take action now to protect your financial future.

|

|

CLICK HERE

To Learn How You Can Grow Your Assets Through Harvest Returns

|

1 The Economist, “Barbarians at the Farm Gate”, Dec. 30, 2014

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |