| Hunting a silver elephant in Colorado |

|

| Please find below a special message from our advertising sponsor, Zephyr Minerals. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Hunting A Silver Elephant In Colorado |

|

Zephyr Minerals (ZFR.V; ZPHYF.OTC) is about to drill a silver-lead-zinc target with striking similarities to one of the largest, richest mines ever discovered.

|

|

With gold barreling ahead on the back of unprecedented monetary and fiscal stimulus, silver can seem like something of an afterthought.

|

|

Seasoned precious metals investors know better.

They’ve experienced past cycles in which gold races ahead, with gold-focused juniors providing leverage on the trend, only to see silver eventually catch up and surpass the yellow metal’s gains.

The current crisis has generalist investors squarely focused on gold stories right now, and many of those stories have doubled and tripled in the two months since the market bottom in mid-March.

|

Now the question becomes: What bets can you make as an investor that have the potential to multiply your gains in the current environment?

| Silver looks poised for big run in its own right, and tiny Zephyr Minerals (ZFR.V; ZPHYF.OTC) has quietly built on its land position Colorado with a silver-lead-zinc project that has all the markings of Broken Hill type deposit.

Why is that such a big deal?

Only this: the Broken Hill mine in Australia was among the largest deposits of silver, lead and zinc ever discovered.

|

The Mine That Put Australia On The Map

|

In 1883, a man named Charles Rasp came across an unusual rock type while working on a remote Australian sheep station in New South Wales.

He initially thought the rock was an example of tin mineralization. Instead, it turned out to be the marker for one of largest and richest silver, zinc and lead mines on Earth, one that would go on to generate a mind-blowing $100 billion in wealth.

Subsequently staked by Rasp and a group of partners, the Broken Hill deposit would form the flagship asset of Broken Hill Proprietary, a company that continues on in the 21st century as the world’s largest mining company, BHP.

| |

| | The Broken Hill Mine In Australia In 1908 |

Boasting 280 million tonnes of ore grading 148 g/t silver and 18.5% lead and zinc, the Broken Hill deposit was that rare combination of high grades and massive scale.

Its discovery put Australia on the map as a major source of mineral resources, and mining remains a bedrock of the country’s economy to this day.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

|

El Plomo: A Broken Hill Target

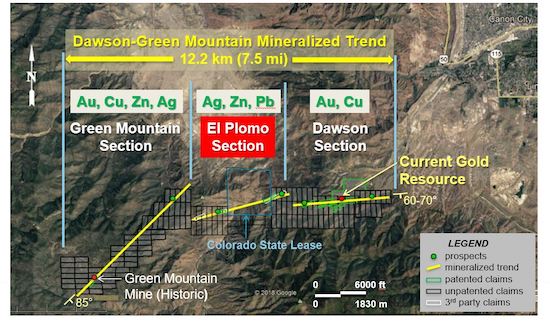

| Fast forward to 2019, and we find Zephyr sniffing around a target area adjacent to its Dawson project in Colorado that appears to be a Broken Hill type target.

The company had spent much of the 2010s pursuing a gold resource on Dawson.

Then, in 2018, it added the Green Mountain and El Plomo properties to the west, with the collective project now dubbed Dawson-Green Mountain.

|

|

In 2019, Zephyr had the good fortune to enlist the services of technical advisor Dr. Paul Spry, economic geology professor at the University of Iowa.

|

Dr. Spry is a recognized world expert in Broken Hill deposits. He has hands-on knowledge of the Dawson-El Plomo-Green Mountain area geology.

|

Combined with prospecting on El Plomo and a review of its historical data — which also included drill core from two shallow drill holes drilled by US Borax in 1981 — he saw potential for the target to host Broken Hill type mineralization.

Of particular importance he noted the presence of a key indicator/pathfinder mineral called gahnite, which has high zinc content, at El Plomo.

High-zinc gahnite is a key indicator mineral found at Broken Hill in Australia. Another similarity is the presence of potosi gneiss, a key Broken Hill rock type.

|

|

Striking Similarities To Cannington

|

A more recent example of Broken Hill type mineralization was BHP’s discovery of the Cannington silver-lead-zinc deposit in Queensland, Australia in 1990.

The Cannington area was identified as highly prospective by BHP because of the presence of high-zinc gahnite.

The magnetic character of the ore deposits at Broken Hill led BHP to conduct an airborne magnetic survey at Cannington. This yielded a magnetic anomaly which was subsequently drilled and resulted in the huge discovery of Cannington.

Originally outlined at more than 40 million tonnes of 520 g/t silver and 16.7% lead and zinc, Cannington began commercial production in 1999 and was the world’s largest and lowest cost silver producer for 20 years.

Spry’s analysis points to a pattern of high-zinc gahnite at El Plomo very similar to the one that led to Cannington’s discovery.

|

Intriguingly, a recent airborne geophysical survey has outlined a large magnetic anomaly on El Plomo.

|

This is particularly noteworthy because the silver-lead-zinc mineralization in the shallow holes drilled by Borax on El Plomo is magnetic (see photo below of drill core from GC-9) and is situated directly above the large magnetic anomaly.

With that same combination of a large magnetic anomaly, gahnite geochemistry and the presence of similar rock types, the key target at El Plomo gives Zephyr the chance to make a Broken Hill type discovery similar to Cannington.

And we’re about to find out if they will....

|

The Drill Is About To Turn

|

Thanks to a private placement completed in February, the company has the money it needs to begin a drilling program to test El Plomo’s key magnetic anomaly.

And the drill is starting to turn next month.

As you can see from the graphic below, that anomaly is both large and marked at surface by Holes GC-8 and GC-9, which hit substantial grades of zinc, lead and silver. Note as well the piece of high-grade core from GC-9 which is magnetic.

| |

| If the drill hits into significant widths of high-grade silver, lead and zinc as were drilled at Cannington, Zephyr’s C$24 million market cap will likely take off like a rocket.

|

Given the scale and grades that Broken Hill type deposits entail, it’s easy to see why.

| In a market where investors are searching for the next big thing in exploration stocks, placing a bet now on a drill-hole speculation with near unlimited upside makes an abundance of sense.

This is a potential home run. The leverage on the current share price in the event of a Cannington-type discovery would be massive.

Remember, Australian BHT deposits are both huge and high grade. Simply put, Zephyr is elephant hunting here on what may well be the only Broken Hill type exploration play in North America.

With a valuation back-stopped by a small, but significant high-grade gold resource with expansion potential on the Dawson section, Zephyr Minerals’ drill program on the El Plomo target this summer makes for one of the market’s more intriguing stories.

Drills are turning within the next few weeks, so time’s running short to hitch a ride on Zephyr.

|

|

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |