| Where does gold go post-slam?

| | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| | .png) | | Gold And Silver:

Slammed Again

| | | Gold and silver both nose-dived on Friday thanks to a surprisingly good jobs report and news that China didn’t buy gold in May.

Both rebounded nicely today, but the status of central bank buying (and the Peoples Bank of China specifically) going forward remains a big question mark.

| |

June 10, 2024

Dear Fellow Investor, | | As gold was undergoing its most severe beating in three years on Friday, there were few questions over what precipitated the selling.

| | In fact, there were two clear reasons for the sell-off:

The first was the nonfarm payrolls report for May, which came in at a surprising 272,000, nearly 100,000 jobs higher than the consensus expectation.

The second was the news that China stepped aside from publicly acknowledged gold purchases in May (who knows what they might have done on the sly, however).

The result: Gold fell off a cliff, and the decline gained steam during the session as sell-stops were hit. Gold finished down $83.40 at $2,292.60 bid, while silver shed an amazing $2.14 to $29.13. The losses were about 3.5% and 6.8%, respectively.

It was a slaughter.

| | The good news is that both metals rebounded strongly today. Gold had gained about $17.00 at the time of this writing, while silver had added about $0.45.

| | The gold stocks also bounced back nicely today, providing leverage to gold with index gains well over 1%.

All in all, not a bad performance considering that both the Dollar Index and Treasury yields were up today.

Regarding the first hit to gold on Friday, that jobs number was stunning...but it was far uglier once you dug into the details.

For one, the household survey showed a loss of 408,000 jobs, and the jobs that were gained were of low quality. Consider what our friend (and presenter at this year’s New Orleans Investment Conference) Jim Iuorio posted on X about these jobs numbers:

|  | | Jim further noted that the NFP report showed “most government jobs created in a 3 year period in history” and “biggest area of growth (by a mile), health care. Not a productive path…at all.”

So despite the market interpretation that the positive beat on jobs would further postpone the Fed’s pivot, the deeper data showed anything but good news for the economy.

In fact, another poster on X had some fascinating insights on the report, particularly the explosion in part-time jobs that was overshadowed by the headline numbers:

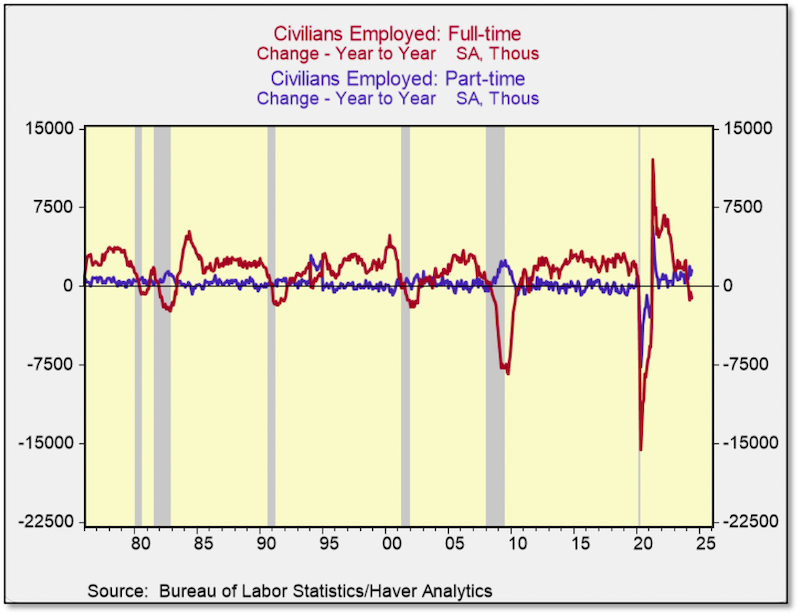

|  | | Supporting his argument was this remarkable chart:

|  | | As many analysts have pointed out, notably including our friend Danielle DiMartino Booth (who is also speaking in New Orleans this year), we are likely already in a recession. The only thing hiding or forestalling the recession has been misleading statistics and the flood of federal largesse.

As I have pointed out, the spiraling costs of servicing massive debt loads by the federal government and corporations are going to force the Fed to pivot. They are actively looking for any excuse to do so, even as their central banker brethren are already cutting.

| | Add in the likelihood of a recession that is looming or already in place, and the Fed pivot doesn’t seem too far ahead.

| | Now, the fact that the People’s Bank of China stepped aside from the gold market last month is more concerning to me. Granted, a number of other central banks continued their purchasing programs, but the PBOC and domestic Chinese demand have been the top two drivers (that we’ve been able to identify) for the current gold bull run.

Unless we see the PBOC return in force this month, I’ll be a little worried about this driver continuing to drive the bull forward until the Fed pivot kicks in.

The good news, as I mentioned above, is that a number of buyers, perhaps including the PBOC and maybe some of those mysterious investors out there, didn’t hesitate to take advantage of Friday’s price drop.

| | What Does This Mean For Gold Going Forward?

| | As you can tell, while it remains to be seen if China will continue buying gold heavily, I firmly believe that the Fed will be forced to begin cutting rates in the not-too-distant future.

This is the big factor that we were expecting to drive the gold price higher this year...and everything else that came into play so far has been a big surprise.

So the future still looks bright.

But if you want to get an inkling of what the future holds, you need to hear what today’s top minds are thinking.

And that’s where I come in.

| | Over nearly 40 years in this business, I’ve listened to, watched, read and met most of the best analysts to share their ideas. I know who’s the best at any point in time.

And I’m bringing virtually all of them to the New Orleans Conference this year.

| | I mentioned a couple of the brilliant analysts coming to New Orleans already, in Jim Iuorio and Danielle DiMartino Booth. In addition to them, we’re also bringing in James Grant, Brent Johnson, George Gammon, Rick Rule, James Lavish, Peter Boockvar, Tavi Costa, Tracy Shuchart, Dave Collum, Dominic Frisby and many more...and we’re still adding to the roster.

Simply put, if in any year you have significant money at risk in the markets...if you have wealth at risk...if you have any reason to want to build your wealth significantly...you need to attend the New Orleans Conference.

But in a market like today’s, when gold is setting new records and the metals are beginning secular bull markets, the need to go to New Orleans takes on an entirely new urgency.

These are the times when the New Orleans Conference truly shines. No other event brings the same caliber of experts — both on the stage and in the audience — to give you immensely valuable and timely insights.

| | The urgency is also enhanced because our fees are set to rise, and you can save up to $400 if you register right now.

| | You’ll also ensure a spot in our convenient host hotel by booking through our room block, and that’s a great advantage for those who don’t want to miss a minute of the exciting presentations and events we’re offering.

In other words, the time is right...and any delay could be very costly. I urge you to click on the link below to guarantee your spot and your deep discounts.

| | All the best,

|  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

| | CLICK HERE

To Learn More About

New Orleans ’24

And Save Hundreds

While Securing Your Spot

| | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the

Gold Newsletter Youtube channel.

| | | | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |