| This Arizona copper play could be big…

| | Please find below a special message from our advertising sponsor, Prismo Metals. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports.

| | Contact Us | Privacy Policy | View in Browser | Forward to a Friend

| |  | | In Elephant Country For Copper

| | | With a drill-ready project in the heart of Arizona’s hugely prolific copper belt, Prismo Metals (PRIZ.CN; PMOMF.OTC; FSE:7KU) is primed to deliver big leverage on the electrification trend.

Plus: Prime silver and gold projects in Mexico provide backstops and upside.

| | | | It’s a fact of the modern economy: The world needs more copper.

| | Lots more.

In fact, driven by the decarbonization trend and the rise of electric vehicles...plus a stunning new surge in energy demand for AI data centers...copper is facing perhaps the steepest demand curve ever seen for any commodity.

And as the planet’s major miners scour the planet for big deposits of copper, one jurisdiction that gets consistent attention is Arizona.

Freeport McMoRan. Rio Tinto. BHP. All three are working major deposits in the state.

| | In the midst of all this activity is Prismo Metals (PRIZ.CN; PMOMF.OTC, FSE:7KU) and its Hot Breccia project.

| | Hot Breccia sits adjacent to Freeport McMoRan’s past-producing Christmas Mine and, as you’re about to see, it contains the same host rocks that produced 363 million pounds of copper, 2.1 million ounces of silver and 55,026 ounces of gold for Christmas.

Best of all, Prismo is about to receive permits to begin drilling Hot Breccia at depth.

Good results from this effort could send the company’s share prices soaring, making now the time to begin taking a closer look at Prismo Metals.

| | A Tier 1 Copper Jurisdiction

| | Hot Breccia is truly located in elephant country. Some of the world’s largest deposits of copper are located in its section of Arizona.

That includes Freeport McMoRan’s Morenci mine (74.7 billion pounds of copper), Rio Tinto and BHP’s Resolution deposit (60.1 billion pounds of copper) and Freeport’s Miami deposit (22.0 billion pounds of copper).

| | | | All the infrastructure needed to build a mine is available in the area, including highways, water, power lines, a smelter and a concentrator.

The Hot Breccia project sits within an hour’s drive of both Phoenix and Tucson, so there are no workforce or supplier issues.

In short, Hot Breccia is in an ideal location for Prismo to make another major copper discovery.

| | Similarities To Resolution

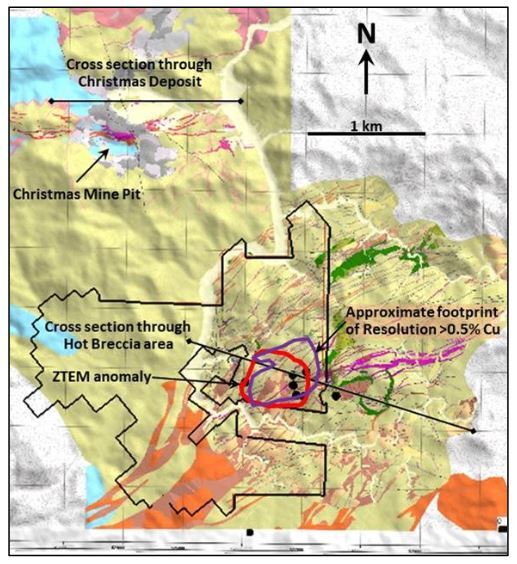

| | As mentioned, Hot Breccia lies adjacent to Freeport’s past-producing Christmas mine.

Christmas was a small but high-grade copper mine, similar to the Magma mine located some 40 km to the northwest.

When geologists explored for the “roots” to the mineralized system at Magma, they found the giant Resolution deposit. Prismo is hoping the roots to the Christmas mine could be at Hot Breccia and there is a lot of evidence to support that theory.

Prismo’s geologists note that this project contains the identical productive geologic units that host high-grade copper mineralization at Christmas.

| | The difference at Hot Breccia is that the host rocks are deeper and covered by a 400-meter layer of volcanic rocks.

| | In the 1970s and early 1980s, Kennecott and then Phelps Dodge drilled a total of nine holes on Hot Breccia.

Their work proved the presence of a mineralized system at depth with compelling results like 77 feet of 0.54% copper...60 feet of 1.4% copper and 4.65% zinc...25 feet of 1.73% copper and 0.11% zinc...and 15 feet of 1.4% copper and 0.88% zinc. Phelps Dodge’s best hole cut 1,270 feet of variably mineralized skarn with several intercepts of better-than-1% copper and as much as 3.16% copper.

Prismo views these results as smoke, and by using powerful new exploration techniques, they hope to be able to find the fire!

|  | | A 2023 ZTEM survey completed by Prismo outlined a geophysical anomaly similar in scale to the mineralized footprint that hosts the massive Resolution deposit located 40 kilometers to the north.

| | On The Verge Of Drilling

| | Prismo is currently awaiting permits to begin a 5,000-meter drill program at Hot Breccia.

That program will twin or deepen one or more of the historical holes at Hot Breccia, test the ZTEM anomaly and target shallow gold mineralization.

To help it zero in on the best targets, Prismo has enlisted the services of ExploreTech, an AI-driven targeting company.

| | Two Intriguing Projects In Mexico

| | In addition to Hot Breccia, Prismo also owns both a silver and a gold project in Mexico.

Its Palos Verdes silver project is particularly compelling, as it is surrounded on three sides by Vizsla Silver’s high-profile Panuco project.

Vizsla has achieved a C$530 million market cap by defining a world class resource at Panuco and, in 2023, it invested C$2 million (C$500,000 in cash and C$1.5 million in Vizsla shares) in Prismo for that company to drill Palos Verdes.

| | Prismo completed 6,000 meters in 33 holes, with the best result coming from Hole 25 — with an eye-popping intersection of 0.5 meters of 102 g/t gold and 3,100 g/t silver.

| | A joint Prismo and Vizsla technical committee, which includes Prismo co-founder and Chief Exploration Officer Dr. Craig Gibson and Advisor and significant shareholder Dr. Peter Megaw, has recommended deeper drilling on Palos Verdes.

That work will likely take place later this summer, with drill set ups sited on Vizsla’s property to ensure the proper angle is taken to test the mineralization at depth.

Prismo’s gold project is called Los Pavitos and is located in Sonora State’s Caborca Gold Belt, home to 15-20 million ounces of gold resources and production. This project was generated by Minera Cascabel, Peter Megaw’s exploration service company in Mexico.

Los Pavitos provides a gold kicker to go with the flagship copper story at Hot Breccia and the silver story at Palos Verdes.

Initial results were very impressive, with the best intercept of 6.65 meters (core length) reporting 10.2 g/t gold and 47.0 g/t silver, within a wider interval of 11.93 meters (core length) averaging 5.77 g/t gold and 28.7 g/t silver in drill hole LP-SC-23-02.

| | Ready For Launch

| | What makes the upcoming drilling program at Hot Breccia truly exciting is Prismo’s drum-tight share structure.

The company has total shares outstanding of just 45 million, with nearly 30% of that held by insiders and 9% by Vizsla Silver. The float is just 21.6 million shares.

Better still, Prismo operates on a low-overhead model — none of the major executives are on fixed salaries. That means shareholder money goes where it should: in the ground.

| | If the drills hit significant copper mineralization, that tight share structure could cause Prismo’s share price to quickly soar.

| | Given the scale of the target Prismo Metals is going after at Hot Breccia, you’ll want to start doing your due diligence on this company well in advance of its upcoming drill program.

| | | CLICK HERE

To Learn More about Prismo Metals Inc.

| | | | © Golden Opportunities, 2009 - 2024

| | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411

| | | |