| You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| A Little Inflation Is A Good Thing…When A Lot Is the Alternative! | |

Economists say inflation is too low. I say it’s just fine.

By Albert Lu

| |

For years, economists have lectured that inflation is too low because economies need an ever-increasing supply of money to prosper. In their view, achieving full employment and stable prices requires a seemingly arbitrary, long-run inflation rate of 2% per year.

But, if you ask me, low inflation is just fine. I wish it was lower.

The core price index for personal consumption expenditures (PCE) rose 3.1% this past year. According to the consumer price index CPI-U, another popular measure, inflation over the last 10 years has averaged 1.8% annually. Too low, they say.

However, that rate is equivalent to a roughly 16% reduction of purchasing power every 10 years. Over 50 years, that amount represents a savings tax of almost 60%. Does that sound low to you?

| |

| | Figure 1: CPI-U; Source: BLS |

If you pay attention to your actual expenditures, you may find the damage is far worse.

Average home prices in the U.S. rose 11.6% over the past year, with a 10-year average of 5.7%, according to Zillow — not so encouraging for renters and first-time home buyers, not to mention the impact on existing homeowners' property taxes and insurance.

Increases in transportation costs have also outpaced the official inflation index. The price of a New York City subway pass, for example, rose by 4% per year on average. My simple oil change used to cost $25 not that long ago. Today, that same service runs in excess of $40. Then there’s gasoline, which is up almost 50% in the last 12 months. So much for that oil glut.

“Well, I drive a Tesla,” you say. But, with core commodities — particularly copper — up roughly 70% since May 2020, that planet-saving technology is about to get much more expensive.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| | The Fed’s Not Worried |

Despite the recent uptick in inflation, the Fed remains largely unconcerned. Speaking at The Economic Club of New York, Governor Lael Brainard supported the transitory inflation theory, reiterating her view that increasing inflation won’t persist: |

“I had been anticipating a notable move up in inflation beginning in April and lasting several months due to a combination of base effects and temporary reopening supply and demand mismatches. Core PCE inflation moved up to 3.1% on a 12-month basis in April, while 12-month total PCE inflation rose to 3.6% amid high energy prices.” |

She added, |

“Core PCE inflation is estimated to be 2.4% in April after adjusting for base effects. Apart from base effects, the underlying factors driving the increase in inflation are consistent with my expectations that we would see temporary price increases associated with sectoral supply-demand imbalances, and that the timing and sectoral incidence of these increases would be difficult to predict.” |

James Rickards, author of “Currency Wars” and “The New Great Depression,” concurs: |

“I get very nervous when I agree with the Fed. I’ve often said they’re one of the most incompetent government agencies in the entire bureaucracy…but I do agree that this so-called inflation is transitory. We’re not heading for inflation. We’re heading for disinflation, maybe even deflation which is much more dangerous.”

“It’s a sad day when a central bank wants inflation, and they can’t get it.” |

It will be an even sadder day when they do.

The fact that the Fed is not worried makes me worried.

| | Heading For Deflation? |

I do agree with Rickards on several key points. The rapid inflation we see now, at least some of it, is indeed transitory. Pandemic-related supply disruptions and other idiosyncratic factors must be accounted for. So, I doubt recent price trends in suburban real estate, used cars and bicycles, to name a few, can continue for long.

I also agree that another deflationary episode is coming, perhaps soon. The Fed's past attempts at tapering QE and interest rate normalization have not fared well. The next time will be no different. Transient or not, inflation is here, and it’s only a matter of time before inflation expectations also rise, once again forcing the Fed’s hand.

But the question is not inflation or deflation because both are coming — stagflation, too.

If history is any indication, any move by the Fed to tighten monetary policy will trigger a recession or perhaps a depression. Their solution will be, as it always is, more money printing. The boom-bust cycle continues. All the while, long-run average inflation ticks along near 2% a year, or higher if the Fed gets its wish.

“It’s only 2%,” they’ll say. But do the math — over the average person’s investment horizon, 2% per year is devastating. Throw in a hefty inheritance tax and you can forget any plans of accumulating generational wealth.

Inflation and deflation, the worst of both worlds.

| | Look Out! — The ’70s Are Trending | |

|

Unfortunately, it gets worse because, sooner or later, the Fed will find it has gone back to the re-inflation well one too many times. The inflation it creates will trigger price increases, without the economic growth it has come to enjoy. Any further attempts to stimulate growth through monetary easing will backfire and stoke inflation expectations instead.

In predictable fashion, the government will resort to price controls, which will undoubtedly cause shortages and further erode public confidence. In short, a return to stagflation.

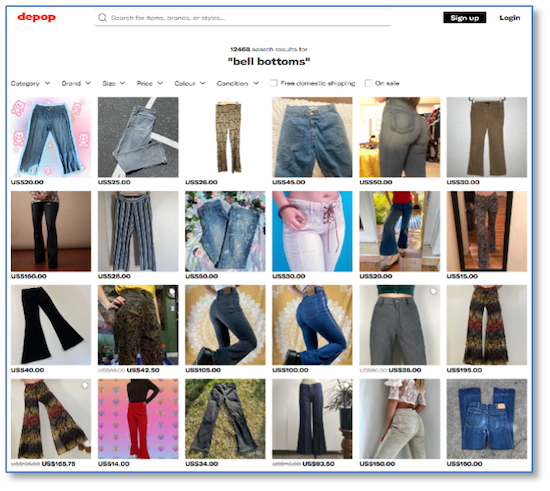

Experts at the White House and central bank believe a return to stagflation is about as likely as a revival of bell bottom jeans. If true, the rising popularity of vintage resellers, such as Depop, is cause for concern. The site, which caters primarily to fashion-conscious Gen-Z shoppers, currently lists over 12,000 items relating to bell bottoms.

In fashion and in life, what goes around comes around.

Albert Lu is the president of Luma Financial and the producer of the Rule Symposium on Natural Resource Investing.

Sign up to receive email alerts about Albert’s new interviews and articles.

| | | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |