| Copper-gold resource set up for potential near-term double | | | Please find below a special message from our advertising sponsor, Granite Creek Copper. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. | |

Copper blew through all-time highs recently — sending smart investors looking for high-powered, still-overlooked ways to leverage the trend.

One prime candidate is Granite Creek Copper (TSXV: GCX; OTCQB: GCXXF), a company whose fresh take on an existing copper-gold resource in Canada could lead to a quick doubling of its mineable “pounds in the ground.”

| | |

These are heady times for copper and gold.

|

The red metal recently posted an all-time high of $4.65/lb. due to bets on a post-Covid recovery, potentially rampant inflation and an unprecedented supply-demand imbalance.

And, after posting historic, nominal highs in 2020 before retrenching, gold looks primed to retest those highs, powered by oceans of fiscal and monetary liquidity.

|

It’s a ripe environment in both metals, one that has commodities enthusiasts looking for underappreciated stories that can attract generalist investor attention as copper and gold uptrends play out.

|

A story built to attract that attention in the short term is Granite Creek Copper (TSXV: GCX; OTCQB: GCXXF), a company whose plan to grow value on the current copper-gold resource identified on its Carmacks project is nearing fruition.

|

|

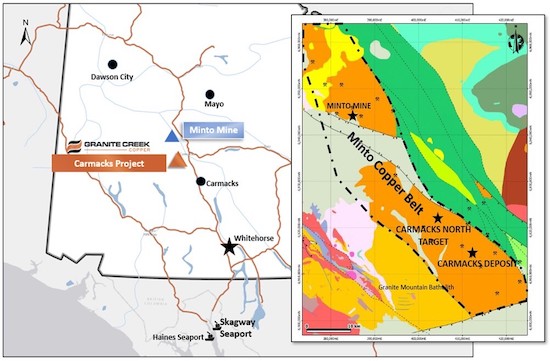

Located along the well-established Minto copper belt in west-central Yukon, Carmacks gives Granite Creek control over a large portion of the southern end of the belt…and an opportunity to quickly double the project’s mineable resources.

|

A Fresh Look At An Old Project

|

Carmacks is somewhat of a known quantity, having seen a number of assessments over the years.

Indeed, the most recent PEA on the project, conducted by the previous owner in 2017, projected a $166 million NPV based on $3.25/lb. copper and $1,350/oz. gold.

|

With copper trading around $4.50/lb. and gold trading near $1,900/oz, it’s obvious that number will improve significantly with an updated PEA using revised, base-case prices.

|

But that’s not where the real opportunity is at Carmacks.

That economic study was based solely on the oxide portion of the resource, with the potentially much larger sulphide material below being effectively ignored.

Currently, the project’s measured and indicated resource consists of 23.8 million tonnes of 0.85% copper, 0.31 g/t gold and 3.4 g/t silver (or 446 million pounds copper, 237,000 ounces gold and 2.4 million ounces silver).

Of that M&I copper resource, 325 million pounds are oxide material and 141 million pounds are sulphide.

Simply put, the 10,000-meter drilling program Granite Creek has underway at this very moment has the potential to double the amount of PEA-level, M&I resources…just by drilling off and expanding the inferred sulphide resources that lie at depth.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

The Quick Path To Double The Mineable Resource

|

The long section below clearly demonstrates the opportunity at Zone 1, Carmack’s primary resource hosting area.

| |

|

Just by drilling off and expanding the inferred sulphide resources at depth, both at Zone 1 and elsewhere on the project, Granite Creek thinks it can virtually double the current copper resource into a substantial, billion-pound deposit.

And, to achieve the broader development plan of advancing the project toward an updated PEA (or potentially prefeasibility in Q1 2022), the company has hired consultants Sedgman and Mining Plus to develop profitable options for processing the sulphide ore alongside the oxide ore at Carmacks.

It’s the very definition of low-lying fruit, as prior operators were so focused on expanding the oxide pounds they completely missed the potential of this sulphide material to dramatically increase the mineable resource and subsequently extend the potential mine life from nine years to as much as 15 years.

|

Drills Are Turning Right Now

|

As mentioned, drills are turning to prove up those sulphide resources into the measured and indicated categories and to expand the known mineralization.

Doing so should allow Granite Creek to show a significant increase in mineable pounds in the ground with a new resource estimate due out by the end of the year.

|

Combined with the processing scenarios that Sedgman and Mining Plus are working up, a new PEA (based on a suddenly larger M&I resource and potentially higher base-case metals prices in both copper and gold) could wow the market.

|

Add in multiple targets that could expand the overall resource still further, and you have a potentially high-powered lever for the copper and gold bull markets.

|

An Undervaluation That’s About To Become Blindingly Obvious

|

With first assays from Granite Creek’s current program at Carmacks due out shortly, the market will soon have a wake-up call on the overlooked potential on this project.

The Yukon in general has been a hotbed of activity over the past several years with Victoria Gold, Alexco Resources and the Minto mine all achieving production status.

In addition, numerous majors have made significant investments in Yukon projects of late.

That includes, most recently and most relevantly, Rio Tinto taking a C$25.6 million CAD (8%) position in Granite Creek peer, Western Copper & Gold, whose massive Casino deposit lies to the northwest.

|

If Granite Creek can follow through on its plan to push Carmacks to a billion-pound copper resource with a 12-15-year mine life, suitors will likely quickly start to line up.

|

The company has been incredibly aggressive since launching in 2019, so things should continue to progress quickly.

In the interim, the drilling and the upcoming resource estimate and PEA (or, perhaps, a prefeasibility study), give Granite Creek ample news flow to grab investor attention.

Given the bright outlook for both copper and gold, Granite Creek Copper’s ambitious re-think of Carmacks has the potential to deliver profitable leverage on both metals — but with drills turning now, the fuse is lit.

|

CLICK HERE

To Learn More about Granite Creek Copper

| | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $7,500. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |