| “Buy commodities; sell bonds” | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | Contact Us | Privacy Policy | View in Browser | Forward to a Friend | | .png) | | Buy Commodities;

Sell Bonds | | | A market update from one of today’s top resource-market analysts. | | Editor’s Note: Our friend Edward Bonner checks in today with another one of his, and his Sprott team’s, outstanding market analyses.

I hope you enjoy Edward’s contribution below. And feel free to contact him with any comments or questions via his information at the end of the article. — BL

| | | | Dear Reader,

The team at Sprott has been hard at work, ducking, diving and weaving through the maelstrom of market data – be it energy, uranium, copper, gold, silver, platinum, “rare earths”, or even more obscure and long-forgotten commodities.

Of course, the big piece of news last week was the Israeli attack on Iran, sending 200 fighter jets to hit over 100 strategic assets, including nuclear enrichment facilities, scientists, and commanders. “As many days as it takes,” said Netanyahu. Trump weighed in, “Excellent”.

No Peace in the Middle East… Yet another sad war front, countless more deaths and misery.

Crude oil rose sharply. Fertilizer markets did too as Iran is the third largest global exporter of urea, a nitrogen fertilizer.

Yet again, gold is distinguishing itself as a safe haven. Bitcoin was down, and so were US bonds. Both trading more like risk assets than defensive positions. The likely implication, of course, is higher inflation, higher bond yields, and lower economic growth (i.e. stagflation).

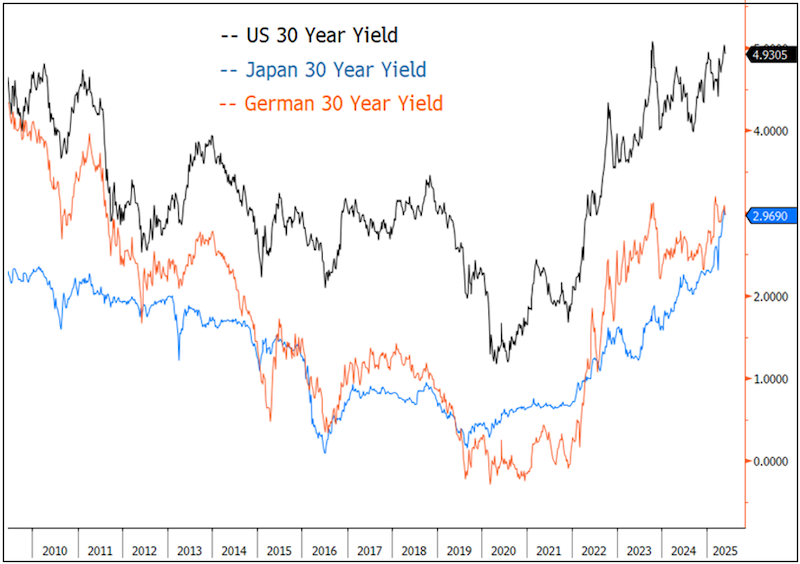

Paul Wong, Sprott’s Market Strategist, was on the case last week, publishing a lengthy note on gold, which you can read here. I’ve gone through and picked out the most salient points, which you can read below. | | “The U.S. has now paired century-high tariff rates with an increasingly unilateral foreign-policy stance, walking away from multilateral frameworks and casting doubt on long-standing security guarantees. The Trump administration argues that the U.S. dollar overvaluation and reserve-currency obligations undermine U.S. industry. It is openly questioning whether the U.S. should continue to underwrite the system it built and has maintained for generations. Foreign investors, however, see something different: a surging U.S. fiscal deficit near 7% of GDP, tax-cut proposals skewed toward the very wealthy, and an executive temperament that appears erratic and authoritarian. “While investors question the neutrality of Treasury bonds and the stability of the U.S. dollar they reach for non-sovereign stores of value, primarily gold bullion. Commodities with robust supply-demand fundamentals also stand to benefit from a structurally weaker U.S. dollar and from investors' search for real assets that hedge against both inflation and geopolitical disorder. The bond market, by contrast, faces a future in which yields may drift higher even during slowdowns, reflecting not just inflation risk but also a creeping discount for political unpredictability. “Structural inflation constitutes another pressure point on government spending. It is driven by factors like deglobalization, tariff and trade tensions, an aging population, larger defense budgets, the green transition and a rising cost of capital. Combined, these forces place heavy fiscal demands on governments. “The rise in long-term yields is not unique to the U.S. It is a global trend. Countries like Japan, the UK and Germany are seeing similar pressures, with yields climbing as fiscal risks mount. Japan, for example, is grappling with a debt-to-GDP ratio exceeding 200%, and the country's central bank has struggled to cap rising yields. This underscores the fact that high levels of sovereign debt and rising yields are a global risk. |  | | “The failure to address growing deficits, has only worsened the outlook for long-term debt management. A case in point is the latest proposed U.S. spending bill which is projected to add about $2.4 trillion to the national debt over the next 10 years.

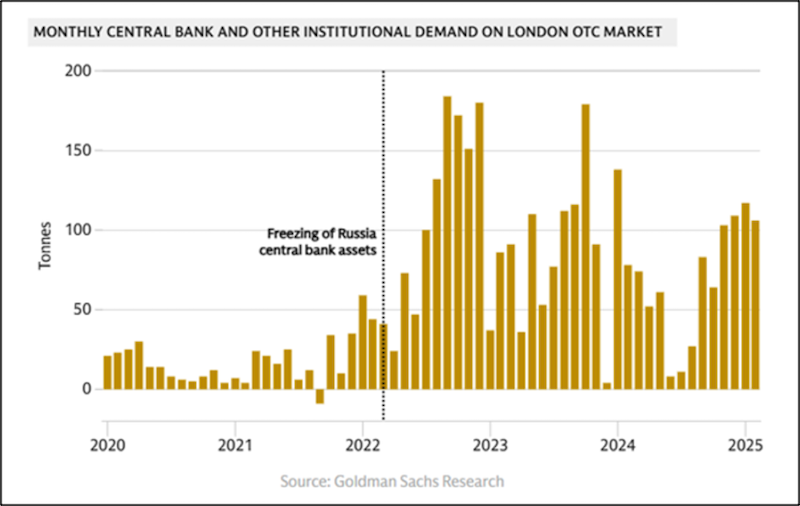

“As the ‘sell America’ trade intensifies and bond vigilantes return to the market, the pressure on governments to stabilize their debt and restore investor confidence will only increase. Whether through fiscal reforms, debt restructuring or financial repression, the coming years will likely be marked by significant challenges in managing sovereign debt with potentially severe consequences for economic growth and financial stability.” | | Perhaps in preparation, central banks have been loading up on gold. Take a look at the chart below showing the sharp increase in central bank purchases of gold since the US weaponized the dollar. Gold is now the second largest component of global central bank reserves, weighing in at roughly 20%. For reference, central banks allocated as much as 70% of their reserves to gold back in the late 1970s. | |  | | In his latest piece, Paul also digs into the silver markets, which are currently experiencing a breakout above the $35/oz resistance. He reckons the next resistance is the $40-42/oz range. If interested, you can read the whole piece here. Given this backdrop, one would think investment banks would be all over this. But here’s the catch. After 12 years and 3 commodity cycle crashes, pretty much anyone who was involved with commodities was wiped out or forced into retirement, and with them all the commodities and mining sector knowledge and expertise. Here’s one last word of wisdom from Paul: “The basic message for multi-asset class portfolios is to buy commodities (the good ones) and sell bonds.” On that note, I hope you have a nice week. I will be up in Newfoundland, visiting a couple mining projects that I am currently invested in alongside my clients. If you have any questions, or if you need any help with managing your natural resource investment portfolio, please feel free to reach out. I will be back in the office next week. Kind regards, Edward

P.S. I will also be attending the Rick Rule Natural Resource Symposium in Boca in July. Sprott is a sponsor of the event, and we will have a booth. If you are attending, please let me know so we can arrange a time to meet. Click here to register. I look forward to seeing some of you there.

P.P.S. If you need help with managing your portfolio of mining equities, please reach out for a free consultation.

Edward Bonner

Investment Advisor, Geologist

ebonner@sprottglobal.com

Sprott Global Resource Investments Ltd.

1910 Palomar Point Way, #200

Carlsbad, CA 92008

| | Interested readers can contact me directly via email at ebonner@sprottglobal.com | | Editor’s Note: Edward Bonner is an experienced exploration geologist and a graduate from the Colorado School of Mines with a Master’s in Economic Geology. He’s now helping many investors protect and build wealth as an investment advisor at Sprott Wealth Management. | | | | Important Disclosure

Relative to other sectors, precious metals and natural resources investments have higher headline risk and are more sensitive to changes in economic data, political or regulatory events, and underlying commodity price fluctuations. Risks related to extraction, storage and liquidity should also be considered.

Gold and precious metals are referred to with terms of art like store of value, safe haven and safe asset. These terms should not be construed to guarantee any form of investment safety. While “safe” assets like gold, Treasuries, money market funds and cash generally do not carry a high risk of loss relative to other asset classes, any asset may lose value, which may involve the complete loss of invested principal.

Past performance is no guarantee of future results. You cannot invest directly in an index. Investments, commentary, and opinions are unique and may not be reflective of any other Sprott entity or affiliate. Forward-looking language should not be construed as predictive. While third-party sources are believed to be reliable, Sprott makes no guarantee as to their accuracy or timeliness. This information does not constitute an offer or solicitation and may not be relied upon or considered to be the rendering of tax, legal, accounting or professional advice. | | | | © Golden Opportunities, 2009 - 2025 | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411 | | | |