The World’s Going

Crazy For Cobalt

As battery makers fight to secure cobalt supplies, well-positioned investors are poised to clean up.

And perhaps none will be in a better position than shareholders of Explorex Resources Inc. (EX.V; EXPXF.OTC).

Dear Fellow Investor,

China’s second-largest lithium producer just told a Canadian company “Bring us all your cobalt.”

Well, perhaps not literally — but as you’re about to see, one of the world’s largest producers of lithium products is about to put its economic power behind one relatively small company.

And as Explorex Resources Inc. (EX.V; EXPXF.OTC) takes full advantage of this remarkable opportunity, its shareholders could reap extraordinary rewards.

Consider this: Over the last five years, the lithium battery explosion has transformed one company from a small cap to a $10 billion behemoth. Its share price soared more than 17 times over in that time span.

That company — Jiangxi Ganfeng Lithium, or simply “Ganfeng” — has long had a special relationship with relatively tiny Explorex Resources.

Now it’s taking that relationship to an entirely new level.

But first, consider this...

Cobalt Is Holding Up Global Battery Production

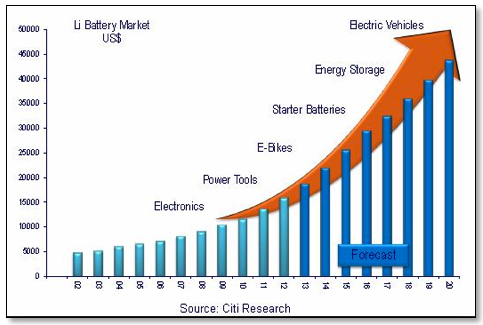

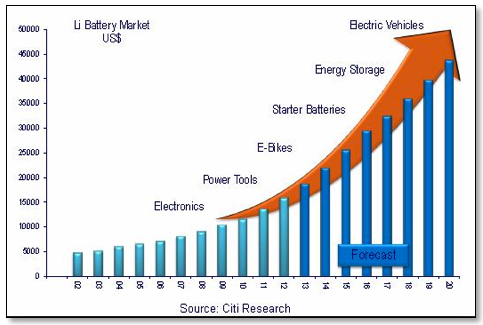

Rechargeable batteries are the irresistible force behind the surge in demand for cobalt.

Battery makers like Ganfeng are snatching up 42% of the world’s cobalt production because cobalt is vital for rechargeable lithium-ion (Li) batteries.

A Techcrunch.com headline put the situation in perspective last year when it asked, “No Cobalt, No Tesla?”

The race for supplies is so intense that traditional cobalt users like jet engine manufacturers and other users of metal alloys are seeing their supplies disappear too.

And that’s why Ganfeng just offered Explorex a $1 million windfall of cash to go find supplies.

Ganfeng needs lithium urgently to continue its growth. In January, Ganfeng announced its plan to manufacture 600 MWh worth of Li-ion batteries. And it needs all the cobalt that Explorex can find and deliver.

The Tight-As-A-Drum Cobalt Market Just Got Tighter...

Today there is no alternative to cobalt in lithium-ion batteries that can yield as much power, longevity and ability to recharge at a price that works in the real world. In short, no substitution metal to cut into the demand for cobalt.

In addition to that, major users like Apple, Google, Microsoft, Samsung and Toshiba have joined the Electronic Industry Citizenship Coalition (EICC), and are refusing to buy cobalt from mines in the Democratic Republic of Congo, where mining companies use children as young as four as laborers.

The cobalt market was already tight as a drum, but this tightened it to the breaking point: The DRC currently produces more than half the world’s cobalt.

It’s a combination of technology, scarcity and ethics that have created a wide open window of opportunity for Explorex and its four cobalt-rich mining prospects…

• The 699-acre Hautalampi nickel-copper-cobalt deposit in Finland (financed with Ganfeng backing)...

• Two potentially super-rich mines within the Cobalt Embayment of northeastern Ontario...

• One promising multi-metal mine within the Bathurst Mining Camp in New Brunswick.

Finland On The Fast Track

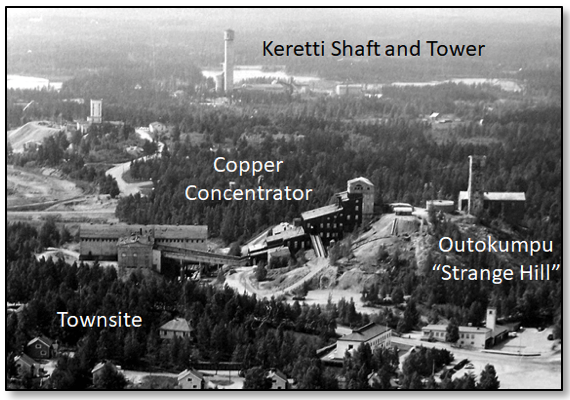

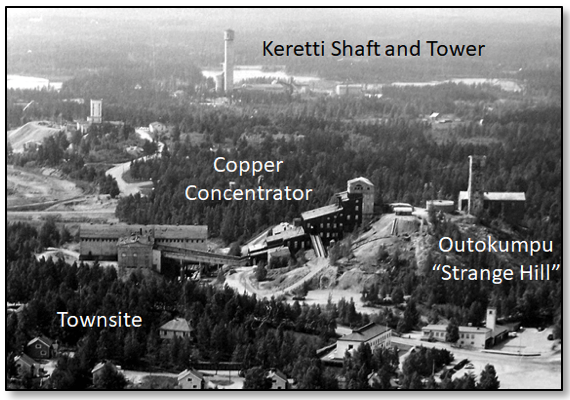

The Hautalampi deposit was the focus of pre-production development in the 1980s. That puts Explorex on a rapid path to leapfrog into development stage here.

Though unmined, the Hautalampi site is well explored and is near population centers, rails, and roads. A copper concentrator, mineshaft and ventilation system are already in place.

Explorex has a 91% interest in the company that owns this mine. FinnNickel completed a feasibility study of this area in 2009 and estimated 2.256,000 tonnes of ore (measured and indicated) that would yield 0.44% nickel, 0.38% copper, and 0.12% cobalt.

This is an advanced development stage prospect. The mining concession is already granted. Environment and water discharge permits are in hand. And Explorex is permitted to dewater the underground workings using a submersible pump lowered into the mineshaft.

Explorex will need to do some additional drilling to bring the old report information up to Canadian NI- 43-101 standards required for public companies.

But here’s the bottom line: The company believes this project provides excellent potential for near-term production.

And Ganfeng, which supplied key financial backing, stands ready to buy cobalt whenever Explorex can provide it.

The Richest Potential:

Canada

Explorex also has three mining properties in Canada with exciting potential.

The Kagoot Brook Cobalt Project lies along the southwest margin the famous Bathurst Mining Camp in New Brunswick. The Kagoot Brook Cobalt Project lies along the southwest margin the famous Bathurst Mining Camp in New Brunswick.

In 1983, the New Brunswick government established very high cobalt values in a stream sediment sampling program. A year later, Brunswick Mining and Smelting sampled the silt and it, too, found strongly anomalous cobalt. Some samples had values as high as 0.60%. High values for copper, lead, zinc and nickel were also found.

The Kagoot has never been drilled, but targets are already identified.

Explorex’s Elk Lake Ontario prospects sit in a historic cobalt mining area that has yielded 50 million pounds since the early 1900s. Explorex has two mines in development here.

The Paragon-Hitchcock mine has been explored and was a productive silver mining area in the past. Recent grab samples from here show as high as 2.34% cobalt.

The Cobalt-Frontenac mine is historically rich with gold as well.

Explorex Resources:

On The Cutting Edge

Of The Cobalt Boom

Rarely does a speculative, high-potential mining investment present such a deep layer of stability. Explorex has a lot to offer:

• A share structure that doesn’t overly dilute the potential. Management holds 20% of the company and private investment and funds hold another 16% — implying deep pockets and strong hands...

• An excellent financial position...

• A strong and well-established alliance with Jiangxi Ganfeng Lithium China’s second largest lithium producer and the fifth largest in the world...

• Leapfrogging into production rapidly in Finland on a property with previous development...

• And a focus on strategic metals with outstanding profit margins.

Add up all the evidence, and it’s obvious that smart investors need to get positioned in cobalt before the market really takes off.

And if they’re looking at cobalt, they need to look at one of the best positioned companies in the space — Explorex Resources (EX.V; EXPXF.OTC).

CLICK HERE

To Get The Full Story

On

Explorex Resources

|

The Kagoot Brook Cobalt Project lies along the southwest margin the famous Bathurst Mining Camp in New Brunswick.

The Kagoot Brook Cobalt Project lies along the southwest margin the famous Bathurst Mining Camp in New Brunswick.