|

| The Raglan Mine is one of Canada’s — and the world’s — largest critical metals mines. |

| Generating 40,000 tonnes per year of nickel-in-concentrate, Raglan’s production also includes substantial amounts of copper and small amounts of platinum group elements (“PGEs”).

And with the electrification trend driving demand for nickel, copper and PGEs, major miners are always on the lookout for new, large deposits of these critical metals. |

| Into this breach has stepped Cupani Metals (CUPA.CN; CUPIF.OTC), a company with a key critical metals project, dubbed Blue Lake, located between continental plates along the same macro collision as Raglan. |

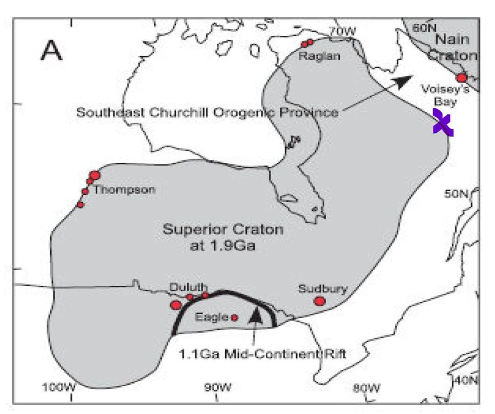

| That’s key because, as you can see from the red dots on the geological map of eastern Canada below, large mines (including Raglan) cluster around the edge formed by the contact between the Superior Craton and surrounding continental structures. |

|

| This macro geological map of eastern Canada shows how the collision of the Superior Craton with surrounding continental plates has created some of the country’s largest critical metals mines. Cupani Metals’ Blue Lake project is marked with an “X.” |

| Marked by the purple “X,” Blue Lake also sits along this contact — and the same geological folding that allowed for the mineralization events at Raglan is also obvious at Blue Lake.

Why does this geology lesson matter to investors? Because it has created a target-rich critical metals environment within Cupani Metals district-scale property position at Blue Lake.

Read on to discover why, building from a historical critical metals resource, Cupani Metals’ project could become northern Quebec’s next multi-generational, polymetallic deposit and have an explosive impact on the company’s share price. |

| A High-Grade, Near-Surface Historical Resource |

| Blue Lake’s historical tonnage was outlined by a platinum company in the 1980s and includes an historical 4.37 million tonnes of 2.28% copper equivalent (0.87% copper, 0.52% nickel, and 0.84 g/t platinum and palladium).

The relatively moribund platinum market at the time caused that owner to eventually walk away from the project, which remained relatively underexplored until Anglo American picked it up in the 2000s. Then the metals downturn in 2012 also led Anglo to jettison Blue Lake. |

| Since then, Cupani Metals has spent several years putting together a massive land package around Blue Lake. |

| The company has combed through the historical data, conducted its own geophysical surveys and identified several large targets that, if mineralized, could multiply that 4.37-million-tonne copper-equivalent resource. |

| District-Scale Project Has Large, Promising Targets |

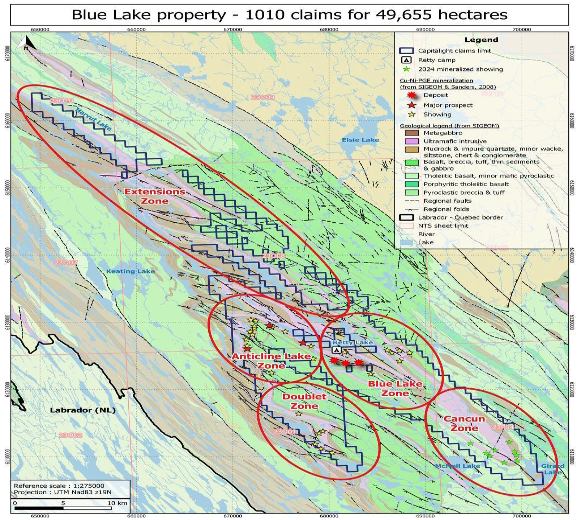

| The five largest of those targets, including the resource-hosting Blue Lake zone, are outlined in red in the map below. |

|

| Blue Lake has a number of large targets, each with the potential to multiply the project’s historical critical metals resource. |

| In addition to the Blue Lake target, the 50,000-hectare property includes the Anticline, Cancun, Doublet and Extensions zones — and each of these zones has exhibited precisely the kind of geology, geochemical assays and geophysical signals that anyone searching for a Raglan look-alike would want to see. |

| Not only is the historical resource at the Blue Lake target open at depth and along strike, but other potential “Blue Lakes” could be lurking, particularly adjacent to the Pogo deposit and within the Extension zone and also the Cancun zone. |

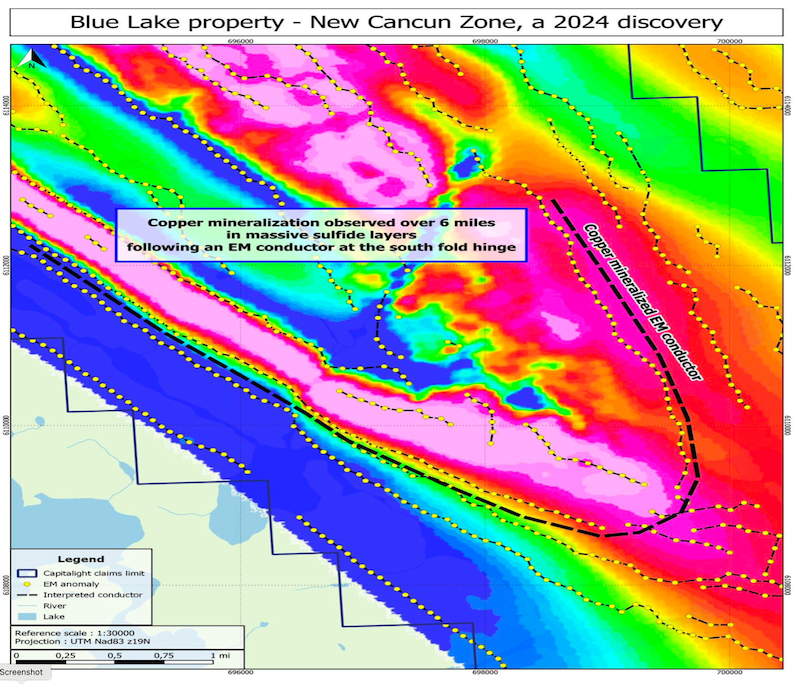

| In fact, geophysical surveys over the Cancun zone reveal an interpreted “hinge” feature of the type known to potentially concentrate mineralization in deposits. This will be a priority target of the upcoming exploration program. |

|

| With a high-grade, 2.2% copper-equivalent resource to build on, Cupani believes follow-up exploration at just the Cancun and Pogo targets has the potential to multiply the tonnage on the entire project. |

| In A Great Mining Jurisdiction |

| There is no doubt that Blue Lake’s Quebec address puts it in one of the world’s best mining jurisdictions. |

| The government is highly supportive of mining and the iron mines in Blue Lake’s region of northern Quebec have provided the project an abundance of infrastructure. |

| Blue Lake is near a railway and hydro power, and the sole First Nation in the area owns part of that railway, which means it also is supportive of developing the region.

Simply put, if drilling can prove up a large critical metals deposit at Blue Lake, this wealth of infrastructure makes the both the project and Cupani Metals takeout targets. |

| Led By A Winning Team |

| In assessing a junior explorer like Cupani Metals, it’s always important to see if that junior is led by a team that has made money for investors in the past.

Cupani passes that test with flying colors.

Prior to heading up Cupani, CEO Brian Bosse led the conversion of Zenyatta Ventures from a graphite to a graphene company, and in the process saw the company’s shares trade up from C$0.45 to as high as $7.00. |

| Along with former Asante Gold leader Douglas MacQuarrie, Bosse and other insiders own 52% of the company. |

| These are successful mining entrepreneurs and their alignment with shareholders is obvious. |

| Funded To Explore Blue Lake Aggressively |

| So why look at Cupani Metals now?

Because the company is in the process of completing a C$4 million private placement that will fund an aggressive exploration program at Blue Lake in the back half of this year.

That program will include summer fieldwork, followed by significant drilling throughout the fall and winter. |

| Given the number, quality and size of targets Cupani has outlined at Blue Lake, market-moving results from that drilling could soon be in the offing. |

| With the world’s major miners constantly on the lookout for new, large deposits of critical metals, Cupani’s work at Blue Lake this year alone could attract the type of strategic interest that could send its share price due north.

For those who want to invest in that possibility, the time to begin your due diligence on Cupani Metals is right now. |

| CLICK HERE

To Learn More about Cupani Metals Corp. |