They say pictures are worth 1,000 words.

|

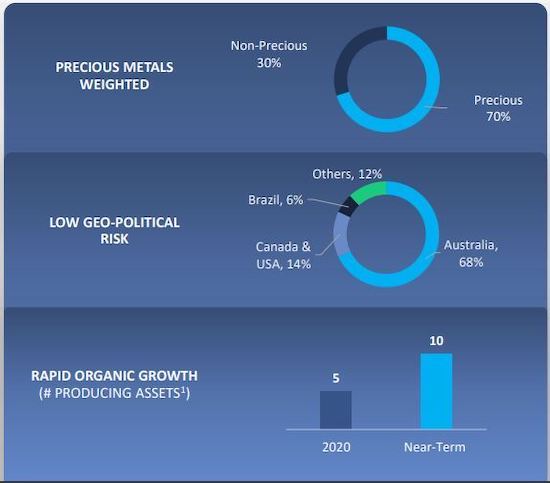

If that old cliché is even close to true, these charts of Vox Royalty Corp.’s (VOX.V; VOXCF.OTC) producing assets and revenue growth border on priceless.

|

|

|

In a sector where cash flow is king, Vox’s revenues, its number of royalty-generating assets and its cash flow are all starting to ramp…and yet the company’s share price has yet to reflect this growth.

It’s a set up for a lucrative re-rating for Vox.

|

Exponential Revenue Growth Forecasted

|

As the graphics above amply demonstrate, this gold royalty company is approaching the steep side of its growth curve.

|

Over the last three quarters alone, Vox’s revenues have grown by an implied compound annual growth rate of 275%!

|

And yet, as the following chart makes clear, Vox still has plenty of room to grow, relative to its peers, on a price-to-NAV basis.

|

|

|

As more revenue-producing royalty projects come online between now and 2023, Vox’s growth rate should only accelerate.

It’s a near-ideal confluence of hard work and great timing for the company, one that has resulted in a growth-level that’s the envy of its peers and, as of yet, is not recognized by the market.

|

|

Adding longer-term potential to the Vox story is the huge exploration upside provided by the company’s operating partners.

In just the past two months, Vox partners have announced plans to conduct more than 110,000 meters of drilling.

|

And some of that aggressive work is already paying off.

|

On the Bulgera project, operating partner Norwest announced high-grade results, led by 16 meters of 7.3 g/t and 6 meters of 11.8 g/t.

On the Kookynie project, partner Metalicity has seen high-grade hits of 19.1 g/t over 3 meters, 17.9 g/t over 5 meters and 6.4 g/t over 4 meters.

These are the kind of results that can really add ounces to a project’s resources, and they provide more NAV upside for Vox and its shareholders.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

|

Plus: More Acquisitions Likely

|

Having recently raised almost C$17 million in an overnight marketed public offering, Vox will likely stay very aggressive on the acquisition front.

|

As part of that strategy, Vox has been divesting itself of non-core assets.

|

A key example is its recent deal with Electric Royalties to unlock the value potential of two graphite royalties.

The deal saw Vox vend those non-gold royalties for C$2.85 million in Electric Royalty shares plus C$50,000 in cash.

Better still, the deal comes with a broad agreement between the two companies to feed each other projects that are better suited for the counterparty’s area of focus (in Vox’s case, that’s gold; in Electric’s case, that’s battery metals).

|

|

Another key recent transaction was for the South Railroad royalty. South Railroad is located along the Carlin Trend, home to 80 million ounces of historic gold production.

|

In an unconventional royalty deal that’s typical of Vox, the South Railroad royalty was acquired from a family of Nevada ranchers.

|

And with access to a huge database of such unconventional royalty projects to choose from, Vox’s info-share agreement with Electric just adds to the company’s deal flow potential.

|

NAV That’s Real…And Growing

|

As it stands, Vox Royalty is putting points on the scoreboard with producing royalties that are set to multiply in the months and years just ahead.

One of the biggest questions for royalty companies is: “Is their NAV for real?”

In Vox’s case, it is very real…and it’s growing.

The company’s focus is on building royalty positions in safe jurisdictions like Nevada and Western Australia.

Between the revenue growth that continues to come online for Vox and the longer-term growth potential of a portfolio that includes more than 50 royalties, Vox Royalty is ideally suited to the gold bull market that appears to be straight ahead.

|

Simply put, the inflection point at which Vox sits gives it both exceptional short-term potential and first-rate leverage on rising gold prices.

|

To take advantage this growth inflection point, you’ll want to consider building a position in Vox Royalty sooner rather than later.

|

|