| Silver riches in a “Valley of Gold” |

|

| Please find below a special message from our advertising sponsor, Mountain Boy Minerals. Golden Opportunities is a free service that gives you valuable investment intelligence all year long at no charge, and advertisements allow us to continue sending these reports. |

|

Silver Riches

In A Valley Of Gold

|

|

Known as one of the most prolific gold regions on the planet, the Golden Triangle is also one of the rare billion-ounce silver districts.

Now Mountain Boy Minerals (MTB.V) is about to pursue those silver riches, following up on a nearly-forgotten drill discovery that hit a multi-kilogram per tonne silver vein.

|

|

The Golden Triangle of British Columbia is gaining legendary status as a gold district, already ranking in the same league as Nevada’s famed Carlin Trend.

|

Lesser known is the region’s enormous silver endowment. In fact, so much silver has been produced along with gold that the Golden Triangle has earned the rare distinction of being a billion-ounce silver district.

Now a small exploration outfit called Mountain Boy Minerals is poised to turn the drills on a nearly forgotten, silver discovery that intersected over 5 kilograms of silver.

|

And if they hit on this incredibly rich discovery this little company has the potential to be ranked among the biggest names in the Golden Triangle.

|

That’s saying a lot, because this region is one of the more fabled in mining history.

|

The Legendary Golden (and Silver) Triangle

|

British Columbia’s “Golden Triangle” is famed for the vast number of rich gold discoveries made within its borders.

For example, the Eskay Creek mine is well known for having produced 3.3 million ounces of gold at tremendously high grades. Less appreciated is the fact that this mine also produced a remarkable 162 million ounces of silver over its 13-year mine life..

You would think a region with that kind of potential — for both gold and silver — would have been picked over by now.

Well, one part has been largely ignored, and for a very surprising reason, as you will see in a moment.

|

|

Following the Trail of Evidence from Previous Explorers

|

One surefire way to increase the chances of making a big discovery is to build upon previous successes...to learn from what others have already accomplished.

You see, there was already a mine operating on the Mountain Boy property in the early 1900s.

| |

| | Crossing American Creek on the way to the Mountain Boy mine in the late 1930s. Geologists can now drive to the mine. |

This was a small mine, and as you can see from the picture above, ore was taken out by packhorses. But it also featured exceptionally high grades.

Of course, a modern mining operation wouldn’t be interested in a small scale operation today. What excites them (and shareholders) is what these old operations are pointing toward: the potential for a much larger deposit.

The reason the larger potential was not seen before is that, as in many historic mining districts, the area was blanketed with legacy claims. Rather than tracking down the heirs of long-departed miners, explorers headed north to open ground and soon made the world class discoveries that led to naming the area “The Golden Triangle.”

The little work that happened around the Mountain Boy mine was focused on a restart of the small, old mines.

Fast forward to today’s situation, after a new management team took control of Mountain Boy and looked at the rugged mountainous area with a fresh set of eyes and ideas, they recognized the similarities between the historic Mountain Boy mine and the neighboring Premier district.

Seeing the potential, they quickly moved to consolidate the entire region from the patchwork of individual legacy and other claims; the result being a substantial land package with the right geology and numerous historic showings and workings.

| |

|

The Problem With Trading Drills For Shovels

| To understand the remarkable potential for the property, we have to go back a few years, to the 1990s, when a private exploration group developed a road to the Mountain Boy mine.

|

This group completed a grand total of two drill holes before they traded their drills for shovels and began mining.

|

They trucked raw ore from the mine directly to the huge smelter complex at Trail, 1,700 kms away. Even with the exceptionally high grades, trucking ore that far didn’t work out for the miners.

Later in 2005, Mountain Boy acquired the property and carried out a small drill program consisting of 19 holes from three pads, with the holes averaging just 47 meters in length.

While the holes barely scratched the surface, the results were still eye-popping: One hole in the aptly named High Grade Vein hit 5,258 g/t silver over 5.18 meters!

Even one-tenth of that grade would excite investors today.

The immediate reaction was to try, once more, to mine the bonanza-grade material. But previous experience taught them that they needed more tonnes to justify a proper mining operation.

They wanted to test the zone down-dip, but they faced a logistical challenge: The vein dips directly into a very steep mountain side. Drilling the zone from above or below was beyond the capability of their drill rig.

In the meantime, they continued to work on the other Mountain Boy projects in the region; the Silver Coin deposit had just received a Preliminary Economic Assessment on a 1.3-million-ounce gold resource; a new silver discovery had been found on the BA property and drilling at the Red Cliff prospect was returning exceptionally high gold values.

When they returned to Mountain Boy in 2011, the intention was to outline enough high-grade material to develop a mine. Knowing their drill wouldn’t be able to test down-dip on the High Grade Vein, they drilled on some of the other veins.

That program consisted of 36 holes drilled from only three pads, with the pad locations determined simply by where they could get road access. The average hole length was just 66 meters — again barely scratching the surface.

|

|

|

| | A valley of historic gold — and silver — discoveries. The Mountain Boy mine is located at the lower center of the photo. The Red Cliff mine is just off the photo to the left (south) and the Dorothy property is on the right. |

The results were positive, including 396 g/t silver over 4.5 meters in the Mann zone.

But once again, drilling from only three pads and the limited reach of the drill left them without the needed combination of both grade and size.

Save

Not A Subscriber Yet?

Get Golden Opportunities For Free

Subscribe to our Golden Opportunities e-letter to receive timely market

updates from the Gold Newsletter research team, plus video

presentations by expert speakers from the New Orleans Conference

— and the Investor’s Guide to Gold and Silver — all at no cost!

CLICK HERE to start your subscription.

| Riches On The Other Side Of The Mountain

|

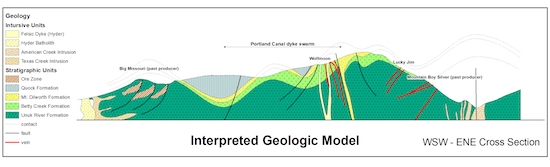

Fast forward again, once the new management had secured the ground, the geological team went to work compiling decades of data from past explorers and ground truthing their findings and ideas over two field seasons.

The result, an up-to-date understanding of the regional geology and mineralizing systems in the area.

It revealed compelling evidence that the cluster of old mines represented surface expressions of a potentially much larger gold- and silver-bearing geological system – exactly the kind of system that hosts many of the other large deposits in the “Golden Triangle”.

|

|

The big breakthrough in confirming the model was the discovery and dating of a previously unknown intrusive unit.

This intrusive unit is remarkably similar to a unit at the Premier District just over the hill, which is the heat engine responsible for mineralization. The Premier mine produced two million ounces of gold and 45 million ounces of silver from 1918 to 1996 and is now on its way back to production.

Looking at the data set in the context of that newly mapped intrusive unit, it is now abundantly clear that this is a distinct system — and one with the same age, geology and potential scale as the Premier District.

| |

The first drill target will be on the High Grade Vein. A more powerful helicopter-supported drill rig will enable the target to be tested from a more meaningful location.

The current exploration model holds that the high-grade silver represents the upper portion of an epithermal vein system. The silver will potentially transition to gold in the deeper parts of the system and that aspect will also be tested.

|

This is perhaps the most exciting target on the entire Mountain Boy property, but it is by no means where the potential ends.

|

The drill program will also focus on a second target, the northward extension of the Mountain Boy veins, which extends for kilometers across the recently optioned Dorothy property. High-grade silver veins have been sampled but this area has never been drilled.

Favorable drill results on the Dorothy property would open the potential for a multi-kilometer mineralized corridor. In fact, that corridor begins four kilometers south of the Mountain Boy mine, at the historic Red Cliff gold and copper mine, in which Mountain Boy holds a 35% stake. Drill results at Red Cliff include 43.9 grams per tonne gold over 7.5 meters.

And there’s yet another high-potential target that will be drilled: the newly discovered Wolfmoon showing, 2.5 kilometers southwest of the historic Mountain Boy mine. The Wolfmoon area has recently emerged from ice cover, as glaciers in this region continue to retreat. Last summer, the geological team took the first-ever recorded samples, which returned highly encouraging samples...including 1,200 g/t silver and 28.5 g/t gold.

Clearly, this is a BIG system, with robust grades of both gold and silver — exactly the kind of system that can generate the spectacular drill results that the Golden Triangle is famous for.

| |

It would be highly unusual for a geological system like this to show so much gold and silver near surface and be barren at depth.

The question is not, “Is there gold and silver down there?” But rather, “Exactly where should the drill be oriented to have the best chance of hitting those high-grade veins?”

To answer that question, the company’s geologists are now in the field checking and expanding on that data set before they finalize the drill hole locations and orientations.

Over the next few weeks, they will conduct further geophysical surveys and carry out structural analysis and further mapping and sampling. All of that work is aimed at determining exactly where to position and orient the drills in the weeks just ahead.

| | Its not every day that we get a chance to get in early on a company that is following up on a past producing project...plus a mountain of historic and recent data pointing to a district-scale opportunity.

Such a compelling geological model located in the midst of a region known for elephant-sized deposits makes Mountain Boy’s next exploration program particularly exciting.

|

With past-producing mines as a guide, drilling is about to get underway on no less than three targets, each of which is a potential company maker. Together they point to a potential district.

|

It’s early days, but this is the time when investors can get in cheaply, and large, on what could be one of tomorrow’s biggest success stories.

|

|

CLICK HERE

To Learn More About Mountain Boy Minerals

| | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please unsubscribe here. Remember, your personal information will never be rented or sold and you may unsubscribe at any time. Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

Warnings and Disclaimers: As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment. This profile should be viewed as a paid advertisement. The publisher and staff

of this publication may hold positions in the securities of companies discussed or recommended. The information contained herein has been received from sources which the publisher deems reliable. However, the publisher cannot guarantee that such information is complete and true in all respects. The advertiser provided a review of the factual content of this advertisement at the time of publication. The publisher

is not a registered investment adviser and does not purport to offer personalized investment related advice; the publisher does not determine the suitability of advice and recommendations contained herein for any reader. Each person must separately determine whether such advice and recommendations are suitable and whether they fit within such person’s goals and portfolio. The advertiser featured in this edition of Golden

Opportunities has paid the publisher for the costs and compensation related to the authorship, overhead, design and distributing this online edition, in the amount of $6,000. The publisher may receive revenue, the amount of which cannot be predetermined, from sales resulting from any accompanying offer. Authors of articles contained herein may have been compensated for their services in preparing such articles.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70118

1-800-648-8411

|

|

| |