| Steering a course through gold’s stormy seas… | | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | |

| Steering A Course Through Gold’s Stormy Seas | |

While gold is rebounding from last week’s steep sell-off, it remains to be seen whether this is simply a bounce from an over-sold bottom or a more meaningful rally.

So how does a long-term gold bull navigate these troubled waters in the meantime?

Here are some ideas...

| |

Last week was a bloodbath in gold and silver.

|

As I reported on Monday, the Fed’s very slight shift in its stance on potential rate hikes — essentially moving from “not even thinking about thinking about raising rates” to “thinking about thinking about...” — was enough to send the financial markets into a tizzy.

And it was enough to send gold from just below the key $1,900 benchmark to around $1,764 at the very lows.

In my comments a couple of days ago, I noted that while gold was up about $20 on that day, it remained to be seen whether this was simply a bounce from an over-sold low or something much more significant.

With gold outperforming silver, I was leaning toward a short-term bounce.

Today we’re seeing gold up about $10 and silver outperforming, so that’s encouraging. Also, futures and options expiries for June over the next few trading days could release some of the selling pressure and aid in the rebound.

As you can see from this chart, the recovery is still young and uncertain. And the trajectories of 200-day and 50-day moving averages, which were about to complete a bullish “golden cross,” are now moving more in parallel.

|

|

The fact remains that we can expect more volatility — sharp moves up and down — over the months just ahead as the Fed adjusts its communications in the face of rising inflation, and as we get more data on how sticky these price rises are.

So how can an investor who’s bullish on gold for the long term navigate these choppy waters in the near term?

Here are some ideas...

| | Golden Opportunities continues below... | | SPONSOR:

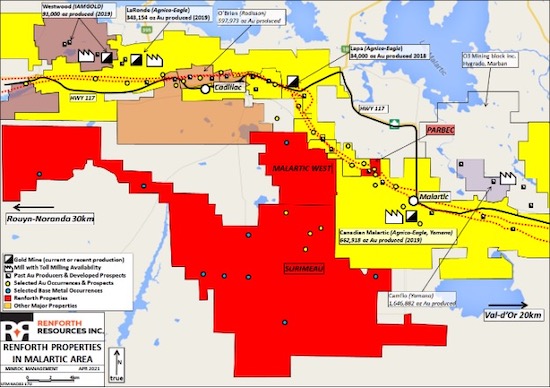

Renforth Resources Inc. (OTCQB: RFHRF; CSE: RFR) | | Growing a Gold Deposit in the Perfect Location | Renforth Resources controls the Parbec gold deposit, next door to Canada’s largest gold mine. Renforth and neighbor Canadian Malartic share a gold-bearing structure, the Cadillac Break. CM will produce about 700,000 ounces of gold in 2021.

Renforth is continuously reporting results from a recently completed drill program, designed to increase the Parbec deposit size. Results include:

• 21.45 meters grading 5.57 g/t gold

• 49.6 meters grading 1.46 g/t gold

Every hole Renforth has drilled at Parbec has intersected gold — and there are still 16 holes to report on in the days ahead. The existing Parbec resource — which is higher grade than CM — will be updated once all results are in, positioning Parbec to be sold to the highest bidder. |

| The sale of Parbec will fund continued exploration at the district-scale Surimeau project, an emerging sulphide nickel, copper and zinc mineralized system. Drilling has resumed, with results pending for 15 prior drillholes, all of which contain visible sulphides.

Renforth is self-funded. It has C$5 million in cash and liquid securities, plus the growing gold resource in the ground at Parbec, with neighbors needing ounces. | | Click here to learn more about Renforth Resources | |

Steering A Course Through Stormy Seas

|

First off, for the portion of your gold and silver holdings that you’re using as insurance — protection for your wealth against the inevitable depreciation of your country’s currency — this is the time to buy.

Of course, that depends upon how much gold and silver bullion you already have. But if you have been building your position, taking advantage of these short-term price swings will help you accumulate more gold and silver over the long term.

So take stock...and take advantage when the metals go on sale.

For the investment portion of your metals portfolio that you use to leverage a long-term rise in metals prices, and perhaps gains in other metals and commodities, the primary tool is the mining sector.

That means mining stocks ranging from large producers down to micro-cap junior exploration companies. And despite this broad range, there are some common themes that we can explore:

|

• Producers — The companies that are actually producing metal, particularly the mid-tier miners, have been among the most undervalued opportunities in the resource sector. However, the recent decline in gold and silver prices, for example, have generally brought the valuations of the producers back in line with the prices of the metals.

If you’re bullish on the long-term trend, this can be a great way to leverage a long-term rally...but keep in mind that these aren’t quite the value that they were at higher metals prices.

• Optionality Plays — These are companies that hold large gold or silver resources, some quite advanced with high-confidence resources and/or economics, that may be barely viable or just below economic viability at current metals prices. Thus, their values can increase quite substantially at higher gold and silver prices.

They are, essentially, a leveraged bet on a sustained metals rally. Since I’m not yet confident that the current rebound has legs, I’m not as excited about these kinds of plays right now.

• Development Plays — These are companies that are already well along in developing a mine, ideally in construction. There’s often a period of doldrums when nothing particularly exciting is happening during the development period, during which it’s common to see a company’s share price trade sideways or even decline.

But if you can find a company that’s within a year or so of actually starting production, it’s common to see its valuation rise as the day of actually earning revenues draws near. Betting on this phenomenon can insulate you somewhat from the metal market’s vagaries, and we’ve been recommending a few of these well-positioned companies recently in Gold Newsletter.

• Exploration Plays — Of course, a company that hits a great drill hole can rise substantially, and independently of whatever’s happening with gold or silver. But most companies aren’t generating that kind of news, or doing so at the most opportune times.

And when enthusiasm for the entire resource sector is lagging, the exploration companies, as a group, will get dragged down along with everything else. The key is to find the companies with the most exciting prospects, the best management teams and near-term news flow. (Again, we specialize on pinpointing these opportunities in Gold Newsletter.)

• Battery Metals — I can’t tell you how often I’m approached by family, friends or friends of friends asking me how they can invest in lithium. I tell them the first step is to find a time machine and go back about five years or so, because most of those plays have already run. (And many of them were revealed beforehand in Gold Newsletter.)

But there are other ways to play the electric vehicle (EV) and global wealth creation megatrends. One of these is the relatively boring “red metal” — copper.

Simply put, the copper market is in the early stages of the steepest demand-growth curve in modern history, and running headlong into supply constraints that are over a decade in the making, thanks to long-running under-investment in exploration and development.

This is one supply-chain disruption that is anything but transitory, and will in fact take many years of much higher prices to rectify. So well-positioned copper plays, especially companies with large, advanced resources and/or gold or silver credits, are particularly appealing right now.

And finally, we’re recommending a relatively young company specializing in royalties on battery metals. Although it’s started to make a move, it’s still a relatively undiscovered way to capitalize on these megatrends. Over the next couple of years I expect it to trade much higher, which is why I personally own this one.

|

I hope you’ve found this brief overview valuable. Once again, we cover all of these sectors in great detail, and frankly very successfully, every month in Gold Newsletter.

Because of the success of our recommendations, we’re going to raise the price of the letter soon. But if you haven’t yet subscribed, I’d like to give you one last, half-price opportunity to join our family of Gold Newsletter readers.

Just CLICK HERE to take advantage of it.

| | All the best,

Brien Lundin

Editor, Gold Newsletter

CEO, the New Orleans Investment Conference

| | | | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

111 Veterans Memorial Blvd. Suite 1555

New Orleans, LA 70005

1-800-648-8411

| | | |