| You’re smarter than Elon Musk... | | You are receiving this message because you have specifically subscribed to Golden Opportunities, have purchased a product or have registered for a conference with us or with one of our partners. If you'd rather not receive emails from us, please click the link at the bottom of this page to unsubscribe from our database. Remember your personal information will never be rented or sold and you may unsubscribe at any time. | | Contact Us | Privacy Policy | View in Browser | Forward to a Friend | | .png) | | You’re Smarter Than Elon Musk | | | Give him credit — Elon and Doge had the best of intents...but the task was always futile.

Plus: A thriller novel based on gold manipulation. | |

June 4, 2025

Dear Fellow Investor,

| | If you’re reading this, I have a good feeling you shared my opinion on Elon Musk and his attempts to slash government waste and spending. | | We had to applaud the effort...while realizing that the effort was futile.

The math is just out of control at this point. We can’t eliminate the federal deficits, or even significantly lower the trajectory, without touching the major entitlement programs.

And there are only two or three politicians in all of Congress willing to even talk about that.

As Jim Geraghty wrote in his column today in National Review: | | “For the first time since 2018, the U.S. began the year 2025 with a Republican president, a Republican House majority, and a Republican Senate. We’re not in a recession, even if there are intermittent rattles in the economic engine. And the president appointed the world’s richest man, a man of hyperactive energy and drive, to a special advisory group focused entirely on spending cuts.

“On paper, this is the best opportunity for significant reductions in federal spending in many years. But it’s probably not going to happen. Yes, the work of the Department of Government Efficiency will cut a few hundred billion dollars in spending, and that’s not chopped liver. But the projected deficit for this current fiscal year is $1.9 trillion, and the “Big Beautiful Bill” will increase the deficit by $3.8 trillion over ten years.

“The elected leaders of this country haven’t been serious about the deficit or the debt for a long time, and as Elon Musk prepares to leave DOGE behind, he’s apparently tired of pretending that everyone else around him ever took this seriously.” | | So it was never going to happen. And as a result, we’re running headlong into a sovereign debt crisis.

You and the rest of our readers have known this for years, and hopefully you’ve prepared for it. But now it seems everyone is talking about it, including some of the most respected names in finance.

Just this morning, Bridgewater founder Ray Dalio warned on CNBC that the debt crisis has become urgent (and recommended gold as protection!). |  | | And just yesterday, the Wall Street Journal reported how a litany of Wall Street and economic legends — including Jamie Dimon, Paul Tudor Jones, Peter Orszag and Kenneth Rogoff, in addition to Dalio, were also signaling the alarm. I posted a link to that story on X, with this commentary: | | For many years, I told my subscribers that I’d listened to hundreds of very smart experts warn about the exploding national debt, but no crisis ever came about.

So no one was more cynical than I about proclamations that the U.S. was going bankrupt.

But then, in 2018, I told them I’d had a conversion: The trajectory was now out of control...the math was undeniable...and we’d soon be paying over $1 trillion just in interest.

...And because of the debt trajectory, we would no longer survive interest rates above the rate of inflation.

It’s taken a while, but as the WSJ noted today, this view has now become popular, and glaringly obvious. | | Unlike Dalio and many of the others, I’m not out there saying we need to do something to avert a crisis. I don’t think there’s anything we can do at this point, or at least nothing practical.

All we can do is prepare. And that means owning gold as insurance...and also investing in gold-related investments like mining stock to leverage the move in the monetary metals.

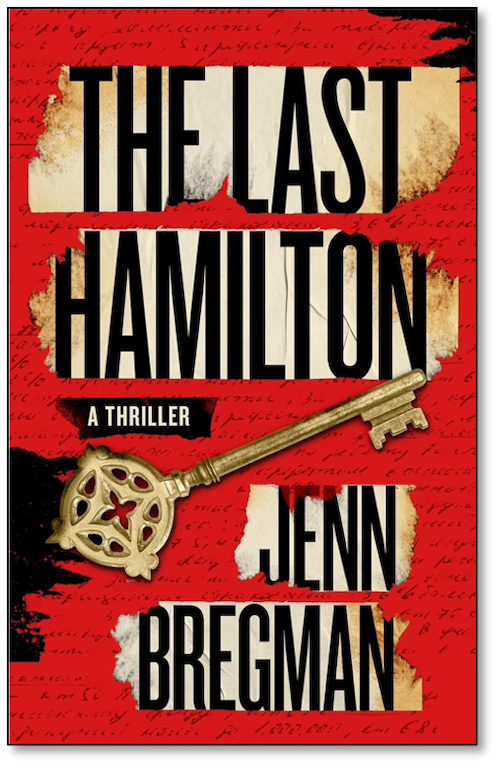

Again, if you’re not already subscribed to Gold Newsletter (where we predicted the current rebound in gold last week), you need to get aboard this train now. (CLICK HERE to subscribe.) | | A Financial Thriller About Gold! |  | | I just finished reading a fascinating new novel based on a global manipulation of the gold market: “The Last Hamilton,” by Jenn Bregman.

Think “The Da Vinci Code” for gold bugs!

As background, Jenn sent me a review copy of her book, and wrote the following in the cover letter: | | “I’ve followed you for over ten years. The thought and research you put into your newsletters is astounding. So much so, that this research formed the basis for my book.” | | I wrote Jenn back and complimented her on that marketing angle!

Still, it was enough to get me to open her novel...and I can tell you that it’s a real page-turner. The plot line is detailed and credible with relatable characters, the story moves quickly and there’s an unexpected twist at the end that I can’t believe I didn’t see coming!

A thriller for sure, but taken to a new level for those of us with knowledge of the gold market and how it could be...and has been...manipulated.

As Jenn also wrote: | | “I think you might really enjoy ‘The Last Hamilton’ because while it is a thriller, the facts about the gold depository audits, repatriation by Germany, the frenzied gold buying and stockpiling by China (and other BRICS nations) is true.” | | I won’t reveal any spoilers here, but suffice to say that I highly recommend “The Last Hamilton” as a wonderful read, especially for gold bugs like us.

You can order it on Amazon here. | | All the best, |  | | Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference | | | | CLICK HERE to watch interviews by Brien Lundin and Kai Hoffmann with many of today's most exciting junior mining companies on the Gold Newsletter Youtube channel. | | | | © Golden Opportunities, 2009 - 2025 | | Advertisements included in this issue do not constitute endorsements from us of any stock or investment recommendation made by our advertisers.

As you know, every investment entails risk. Golden Opportunities hasn’t researched and cannot assess the suitability of any investments mentioned or advertised by our advertisers. We recommend you conduct your own due diligence and consult with your financial adviser before entering into any type of financial investment.

Golden Opportunities

Jefferson Companies

2117 Veterans Memorial Blvd., #185

Metairie, LA 70002

1-800-648-8411 | | | |