It’s Elementary:

Here’s Why Lithium Demand Is Soaring Again

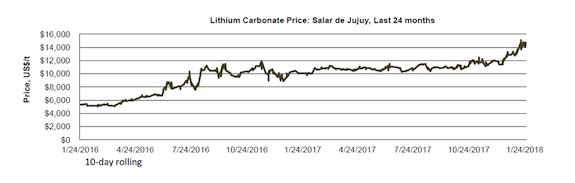

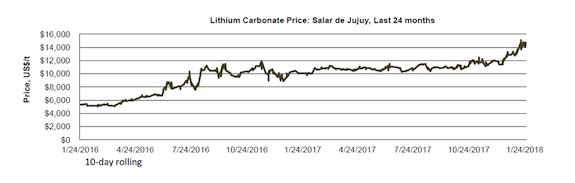

Demand for lithium keeps pushing forecasts higher. Experts agree that supply pressures won’t let up this year, next year or for years to come.

Who’s best positioned to benefit? Recent discoveries have investors looking hard at QMC Quantum Minerals (QMC.V).

Dear Fellow Investor,

Global lithium demand is skyrocketing and many investors have already made fortunes in the sector.

But here’s better news: The chance for life-changing profits in lithium investing is just getting better.

Despite explosive growth in lithium demand, what you see now may be the earliest stage of a massive market opportunity unlike anything you’ll see in your lifetime.

All of which makes this the perfect moment to be smarter and get into high-potential lithium companies like QMC Quantum Minerals (QMC.V; QMCQF.OTC).

The Potential To Hold A World-Class Lithium Resource

A word to the wise — mining stocks tend to explode when a lot of outside investors start to believe the possibilities are real. That typically happens when a credible geologist reports delineates exactly what resources are on the property, precisely where they exist, and how economic they are.

For Canadian companies like QMC Quantum Minerals, it often happens after the required NI 43-01 report is unveiled.

That’s also when the early backers — the ones who gave the company their trust from the start — make their big paydays, too. As new investors pour in with money in one fist and a geological report in the other, the early investors prosper.

But QMC Quantum Minerals offers a twist on the usual order. It’s a rare chance to side with the early money but feel as confident — and rightly so — as the latecomers waiting to see what the geologists have to say about Quantum’s new Irgon Mine property.

That’s because the “new” Irgon Mine has a history. Quantum’s NI 43-01 report is on the way, but we have unusually good historic data on the mine. The geology is clearly a winning proposition.

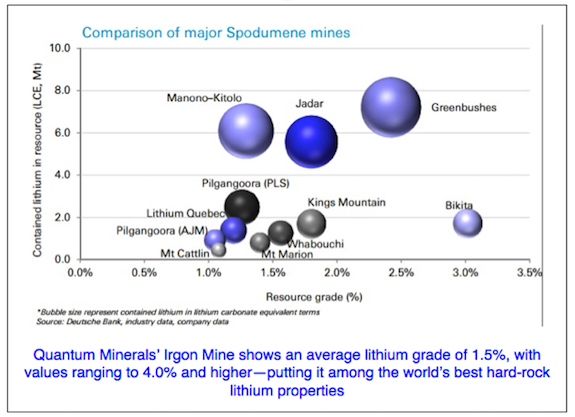

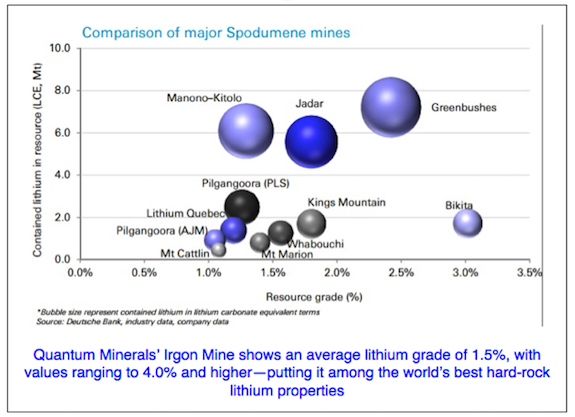

In fact, everything that we know so far shows that the Irgon mine should rank with the world’s top lithium mines for the richness of its ore. We’ll explain that a bit more, but at 1.5% lithium on average, the Irgon is a property to keep your eye on.

Infrastructure Is A Key To Rich Economics

When the Lithium Company of Canada (LCOC) explored the area in the 1950s, it saw excellent prospects at Irgon, too. LCOC drilled 25 holes into a geological formation at Cat Lake called the Irgon Dike. Its geologists estimated the part of the resource they looked at contained 1.2 million tons of ore grading 1.51% Li2O over a strike length of 365 meters and to a depth of 213 meters.

As you can see from this graph of the world’s top lithium mines, numbers like that put Irgon squarely in with the best mines in the world. But it gets even better.

Late last year, QMC Quantum Minerals carried out additional channel sampling and found lithium grades of up to 4.31% in some areas. Almost a fourth of the area surveyed had concentrations of 1.5% or better.

More than half the property that was assessed in the sampling program returned values of 1.0% or higher.

Those are numbers that excite any company hoping to mine lithium.

Such rich prospects are the reason that, in the 1950s, LCOC built a road onto the property, dug a three-shaft mine and set up a processing plant for the ore. Unfortunately for LCOC, the bottom fell out of the lithium market soon afterwards.

You see, in those days lithium was only used for glass, ceramics and some metallurgy. Rechargeable batteries were still far in the future.

Supply, Demand and Clarity — Why The Irgon Mine Is Set To Fulfill Its Promise

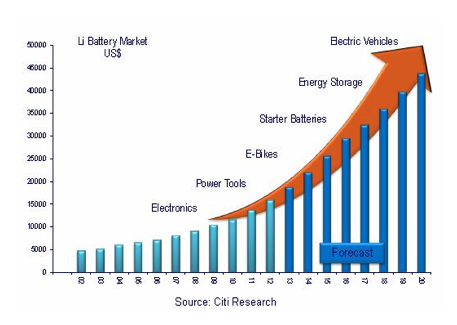

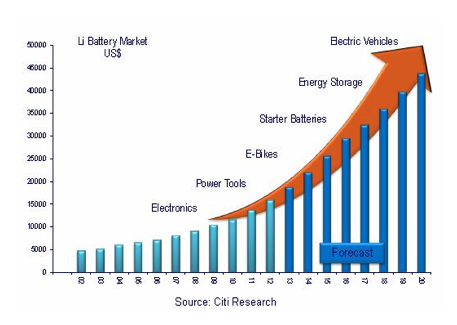

Today’s lithium demand is pushed hard by the growing rechargeable battery industry. Batteries for electric vehicles (EVs) require thousands of times more lithium than a camera or hearing aid does. Today’s lithium demand is pushed hard by the growing rechargeable battery industry. Batteries for electric vehicles (EVs) require thousands of times more lithium than a camera or hearing aid does.

In response to this need, existing producers have increased supplies. New producers have added small amounts, but the price of lithium still doesn’t fall. Demand refuses to back down.

This is excellent news for investors if we can trust it. And it looks like we can.

Most people think “supply and demand” is about demand rising or falling. It’s not. It’s simply a rule of thumb that says when supply is great and demand is low, prices fall. And vice versa.

Demand itself only partially responds to price. And in the case of lithium, other factors are FAR more important.

Beyond Simple Supply And Demand:

Why Lithium Demand Continues To Rise

The lithium-ion battery market is expected to reach $67 billion by 2022, more than doubling its 2016 sales. Even with the price rising, the demand keeps increasing.

That’s because demand is driven by many forces that supersede price…

Consumer Tastes and Preference — EVs are becoming popular much more quickly than anticipated. Not only do consumers want them, some countries are making electric vehicles mandatory. Car and Driver magazine reports that by 2020, fully 3% of light vehicle sales will be electric.

Paris wants gas-guzzlers out of town by 2030. China, France, India, Germany, Ireland, Israel, Norway, Israel and Taiwan already have future bans in place or will soon. By 2040, more than half of all sales (55%) will be electric.

The Price of Related Goods — If a cheaper substitute is available, price will fall. That’s generally true…

But there is no viable cheaper material available to replace lithium in rechargeable batteries and do the job as well.

All the research so far has only produced batteries that are too small to power EVs, generators or remote alternative energy grids — the new uses that are primarily feeding the huge demand for lithium. And those that have more power fail to recharge more than a few times. Lithium remains the king.

Number of Buyers — Every major automaker is ramping up EV production now. It’s not just Tesla dreaming and Ford offering a plug-in hybrid anymore. What’s more, buses, commercial trucks and mining equipment are going electric even faster than cars are.

In addition to that, Benchmark Mineral Intelligence reports that 12 new lithium battery mega factories are due to open by 2020. The number of buyers and their appetites for lithium is multiplying rapidly.

Expectations of the Future — It is now clear that new lithium supplies are not going to arrive quickly enough to fulfill demand any time soon. Most of the new mines are brine operations, which require years of evaporation after the facility is permitted, licensed and finally built. We have reached a tipping point. Acceptance of EVs has become strong enough to accelerate the trend.

Buyer’s Income — This is the only determiner that doesn’t necessarily push lithium demand higher!

Propensity to Consume — It’s a simple proposition, people want to own cars, and that’s not changing. Freight requires trucks, and that’s not changing, even if drones are in the offing. The demand for lithium batteries will persist.

QMC Quantum Minerals Is Perfectly Placed

An investor could hardly ask for more. QMC Quantum Minerals holds the rights to a spectacular resource. The official NI 43-01 report which is being prepared now will be definitive, but work on the property so far already points to world-class potential.

And it’s likely to get much better....

LCOC’s work in the 1950s and recent channel sampling looked at one spodumene dike near Cat Lake, site of the original Irgon Mine. Spodoumene is a type of igneous rock that carries lithium-rich crystallization. The Irgon Mine property so far has concentrated on one pegmatite (granite-like) intrusion, or dike, in the landscape.

As we’ve noted, QMC Quantum Minerals’ Irgon Mine property is rich in lithium, with values that compete with the best hard-rock mines in the world.

QMC’s CEO Balraj Mann also notes that the property has seven other dikes nearby, and the company has increased its claim area to accommodate future exploration.

Best of all, the Irgon Mine is in mining-friendly Manitoba, just 60 kilometers from Winnipeg. In 2016, the Fraser Mining Institute rated Manitoba the second best place for mining in the world.

The property has a road through it, is located near a major highway and close to rail transportation.

Six Reasons Why QMC Needs To Be Considered Now

1) QMC is a “hard-rock” miner. In other words, once the company begins to strip away the overburden, it can mine and process ores immediately.

2) Lithium concentrations of 1.0% or better would put QMC’s Irgon Mine among the world’s best properties.

3) QMC Quantum Minerals offers investors a chance to get in early with some confidence because the geologic data — while not yet at NI 43-01 standard — is already indicative of the potential. Even the work done in the 1950s with the best available technology at the time is proving to be very accurate.

4) The Irgon Mine project is just one stake in a property that could contain seven more dikes with equal potential.

5) Lithium demand is not backing down. The trend toward EVs is getting stronger because, once a certain number are on the road and charging stations are available, more buyers will decide that EVs are the future and gas guzzlers are for dinosaurs.

6) North America is home to some of the world’s largest battery makers, including several that are already leaders in EV batteries, such as Ener1, Active Power Inc., 3M Automotive, and Envia Systems, as well as major manufacturers like Energizer and Duracell.

Put QMC on your personal watch list. And don’t forget that when the NI 43-01 is published, everyone else will know what you have already discovered: QMC is a potential world-class lithium miner.

CLICK HERE

To Get The Exciting Story On

QMC Quantum Minerals

|

Today’s lithium demand is pushed hard by the growing rechargeable battery industry. Batteries for electric vehicles (EVs) require thousands of times more lithium than a camera or hearing aid does.

Today’s lithium demand is pushed hard by the growing rechargeable battery industry. Batteries for electric vehicles (EVs) require thousands of times more lithium than a camera or hearing aid does.